Trump keeps market guessing amid China trade talks

- Go back to blog home

- Latest

Attention in the FX market today is firmly on the US-China trade discussions.

Donald Trump is keeping the market on its toes, stating yesterday that a deal with China ‘is still possible’ this week following what he claimed was a ‘beautiful letter’ from Chinese President Xi. The safe-havens briefly reversed some of their gains on the news on Thursday, with the Euro and Pound both rallying back above the 1.12 and 1.30 levels respectively.

Currency traders are likely to remain jittery today as they await news out of discussions, although this may not come until after European market close this evening.

Sterling holds above 1.30 level after solid UK data

As mentioned, Sterling rose back above the 1.30 level yesterday afternoon, although remained mostly in a holding pattern this morning despite a slew of economic data releases.

The latest GDP numbers showed that the UK economy expanded, as expected, by 0.5%

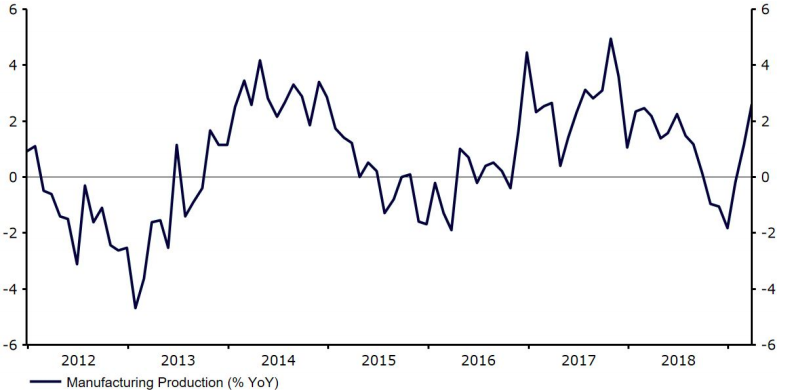

quarter-on-quarter in the first three months of the year. We also had some better-than-expected manufacturing and industrial production numbers, the former of which leapt by 2.6% year-on-year, its largest increase since late-2017. These numbers suggest that the UK economy is remaining remarkably resilient to the elongated uncertainty surrounding Brexit. Cross party talks continue to yield very little and it could be some time before we see any positive news on that front.

US inflation numbers eyed this afternoon

Aside from news out of the US-China trade talks, today will also be a pretty busy day in terms of macroeconomic data releases. This afternoon’s US inflation numbers are likely to prove a market mover, given their importance to Federal Reserve monetary policy. Amid recent trade uncertainty, and its recent perceived negative impact it could have on the US economy, expectations for Fed rate cuts are now higher than ever. Fed fund futures are now placing more than a 50% chance of at least one rate cut from the FOMC this year. We do, however, think that this is somewhat of an overreaction. Some positive inflation data today and news of some form of breakthrough in trade talks would certainly cause markets to dial back these bets, which could be supportive of the US Dollar.