Sterling soars after retail sales for July smash expectations

- Go back to blog home

- Latest

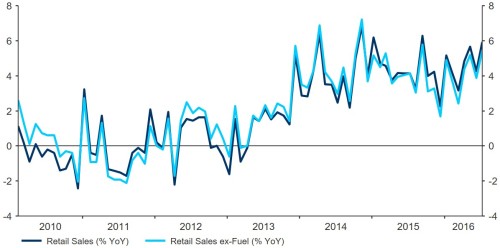

The Pound rose sharply this morning following a very impressive set of retail sales figures which suggested that consumption in the UK economy was unaffected by June’s Brexit vote.

Figure 1: UK Retail Sales (2010 – 2016)

This very encouraging result sent the Pound almost one percent higher against the Dollar this morning and suggested that the UK economy is in decent health despite uncertainty created following the shock referendum outcome.

Last night the US Dollar fell against almost all of its major peers following the release of a fairly mixed set of minutes from the Federal Reserve. There was no clear indication as to the possible timing of the next interest rate hike in the US.

The central bank of the world’s largest economy expressed relief that fears surrounding the Brexit vote had proved unfounded. However, the voting members appeared slightly more divided as to the timing of the next rate hike and are no doubt looking for further improvements in the US labour market before voting for an immediate increase in the main rate.

Earlier in the day, the Pound received support from a generally impressive set of labour data, which saw a decline in the jobless total and increasing earnings growth in June. However, given only a fraction of these numbers take into account the effect of the Brexit vote, we think next month’s jobs figures will take on much greater significance.

Eurozone inflation figures for July were in focus this morning, with consumer prices remaining at a lowly 0.2% year-on-year. This afternoon’s European Central Bank meeting minutes at 12:30 UK time could shed more light on the possibility of further easing. We also expect to see an explicit reference to the Brexit vote and its effect on the short term economic backdrop in the Euro-area.

Major currencies in detail:

GBP

Sterling rose 0.9% against the US Dollar, largely driven by this morning’s bumper retail sales figures from the ONS.

Yesterday’s employment data also showed little sign of a negative effect from June’s Brexit vote. The jobless total fell in absolute terms by 52,000, although the rate of unemployment was unchanged at 4.9%.

Average earnings growth was also impressive. Earnings excluding bonuses, a key gauge used by the Bank of England when deciding on monetary policy, rose to 2.4% from 2.3% and to 2.3% from 2.2% excluding bonuses.

EUR

The single currency increased 0.6% against the US Dollar following the release of last night’s Fed minutes.

The Euro was range bound throughout the London session on Wednesday, with no economic announcements whatsoever in the Eurozone keeping all eyes on the FOMC minutes and volatility to a minimum.

Today should be a much busier day in Europe. Inflation data this morning was unchanged as expected, although focus will be on the ECB’s meeting accounts at 12:30 UK time. Traders will be looking for comments on the Brexit referendum and any hints as to the likelihood of additional easing in response, but we note that these minutes seldom contain market moving information.

USD

A fairly noncommittal set of Fed minutes sent the US Dollar index 0.6% lower yesterday.

The Fed appeared unconcerned by the effects of the Brexit vote, with the country’s independence from events in Europe allowing its economy to perform fairly well in the past couple of months. Despite this, some officials voiced concerns about the stubbornly slow rate of inflation and the effect of low interest rates on financial stability. Some members backed a July hike but others wanted to see more data on the economy and inflation.

We now await the next labour report in the first week of September. We think a strong nonfarm payrolls figure could put the Fed firmly on course to hike rates in December after the US Presidential Election.

With focus on events in the Eurozone today, announcements in the US will likely take a backseat. Initial jobless claims and another speech from Federal Reserve member John Williams this evening will be the main focal points across the pond.

Receive these market updates via email