Impressive US inflation data bolsters Fed rate hike chances

- Go back to blog home

- Latest

The US Dollar dipped against its major peers on Wednesday, despite the release of an impressive set of inflation figures out of the US economy.

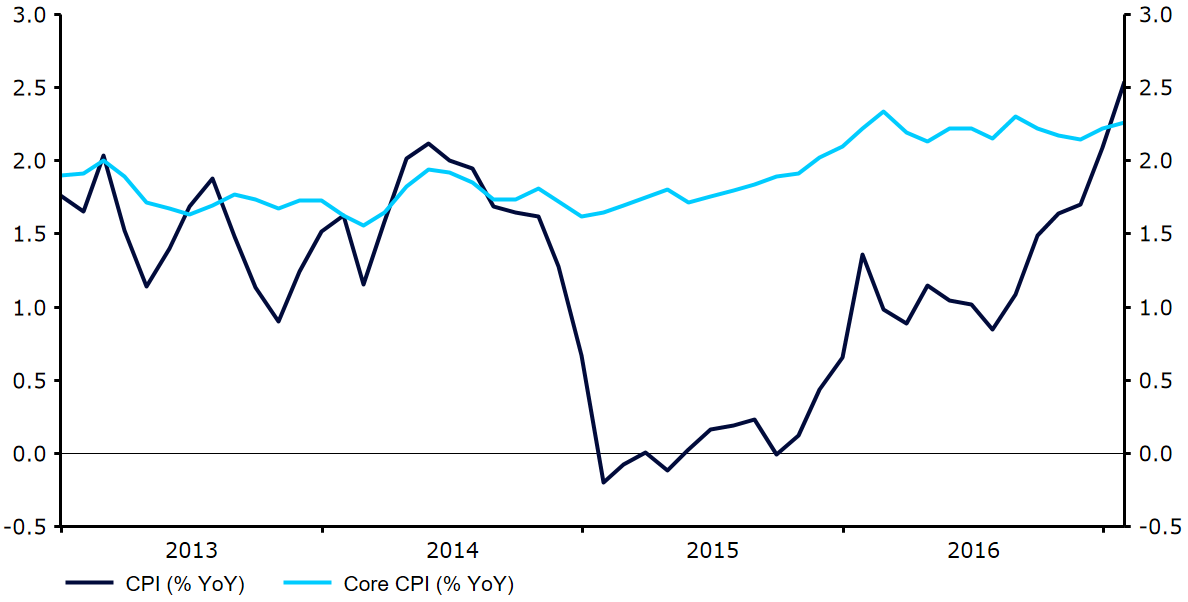

Figure 1: US Inflation Rate (2013 – 2017)

Moreover, the latest retail sales figures out of the US released yesterday also beat even the most optimistic of forecasts. Expectations for a hike at the next FOMC meeting next month appear to be back on the table after Wednesday’s data and Janet Yellen’s relatively hawkish comments at Congress this week.

Sterling briefly slipped to its weakest position in over a week against the Dollar following the release of a slightly disappointing labour report in the UK, before recovering later on. Unemployment in Britain remained unchanged, although an unexpected slowdown in earnings growth raised question marks over the general health of the UK economy.

Elsewhere, the Swedish Krona sank after the country’s central bank, the Riksbank, promised that interest rates in Sweden could be cut from already record low levels. The Riksbank kept its benchmark interest rate unchanged on Wednesday, although suggested that an additional cut could be on the way should inflation fail to show a significant pickup.

The European Central Bank will be releasing its monetary policy meeting accounts this afternoon in what is likely to be the main economic announcement today. Jobless claims in the US this afternoon are expected to remain around their four decade low.

Major currencies in detail

GBP

Sterling recovered after yesterday’s below forecast earnings data, ending the session 0.1% higher against the US Dollar.

Labour data out of the UK yesterday was mixed. The unemployment rate remained at a healthy 4.8% in the three months to December, its lowest level in a decade, although unemployment actually decreased in real terms. Average earnings excluding bonuses, however, dipped to 2.6% from the 2.7% recorded in November. While wages remain around the level of inflation, the gap between the two is now narrowing, and should cross at some point in 2017. This increase in the cost of living will make it difficult for the Bank of England to hike rates in the coming months.

With no major economic data releases in the UK today, investors will turn their attention to Friday’s retail sales figures announcement.

EUR

The Euro rallied 0.2% against the US Dollar on Wednesday.

The single currency was largely driven by external factors yesterday, with the latest trade balance data not a major market mover. The trade surplus in the Euro-area swelled to 28.1 billion Euros in December from 25.9 billion Euros, its highest reading in six months. This followed a sharp 6% rise in exports year-on-year compared to a slightly more modest 4% increase in imports.

The ECB’s meeting accounts will be released at 12:30 UK time today, although generally fail to prove a major market mover.

USD

The Dollar just missed out on its longest run of daily gains against its basket of peers in almost five years on Wednesday, despite an impressive set of inflation figures in the US. The US Dollar index ended London trading 0.2% lower.

News out of the US economy was positive across the board. A strong headline inflation number was matched by a pickup in core inflation, which rose to 2.3% versus the 2.1% consensus. Retail sales also rose 0.4% in January, the fifth straight month of expansion.

Meanwhile, Fed Chair Janet Yellen continued her two day testimony to Congress. Yellen struck a similarly hawkish tone, claiming that the central bank was close to achieving its labour market objectives.

Jobless claims and the monthly housing data from the US Census Bureau will be released at 13:30 UK time. The next major economic announcement will be the Fed’s meeting minutes next Wednesday.