Sterling recovers after being pummelled almost 2%

- Go back to blog home

- Latest

Sterling tanked for the second straight day this week on Tuesday, with investors and analysts alike bracing for further weakness.

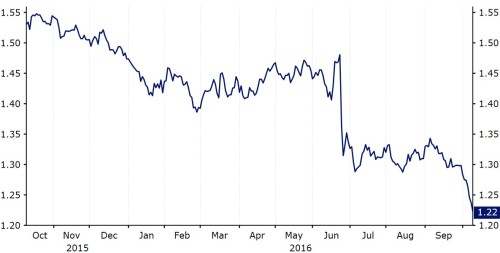

The Pound went into freefall yesterday afternoon, plunging by just shy of 2% against the US Dollar to around the 1.21 level, after a number of senior officials warned on the potential negative impact on the UK following June’s Brexit vote. This extended the currency’s losses to almost 20% since June’s referendum (Figure 1).

Figure 1: GBP/USD (October ‘15 – October ‘16)

Recently appointed Bank of England policymaker Michael Saunders suggested yesterday that the immediate fall in the Pound was not a concern, although a ‘bumpy’ Brexit could sharply lower Britain’s economic growth. Earlier, the Treasury warned that Britain’s exit from the EU could shave as much as £66 billion off the UK economy each year, with GDP set to be 5.4-9.5% worse over the next 15 years.

In trade-weighted terms, the Pound declined to its weakest position in 26 years, lower than after the collapse of Lehman Brothers in the height of the financial crisis. It did, however, recover strongly this morning, erasing almost all of yesterday’s losses.

In an especially volatile day, the Euro sank against a broadly stronger US Dollar as expectations for an interest rate hike by the Federal Reserve before the end of the year continued to grow. The single currency fell to its weakest position since early-August.

The South African Rand plummeted over 4% at one stage after prosecutors ordered Finance Minister Pravin Gordhan to appear in court over fraud charges.

The Swedish Krone also depreciated by close to 2% following comments from the Riksbank, which opened up the possibility of further interest rate cuts.

Major currencies in detail:

GBP

Sterling tanked 1.7% against the Dollar and 1% versus the Euro on Tuesday, although recovered almost all of its losses this morning following the report released by Bloomberg.

New BoE policymaker Michael Saunders issued a stark warning on the effects of the Brexit vote yesterday, although suggested that the Bank of England would look through the inflationary effects of a weaker Sterling when deciding monetary policy.

A member of the central bank’s Financial Policy Committee, Anil Kashyap, also spoke on Tuesday, warning that Sterling could be in for further weakness in the face of a ‘hard’ Brexit. Kashyap claimed to be ‘very concerned’ about an economic slowdown in the UK in the coming months.

The increased Sterling volatility highlights the benefits of hedging currency exposure and mitigating the risk of adverse market moves.

EUR

The single currency fell 0.7% versus the Dollar on Tuesday, sinking to its lowest level since the 5th of August.

Euro traders appear to have completely overlooked confidence data out of the Eurozone yesterday, which beat almost every expectation. The ZEW economic sentiment index jumped in October, in a sign that growth remains robust despite ongoing concerns regarding the health of the European banking system. The index rose to 12.3 from 5.4, well above the 6.3 consensus.

Industrial production numbers out of the Eurozone this morning will be the main economic release today.

USD

Growing expectations for a December interest rate hike by the Federal Reserve caused the Dollar to strengthen 0.5% against its major peers on Tuesday.

Comments overnight on Monday from Federal Reserve member Charles Evans provided solid support for the US Dollar yesterday. Speaking in Sydney, Evans claimed he would not be surprised if the Fed hiked rates in December, although he would need to wait for further data before deciding whether this is likely to happen.

Tonight’s FOMC minutes at 19:00 UK time could shed more light on the possibility of the next interest rate hike before year end. Financial markets are pricing in around a 70% chance that the Fed hikes rates in December. We see this as a near certainty, barring any significant slowdown in the labour market.

Receive these market updates via email