Sterling slides to six-week lows on EU vaccine spat

- Go back to blog home

- Latest

The US dollar continued to advance against its major peers on Tuesday, rising to its strongest position in four months, as investors sought the safety of the currency amid concerns over rising virus cases in Europe.

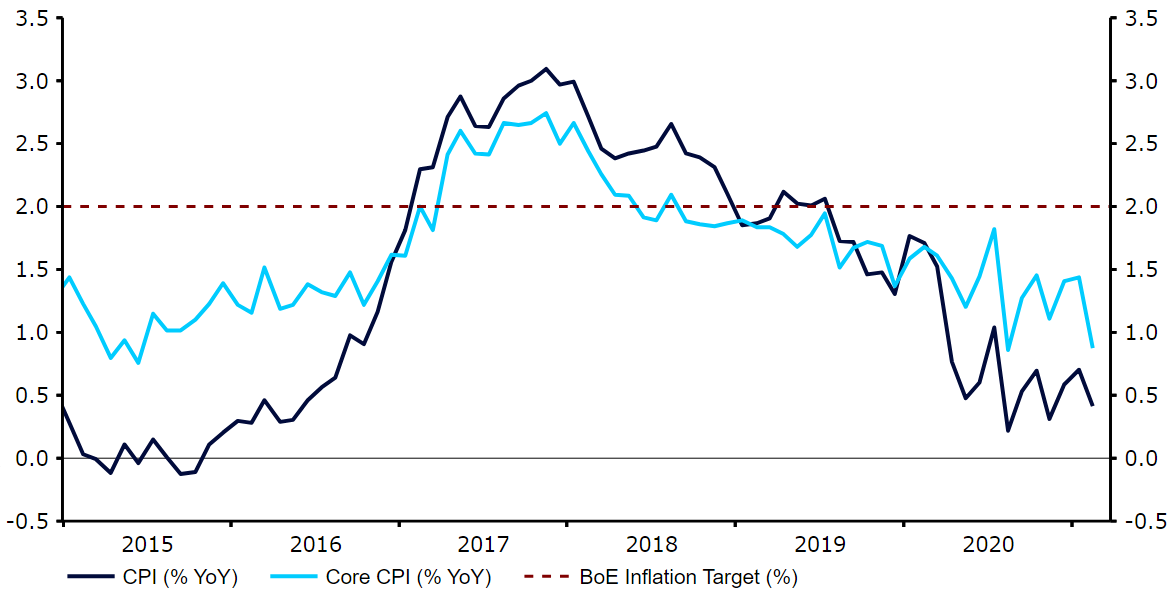

This week is a very data heavy one in the UK. A larger than expected drop in the unemployment rate to 5% from 5.2% provided little assistance to the pound yesterday. A sharp decline in February inflation data out this morning has also weighed on the currency, which is currently trading around its weakest position since the first week of February on the dollar. The headline rate of consumer price growth slipped to just 0.4% year-on-year last month, well short of the 0.8% expected. This will likely quash any lingering thoughts that the Bank of England might be in a position to raise interest rates in the UK any time soon.

Figure 1: UK Inflation Rate (2015 – 2021)

Source: Refinitiv Datastream Date: 24/03/2021

Having said that, the March PMI numbers, also out this morning, provided reason for optimism, with both the manufacturing and services indices coming in much higher than consensus. The jump in the services PMI to a comfortably expansionary 56.8 from 49.5 is a particularly welcome development and suggests that the downturn in activity in the first quarter may not be as bad as first feared.

Euro Area PMIs rise sharply, despite threat of third wave

The euro has similarly lost ground versus the dollar so far this week, although its sell-off has been slightly more contained. The ability of the common currency to better withstand losses is slightly hard to fathom, although it may partly be due to the fact that the euro has already underperformed most of its major peers so far this year. Much better-than-expected European PMI numbers out this morning have also provided the euro with a bit of assistance. Germany and France saw increases in both the services and manufacturing indices, helping to lift the Euro Area’s composite PMI to an eight month high 52.5. Fears over a third wave of infection in the bloc and the possibility of prolonged lockdowns may, however, drag this number back into contractionary territory in April. A host of countries in the EU have now either extended lockdowns, or reinforced restrictions in an attempt to allay the recent surge in infection, including Germany, France and Italy.

Attention this afternoon will now shift to a number of economic releases out of the US, including the March PMIs and durable goods orders. FOMC chair Powell will also continue his Congressional testimony, having yesterday reiterated his recent comments that any near-term increase in inflation will be transitory and therefore overlooked by the bank.