Ugly US PMI numbers trigger reversal in dollar rally

( 3 min )

- Go back to blog home

- Latest

A dismal set of business activity PMI numbers out of the US sent the dollar sharply lower on Tuesday afternoon, with the greenback reversing its gains from earlier in the week against most of its major counterparts.

Summary:

- US dollar falls sharply after much weaker-than-expected PMI numbers.

- EUR/USD briefly rallies back above parity, but ongoing concerns over European energy crisis prevent a meaningful rebound.

- August PMI numbers out of the Euro Area and UK are a mixed bag. UK economy appears to be holding up slightly better thus far, but still on brink of contraction.

- Emerging market currencies post big gains on the USD, led by commodity currencies.

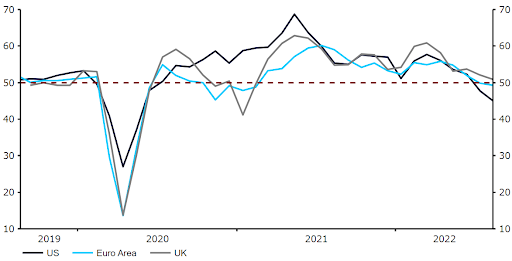

We had billed yesterday’s PMI numbers as the most important data releases on the economic calendar this week, and they certainly lived up to all the hype. Most alarming was the far worse-than-expected data out of the US economy. The US services PMI from S&P was an unmitigated shocker, collapsing to 44.1 in August from 47.3, after markets had expected a bounce to just below flat growth. Not only is this now well below the level of 50 that separates expansion from contraction, but it is comfortably the lowest level since the pandemic shutdowns in May 2020. US manufacturing activity appears to be holding up slightly better, although the big downside surprise in the composite index (45.0 vs. 47.5 expected) does not make for very good reading at all.

Figure 1: G3 PMIs (2019 – 2022)

Source: Refinitiv Datastream Date: 23/08/2022

Higher interest rates and the rising cost of living clearly appear to be having a greater impact on US activity than first thought, with markets also wary of the possible growth spillover from the ongoing energy crisis in Europe. Investors reacted as one would expect, with the dollar selling off sharply across the board. EUR/USD was up over one percent at one stage to back above parity, although the pair gave up some of these advances towards the end of the London session. Prior to the data, markets were pricing in around a 50/50 chance of another 75 basis point interest rate hike from the Federal Reserve at its September meeting. But, with inflation beginning to show signs of easing, and US activity data taking a turn for the worse, we think that the safe money is on a return to a more measured approach.

Earlier in the day, the PMI numbers for both the Euro Area and the UK were a bit mixed, albeit nowhere near as disappointing as those out across the Atlantic. The Euro Area composite PMI actually beat expectations, although still fell to 49.2 in August, following far weaker-than-expected services activity in both France and Germany. With European energy prices continuing to break to fresh highs, this appears to be a prelude to a pending recession – we think that the data is highly likely to worsen further in the coming months. But the narrative for a little while now is that the US economy is in a better position to weather the storm than its counterpart in the Eurozone, so the euro was well placed for a much needed rebound following the dire numbers out of the US on Tuesday afternoon.

Yesterday morning’s UK PMI data was also very much a mixed bag, with a sharp slowdown in manufacturing activity (to 46.0 in August) offsetting the stronger-than-expected services index (52.5 vs. 52.0 consensus). For now, the composite PMI continues to print above the key level of 50, although only barely, and it surely won’t be too long before we see this indicator tip into contractionary territory. The UK’s cost of living crisis is set to get worse before it gets better, and with energy prices continuing to march to fresh highs, it seems increasingly likely that a sharp slowdown, and a potentially protracted recession, may be on the horizon. Sterling did, however, take the data in its stride, and investors may perhaps be encouraged that for now at least, UK economic data is holding up slightly better than elsewhere.