Time for a dovish pivot?

( 5 min )

- Go back to blog home

- Latest

We think that this week’s Federal Open Market Committee meeting could be one of the most important in the current tightening cycle.

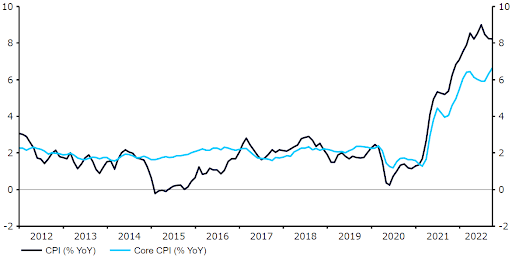

Figure 1: US Inflation Rate (2012 – 2022)

Source: Refinitiv Datastream Date: 31/10/2022

The pace of additional tightening beyond Wednesday’s meeting is, however, more of an open question. There will be no ‘dot plot’ released this week, so market participants will be fully focused on the forward guidance in the Fed’s statement and chair Powell’s accompanying press conference. We will be scrutinising the tone and content of the Fed’s communications for any clues that could guide the following assumptions:

Will the Fed revert back to a 50bp rate hike at the last FOMC meeting of the year in December?

Could the tightening cycle be drawn to a close at the subsequent meeting in February?

With regards to the former, we do indeed expect the Fed to hint on Wednesday that a slowdown in the pace of rate increases may be on the way from December, though this will be a very close call. A report released by the Wall Street Journal earlier this month suggested that some policymakers are becoming increasingly uncomfortable about the impact of aggressive hikes on the US economy. We have also seen signs of a dovish pivot among a handful of Fed members in recent weeks. Members Brainard, Evans and George, to name a few, have all let it be known their trepidation for going big again beyond this week’s meeting, and this faction of dissent is likely to be alluded to in the bank’s official communications. In our view, a return to a 50bp hike in December, in line with the FOMC’s September ‘dot plot’, is now the most likely scenario.

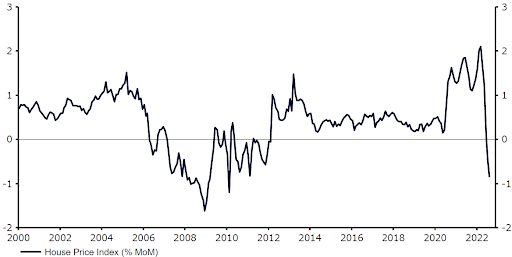

Since the release of the WSJ report, US macroeconomic data has deteriorated, which we think will further pressure policymakers towards delivering a dovish pivot. The composite PMI from S&P has fallen deeper into contractionary territory (47.3), consumer confidence fell well short of expectations and the housing market has shown signs of a slowdown – US house prices fell for the second straight month in August for the first time in over a decade.

In any event, the Fed is likely to stress that it remains in data-dependent mode, so another blow up in consumer prices in the interim could change this stance. We mustn’t lose sight of the fact that the Fed’s primary goal is ensuring price stability, and Powell has long stressed that the bank plans to continue raising rates until it sees compelling evidence that inflation is under control.

Figure 2: US Housing Price Index (2000 – 2022)

Source: Refinitiv Datastream Date: 31/10/2022

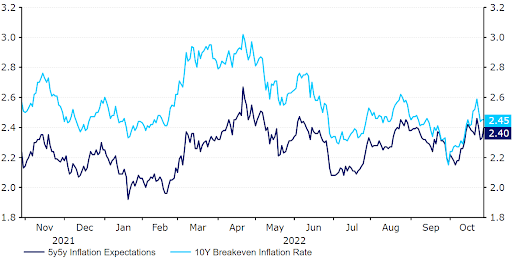

With regards to the latter of the two questions, we believe that we won’t get any clear forward guidance on when the Fed expects to end the hiking cycle. Again, this will be entirely data-dependent, and policymakers will likely steer clear of providing any assurances on rates this week. In our view, this would be premature in an environment where core inflation remains sky-high, job creation is robust and unemployment is at multi-decade lows. It’s also worth noting that inflation expectations have increased again – the 10-year breakeven inflation rate is back up to 2.45% (from a low of 2.15% in September). We instead think that the Fed will wait until the December meeting, when its next set of macroeconomic and interest rate projections are released, before providing any clear idea on when it may end the tightening process.

Figure 3: US Inflation Expectations (2021 – 2022)

Source: Refinitiv Datastream Date: 31/10/2022

The US dollar has retreated from its strongest position against its major peers in twenty years in the past few weeks, partly in response to an easing in Fed rate hike expectations. Fed fund futures are now only pricing in around a 30% chance of another 75bp rate hike in December (from 75%), so a dovish pivot at this week’s meeting wouldn’t be a complete disaster for the dollar, though it would nonetheless likely lead to a sell-off. Should the FOMC stick to its guns, and leave the door open to another 75bp rate increase in December, then the dollar would probably be very well supported during the second half of the week. Given the limited progress made on the inflation front, this cannot be entirely ruled out.

The FOMC will announce its latest policy decision at 6pm GMT (7pm CET)on Wednesday, with chair Powell’s press conference to follow 30 minutes later.