Sterling shrugs off US inflation news to rally after budget u-turn

( 5 min )

- Go back to blog home

- Latest

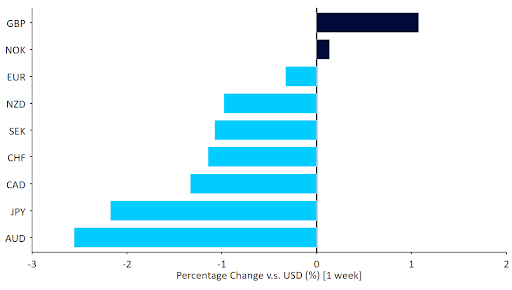

The Pound stole the spotlight in yet another volatile week of FX trading.

The week’s best performers were the Eastern European currencies, which were buoyed by the Hungarian National Bank’s draft of extraordinary measures to combat forint depreciation, including massive rate hikes targeted at currency markets. Considering the negative inflation news, risk assets and the common currency held up remarkably well to end the week nearly unchanged.

A light economic calendar elsewhere means that the focus this week will once again be on the UK bond and currency markets, now that the Bank of England has promised to stop supporting the long-term bond market. The inflation report out of the UK on Wednesday is sure to add to the market drama. A slate of public speeches by Federal Reserve officials starting on Tuesday should also drive markets, as the expected Fed funds terminal rate inches closer to 5%.

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 17/10/2022

GBP

Truss’ dismissal of Kwarteng and the reluctant announcement that some of the tax cuts would be reversed brought sterling back to where it was before the disastrous budget announcement three weeks ago, though the UK bond market has not fared as well. The announcement that an orthodox figure like Jeremy Hunt would replace Kwarteng, and news this morning of additional U-turn, notably the scrapping of the basic tax cut, should add calm to markets unnerved by the end of the Bank of England’s temporary bond purchasing programme last Friday.

Hopes are high that the inflation report on Wednesday will be the peak in both headline and core inflation, but even so markets are pricing in an unprecedented 100 basis point hike, or perhaps even more, in each of the next two Bank of England meetings. BoE governor Bailey warned again over the weekend that a large hike was coming, though market expectations may be dialled back somewhat following this morning’s announcement from the new chancellor.

EUR

In a week with little news of note, the common currency performed remarkably well, managing to close unchanged against the dollar in spite of the bad inflation report in the US and the subsequent rise in Treasury yields. A sharp drop in EU natural gas prices since their peak in late-August has partly helped the euro, and indeed European currencies in general, which almost all sat near the top of the FX performances rankings last week.

New support packages for consumers and businesses to ease the impact of energy prices also continue to be announced, while markets appear to be quietly confident that energy shortages over the winter will be avoided. We think that the impact of all these demand-supporting measures is underappreciated and lowers the risk of a deep, prolonged recession in the common bloc. The significant drop in commodity prices from the summer highs has also eased the impact on European terms of trade, another improvement that we believe is not yet reflected in euro trading levels.

USD

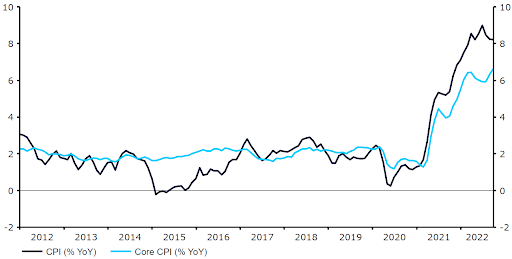

The September US inflation report delivered the second consecutive unpleasant surprise. Once again the headline number dropped on easing energy prices, but the more meaningful core index broke through to yet another record, at 6.6%. Markets are now fully pricing in a 75bp interest rate hike from the Fed at its next monetary policy meeting in November, and now see a strong possibility that we could get another in December, with a terminal Fed funds rate of nearly 5%.

Figure 2: US Inflation Rate (2012 – 2022)

Source: Refinitiv Datastream Date: 17/10/2022

Without much in the way of first-tier economic news this week, the main news out of the US will come from the bond market. If longer-term yields have some sort of stability around current levels, there may be room for the dollar to give up some of its recent gains. A handful of Fed member speeches will also be closely watched, as markets try to gauge the likelihood of another bumper rate hike at the December FOMC meeting.

