UK business activity slumps post-Brexit, ECB keeps rates unchanged

- Go back to blog home

- Latest

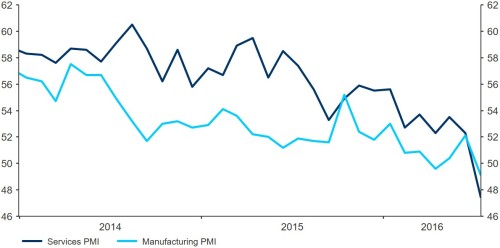

The Pound fell sharply this morning on the back of a dismal set of PMI figures for July which showed the first real indication of the impact of last month’s vote to leave the European Union on Britain’s economy.

Figure 1: UK Purchasing Managers’ Indexes (2014 – 2016)

Such weak numbers are consistent with a quarterly contraction in GDP of around 0.4% and we think this all but confirms we’ll see some sort of response from the Bank of England at its August meeting. We expect at least a 25 basis point cut in the benchmark interest rate and we could even get an explicit hint that further quantitative easing might be on the way later in the year.

Prior to this morning’s numbers the Euro was little changed on Thursday, with a fairly uneventful and noncommittal monetary policy meeting from the European Central Bank not causing the currency fireworks we’ve seen in the past from the ECB.

There were no real surprises yesterday, with policymakers holding off from adding to the ECB’s already substantial easing measures. The main interest rate was kept at zero, the deposit rate held at -0.4%, while the quantitative easing programme was unaltered at 80 billion Euros a month, as expected.

President of the ECB Mario Draghi failed to commit to further stimulus in the coming months, disappointing some investors that had hoped for hints of a September move. The ECB is clearly in ‘wait-and-see’ mode given it has, at present, very little information on the impact of the Brexit vote.

However, Draghi did reiterate that the central bank remains willing and able to act and, by September, it should have a much clearer view on what affect the Brexit vote has had on economic conditions in the Euro-area.

All in all, there was little new information to take away from the ECB yesterday and the Euro was barely moved as a result. We continue to expect no change in policy from the Governing Council until at least the September meeting.

Major currencies in detail:

GBP

Sterling fell 0.6% against the US Dollar this morning with the weak set of PMI’s and yesterday’s underwhelming retail sales figures sending the Pound broadly lower against its major peers.

Retail sales in June were much lower than forecast, falling 0.9% for the first time since March. In the year to June sales also slowed, growing by just 4.3% versus the 5.7% recorded in the month previous. With only a small fraction of these figures taking into account the post-Brexit impact, the sharp drop can largely be attributed to last month’s unseasonably poor summer weather.

Markets are pencilling in a drop in the key services PMI to 49.2 from 52.3 this morning, well below the expansion/contraction line of 50. However, given the unprecedented situation, this estimate is little more than a guess.

EUR

Despite rallying to a two day high following the ECB’s decision to hold rates, the Euro ended the day 0.2% lower against the US Dollar.

Traders hoping for a sharp rally below the 1.10 mark in EUR/USD were left disappointed following the ECB’s very low key meeting, giving investors very little reason to either buy or sell the Euro yesterday.

Notably, Draghi did explicitly call for looser fiscal policy and reiterated Eurozone banks remain solvent, even amid concerns regarding the recent banking crisis in Italy.

The Eurozone PMI numbers were slightly better than expected this morning, although activity still slowed to its lowest level in eighteen months with the composite index declining to 52.9 from 53.1.

USD

The US Dollar index was unmoved for the second session in a row yesterday following the ECB’s uneventful press conference.

Strong economic data keeps flowing out of the US economy. Initial jobless claims fell again to 253,000 yesterday, extending the longest run below the threshold 300,000 mark since 1973 to 72 consecutive weeks. The more representative four week moving average also fell to just 257,750.

Existing home sales rose more than expected, climbing 1.1% to 5.57 million. Such impressive economic data will be welcome news to the Federal Reserve which holds its next monetary policy meeting on Wednesday next week.

Given the US economy’s isolation to events in Europe, we’re not expecting to see any signs of a slowdown in the US manufacturing PMIs this afternoon.

Receive these market updates via email