Sterling slips on inflation slowdown, Fed hike chances drop

- Go back to blog home

- Latest

Sterling slumped by over half a percent back towards the 1.30 level against the US Dollar this morning, slipping from its strongest position since September 2016.

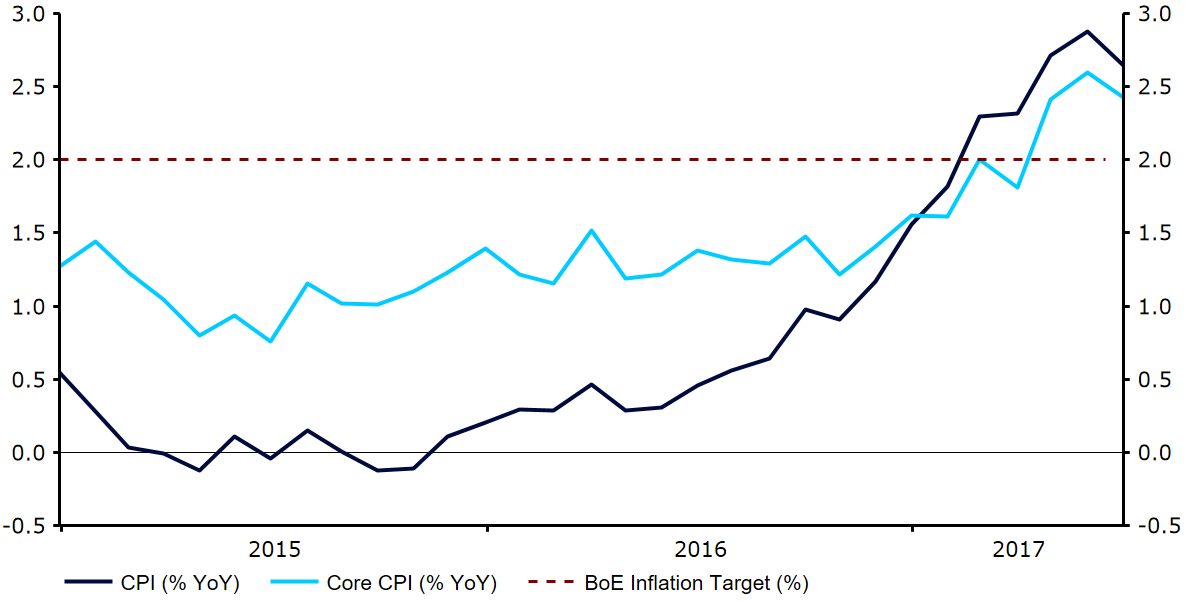

Figure 1: UK Inflation Rate (2015 – 2017)

While the move was largely driven by the volatile fuel component, it significantly lessens the pressure on the BoE to raise rates sooner rather than later. We are now unlikely to see any additional dissenters at the bank’s next meeting in early August.

Brexit negotiations also resumed in Brussels on Monday, with David Davis in the Belgian capital for talks with the EU’s chief negotiator Michel Barnier. With negotiations likely to be long and drawn out, it may still be awhile before any progress is known and short term risks for the UK currency lie predominantly in the Bank of England’s court.

Dollar struggles continue as investors discount 2017 Fed hike

The US Dollar continued to struggle against most of its major peers as markets opened for the week on Monday, with investors selling the currency on doubts that the Federal Reserve will raise interest rates again in 2017.

Expectations for another rate increase by the Fed this year have taken a blow in the past few days after Chair Janet Yellen’s comments at Congress last week suggested that the Fed was worried inflation was less certain to return to its medium term target. This comes off the back of a series of relatively disappointing macroeconomic news. US inflation has slowed, consumer spending has been tepid and retail sales have now fallen short of expectations for each of the past five months. Financial markets are subsequently pricing in just a 43% probability of another interest rate hike by the Fed in 2017, a fairly significant departure from the near 60% priced in a matter of weeks ago.

With the economic calendar in the US fairly barren this week investors may have to wait awhile before receiving further evidence on the likelihood of another FOMC rate increase. Housing data on Tuesday and Wednesday are unlikely to rock the boat and the greenback will instead be driven almost entirely by Thursday’s European Central Bank meeting.

Eurozone inflation slows ahead of ECB meeting

The biggest event risk in the currency markets this week is undoubtedly the European Central Bank’s July meeting on Thursday. Ahead of this week’s main event, inflation in the Eurozone economy was confirmed to have slowed yesterday, fuelling the argument that President of the ECB Mario Draghi may take on a slightly more cautious tone during his press conference. The revised rate of inflation came in at 1.3% YoY, although the core measure did rise to 1.2% from 1.0%.

Despite the undoubted improvement in economic conditions in the currency bloc, inflation still well below the 2% level is insufficient in our view for the central bank to hint that a tightening in policy is on the way. A more cautious message from Draghi that fails to hint at a tapering in the bank’s QE programme could lead to a fairly sharp retracement in the single currency on Thursday afternoon.