CHF

The Swiss franc was among the underperformers last week, with the EUR/CHF pair returning to the 0.98 level, the top of the range for the past three months or so. Attention in the past few weeks has been focused on the significant shifts in SNB sight deposits (including the biggest weekly drop on record), and the considerable use of the Fed’s dollar swap line (to the tune of $9bn so far in October). Some market participants have raised questions about the latter, but we don’t yet see a reason to view this as particularly worrying.

We think that speculation will now turn to monetary policy tightening. SNB president Jordan suggested last week that another rate increase is on the cards, with the question revolving around the size of this increase. In our opinion, another non-standard move of at least 50 basis points is most likely in December, although the scale of tightening beyond then will be data dependent. This week’s domestic economic calendar is largely empty, so market participants will likely focus on news elsewhere.

AUD

Aside from the Japanese yen, the Aussie dollar was the worst-performing currency in the G10 last week. Markets continued to digest the recent dovish turn from the Reserve Bank of Australia, which became the first major central bank to revert back to a ‘standard’ 25 basis point hike at its October meeting. A sizable downside surprise in consumer inflation expectations, which remained unchanged at 5.4% (5.8% expected), also weighed on AUD, as markets dialled back bets in favour of RBA rate hikes.

Communications from the RBA will remain front and centre this week, notably the release of the bank’s latest meeting minutes on Tuesday. Signs that members are growing increasingly comfortable with a slower pace of policy normalisation could weigh on the dollar this week. Thursday’s labour report will also likely be important for the currency, with economists eyeing another healthy month of job creation and a near record low unemployment rate.

CAD

The Canadian dollar lagged behind most of its major peers last week. While market pricing for the terminal level of interest rates continued to tick higher, particularly following some hawkish comments from Bank of Canada governor Macklem, the drop in oil prices partly erased some of this optimism.

This Wednesday’s Canadian inflation report for September will be closely watched by market participants. Economists are bracing for another modest easing in the headline number, although given recent surprises to the upside in global inflation prints, this is far from a given. As things stand, markets are fully pricing in another 50bp hike from the BoC at its October meeting, but see a reasonable chance of a return to a ‘standard’ 25bp move in December. Another strong inflation print could fuel bets in favour of back-to-back 50bp hikes, which would likely support the Canadian dollar in the second half of the week.

CNY

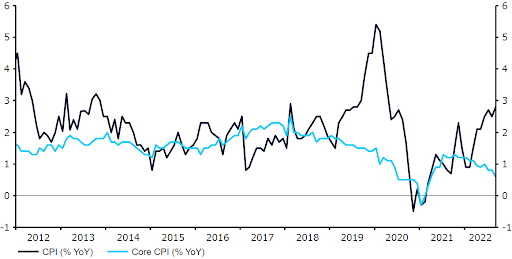

The yuan remains weak, with the USD/CNY pair edging back above the 7.20 level last week. The currency has held up slightly better in trade-weighted terms, albeit the CFETS RMB index is only slightly above recent lows. September data on new loans surprised to the upside last week, suggesting that the central bank’s efforts to reinvigorate the economy is bearing fruit. Inflation data failed to rock the boat, although the headline print did rise to a 29-month high. At 2.8%, CPI inflation is still comparatively low and downside pressures to economic activity should help to keep it in check.

Figure 3: China Inflation Rate (2012 – 2022)

Source: Refinitiv Datastream Date: 17/10/2022

China will garner global attention this week thanks to the 20th National Congress of the Communist Party. President Xi’s comments indicate a focus on supporting low income households and ensuring food, energy and industrial supply chains security, although there is no change in sight with regards to the zero-Covid policy. News from the Party Congress, including the expected re-election of Xi as party general secretary, will be closely watched this week. Upcoming economic data, including the third-quarter GDP print, previously scheduled for Tuesday, have been delayed. On Thursday, the PBOC is set to announce its key loan prime rates, although no change is expected there. The 1-year MLF rate was left unchanged earlier today.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports

🔊 Stay up to date with our podcast FXTalk