Sterling retreats after Brexit headlines worsen

( 2 min )

- Go back to blog home

- Latest

The past 24 hours or so of currency trading have been rather messy for the pound.

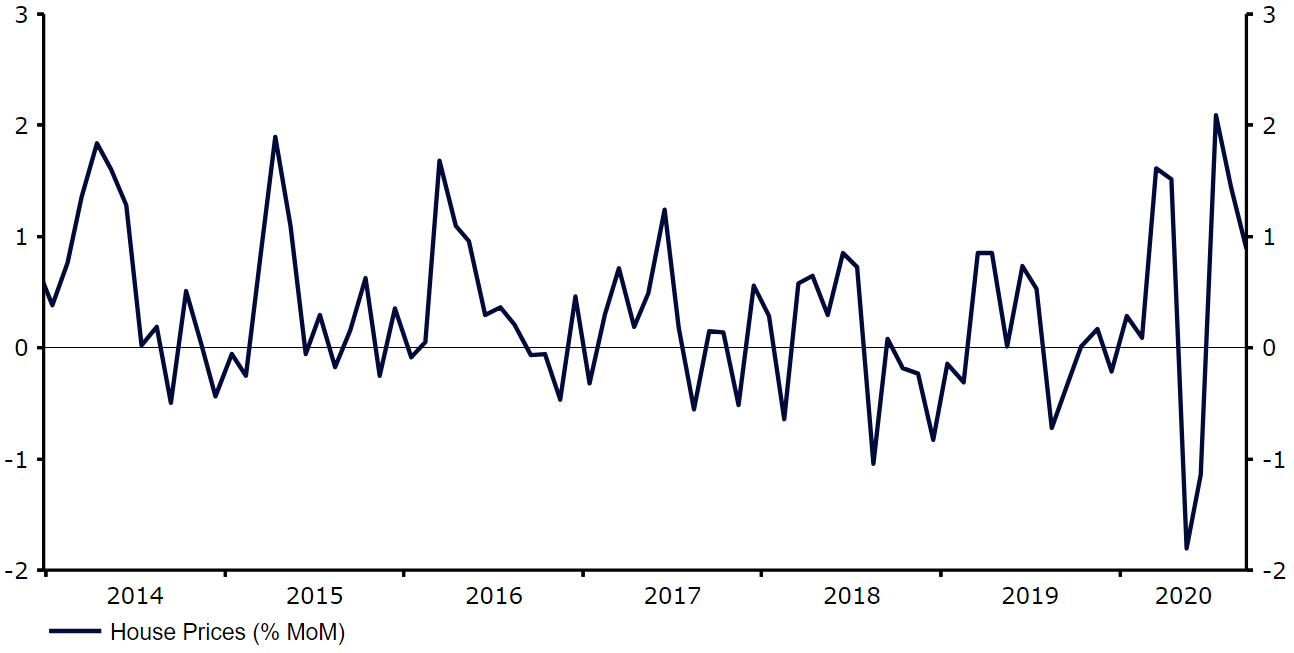

Meanwhile, economic data out of the UK yesterday was broadly encouraging. House prices according to Nationwide rose by a greater-than-expected 0.9% in September, aided in part by the stamp duty holiday announced by the government earlier in the year. Second quarter GDP was also revised upwards, with the UK economy contracting by 19.9% versus the 20.4% initially reported.

Figure 1: UK House Price Growth [Nationwide] (2014 – 2020)

Source: Refinitiv Datastream Date: 01/10/2020

This optimsm was quickly dashed this morning, however, amid headlines that EU and UK negotiators had failed to close the gap on state aid – one of the key sticking points in the ongoing Brexit discussions. The pound has already erased all of its gains from Wednesday at the time of writing and could be set for further losses should no common ground be found in the next few days.

Dollar loses ground after messy US election debate

Despite some strong US data, the dollar sold-off against most major currencies on Wednesday, perhaps a result of the messy election debate earlier in the week that gave voters very little to go off.

The political mess surrounding the election campaigning largely overshadowed yesterday’s positive US macroeconomic news. Pending homes sales surged in August, up 8.8% for the month (3.2% expected), as buyers took advantage of record low interest rates. Similarly to the UK, the US Q2 GDP estimate was revised upwards, while the ADP employment change number showed that job growth in the private sector accelerated last month. 749,000 jobs were created in the private sector in September, its largest in three months, amid a sharp increase in hospitality and construction hiring. This bodes well for tomorrow’s more important nonfarm payrolls report.

Aside from tomorrow’s US labour report, we may get a bit of market action surrounding Friday morning’s Euro Area inflation numbers – the highlight of an otherwise relatively quiet week of economic news in the common bloc.