The yuan’s share of the foreign exchange market is rising

( 3 min )

- Go back to blog home

- Latest

The Triennial Central Bank Survey from the Bank of International Settlements provides us with a number of very interesting details about the evolution of the foreign exchange market.

The latest survey conducted in April, involving central banks and authorities from 52 jurisdictions, and more than 1,200 financial institutions, allows us to obtain a more complete and up-to-date view of the market. The foreign exchange market is growing strongly and, notably, the Chinese yuan is becoming increasingly important.

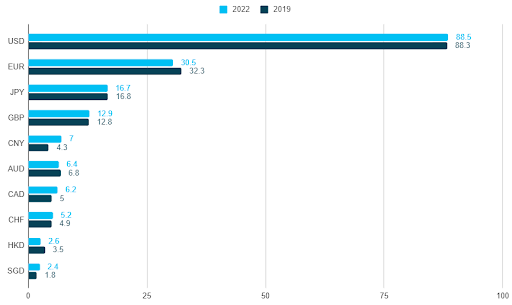

In the last three years, the average daily FX market turnover jumped from around $6.6 trillion to $7.5 trillion, an increase of almost 14% – the highest in the history of the survey. The US dollar is still the dominant currency, as 88.5% of transactions involve the dollar on one side or the other of the trade. The euro, the Japanese yen and the pound retain their FX turnover rankings from the previous survey, at second (30.5%), third (16.7%) and fourth place (12.9%) respectively.

Since the 2019 survey, the Chinese renminbi has posted the biggest increase in market share, with the currency involved in 7% of all trades in 2022 (up from 4.3% in 2019). As a result, the renminbi has become the fifth most widely traded currency, up from eighth place three years ago. The top three most widely traded currency pairs remain EUR/USD, USD/JPY and GBP/USD, but interestingly, USD/CNY has overtaken USD/CAD and AUD/USD into fourth spot.

Figure 1: Largest FX Turnover by Currency (2019 vs. 2022)

The steady growth of the renminbi’s share over the course of the last few years has been a noteworthy one, as it expands its global role in international payments, investments and foreign exchange reserves. As China deepens its financial openness and trade cooperation, the PBoC has sought to advance the internationalisation of the renminbi to facilitate its use, promoting greater settlement in the local currency. The Chinese currency accounted for a total of $526 billion in daily settlements according to this year’s survey, an 85% increase compared to 2019 ($285 billion).

The growing importance of the yuan in currency trading can be explained by these factors:

- The PBoC’s promotion of renminbi internationalisation through local currency settlement. According to the report, the central bank pledged efforts to facilitate the use of the renminbi in cross-border trade and investment, deepen the opening up of financial markets, promote local currency settlement with more central banks and enrich the products offered by offshore renminbi markets.

- China’s strong exports and the appeal of yuan-denominated assets to foreign investors have led to an increase in the renminbi’s use for global payments and settlements.

- The use of the renminbi has increased in some parts of the world due to the sanctions imposed by the US during geopolitical tensions. The use of the yuan will likely increase further in these areas, particularly if the sanctions are prolonged.

- The gradual shift to a multipolar global currency system, that is less centred towards the major economic areas.