Sterling has best day since 2008 after Theresa May’s Brexit speech

- Go back to blog home

- Latest

UK Prime Minister Theresa May triggered Sterling’s best daily performance since 2008 on Tuesday, with the Pound surging by over 2% for the day against both the Euro and the US Dollar following her highly anticipated speech in London yesterday morning.

With this largely priced in by the market, investors instead reacted by buying into the Pound on May’s promise that a parliamentary vote would be required on Britain’s deal to leave the European Union. The speech itself was also significantly less tough sounding than the market had been anticipating. Sterling was already 1% higher prior to her speech and rallied further to its strongest position against both the Euro and the Dollar in 10 days.

We expect the bumpy ride in Sterling to continue in the coming weeks and months. The real test for the currency will come once Article 50 is formally triggered, where specific details of Britain’s trade deals begin to materialise. With markets currently bracing themselves for the worst-case scenario to negotiations, we think further modest gains for Sterling against its major peers are possible in the next few weeks, particularly against a much weaker Euro.

Major currencies in detail

GBP

Sterling strengthened sharply following Theresa May’s speech, largely off the back of the announcement that parliament will vote on the proposed Brexit deal. The Pound ended London trading a massive 2.4% higher against the US Dollar and 1.8% up versus the single currency.

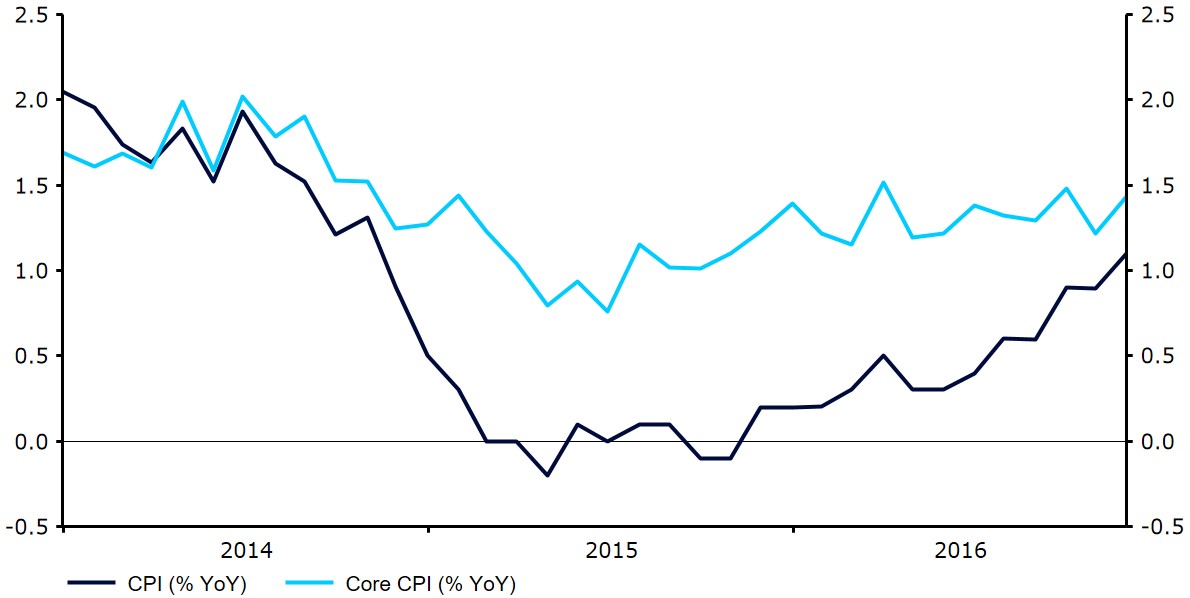

The UK currency received further support early yesterday morning from a very impressive set of inflation figures that far exceeded expectations. Headline consumer price growth in the UK surged to 1.6% in December from 1.2%, with rising air and fuel fares pushing inflation to its highest level since July 2014. A sharp decline in the Pound last year is beginning to filter its way into domestic prices, and we expect to see inflation reach the BoE’s 2% target at some point in 2017.

Figure 1: UK Inflation Rate (2014 – 2016)

Attention in the UK this morning will be on the latest labour report, including November’s unemployment and earnings data.

EUR

The single currency rose 0.6% against the US Dollar yesterday, helped along by Theresa May’s comments on negotiating trade deals with European counterparts.

Economic sentiment data was also fairly encouraging on the whole in the Eurozone yesterday. The ZEW economic sentiment index rose to 23.2 this month from 18.1 recorded in December, albeit slightly below expectations. Sentiment in Germany also increased to a seven month high, mainly due to a general improvement in overall economic conditions in Europe.

Revised inflation data will be the main focal point for Euro traders this morning when released. With price growth widely expected to remain unchanged, we’re unlikely to see a significant shift in the Euro to the news as investors instead eye up Thursday’s ECB meeting.

USD

Yesterday’s Dollar slump against the Pound and the Euro hit the US Dollar index hard on Tuesday, which ended trading 0.8% lower.

Speeches from Federal Reserve members will be the focal point of the week this week. William Dudley spoke yesterday, claiming that the US economy remained in “quite good shape”, with expansion in the economy to continue. Fed member Brainard also spoke rather hawkishly on Tuesday, entertaining the possibility that the Fed could hike rates more aggressively this year in response to fiscal policy changes under a Donald Trump presidency.

Inflation in the US this afternoon is expected to see a modest upward revision to 2.1% in December from 1.7%. Chair of the Federal Reserve Janet Yellen will also be speaking this afternoon.