UK Mini-Budget Reaction: Sterling hits record low after budget catastrophe

( 3 min )

- Go back to blog home

- Latest

Sterling has been battered in the past couple of trading sessions, as investors make their feelings about last week’s (not so ‘mini’) budget announcement from the UK government abundantly clear.

Figure 1: GBP/USD (22/09/2022 – 27/09/2022)

Source: Refinitiv Date: 27/09/2022

What was unveiled during the budget announcement?

- Basic tax rate cut to 19% from 20%, as of April 2023.

- 45% top tax rate for highest earners (£150k+ per annum) scrapped.

- Stamp duty relief increased to £250k (from £150k), and to £425k (from £300k) for first time buyers.

- Planned corporation tax increase (from 19% to 25%) due in April 2023 has been scrapped.

- Average household energy bills to be frozen at £2,500 for the next two years.*

- Cap to roughly half energy bills for UK businesses over next six months.*

*already announced prior to last week’s budget

In short, the government plans to deliver more tax cuts than expected (around £160 billion over the next five years – the largest in decades), and has provided no real assurances as to how it will eventually balance the books. The exclusion of the Office for Budget Responsibility (OBR) from the budget, an independent body designed to assess the potential impact of policy announcements on GDP, deficit and debt levels, has also weakened both the plan’s transparency and credibility. According to Kwarteng, these will be made available on 23rd November.

What does this mean for the UK economy?

In our opinion, we think that the near-term risk of recession, and the possibility of an immediate sharp downturn in economic activity, has eased since Truss announced plans to freeze UK energy bills over the next two years. We viewed the increase in the energy price cap, which was set to rise to around £3,500 and £6,600 for the average household in October and April respectively (from £2,500), as the biggest downside risk to UK growth in the next 6-12 months.

- In our opinion, we think that the near-term risk of recession, and the possibility of an immediate sharp downturn in economic activity, has eased since Truss announced plans to freeze UK energy bills over the next two years. We viewed the increase in the energy price cap, which was set to rise to around £3,500 and £6,600 for the average household in October and April respectively (from £2,500), as the biggest downside risk to UK growth in the next 6-12 months.UK inflation to stay higher for longer. Announcing sweeping tax cuts and injecting significant fiscal stimulus is a very risky play for an economy already experiencing sky-high inflation (9.9% in August). The market clearly sees the medium-term impact from higher disposable incomes as inflationary, and it now seems likely that it will take much longer for the Bank of England to reach its 2% inflation goal, even if the near-term peak may fall slightly lower. Moreover, the sharp drop witnessed in sterling (now trading around 9% down in trade-weighted terms since the start of the year), has clear inflationary implications and will further exacerbate matters. This presents a significant downside risk to growth, once the near-term boost from lower tax rates subsides.While one cannot make a direct comparison between the current state of affairs and the massive tax cuts from the Anthony Barber budget of 1972, these measures merely boosted growth temporarily, before triggering a sharp increase in inflation (that more than tripled in the three years following).

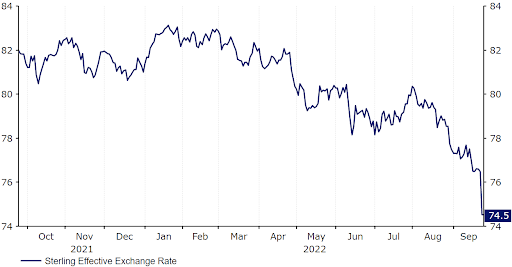

Figure 2: Sterling Trade-Weighted Index (2021 – 2022)

Source: Refinitiv Datastream Date: 27/09/2022

-

Bank of England to raise interest rates more aggressively.

Even prior to last week’s budget announcement, the MPC warned at its September meeting that inflation rates would likely be higher in the medium-term, rather than lower, as a result of the government’s energy bill freeze. Since the budget, markets have doubled-down on expectations for higher Bank of England interest rates, and are now pricing in rates in excess of 6% in mid-2023 (currently 2.25%). The risk here is that any positive impact on growth from the fiscal stimulus may be either partly, or fully, offset by the downside risk to growth from higher interest rates. This would make the fiscal measures an ultimately self-defeating policy change.

There was speculation that the MPC could raise rates in an emergency meeting on Monday, although investors were left disappointed, as all we received was a comment that the pound’s drop and fiscal plan will be assessed at the next meeting in November. Markets were hoping for a little more, and sterling shed more than 1% off the back of the press release.

We think that investors may not let the Bank of England wait that long, and still wouldn’t be at all surprised to see an emergency rate hike in the interim, though direct FX intervention seems unlikely.

-

UK borrowing to rise.

For tax cuts to be self-financed, they are dependent on an equal or disproportionate increase in economic activity, but this isn’t on the cards. In reality, the tax cuts and fiscal injection is set to be financed by much higher borrowing at a time when the Bank of England is raising interest rates aggressively. This has raised concerns about a sharp increase in the budget deficit and public debt levels, further knocking investor confidence towards UK assets.

The reaction in fixed income markets to the budget has been dramatic, with investors selling UK bonds en masse. The UK’s cost of borrowing, represented by the yield on these bonds has, therefore, increased sharply. The yield on the 10-year Gilt, for instance, has now risen by around 70 basis points since Friday morning to above 4.1% – its highest level since 2010. Not only does this have a direct impact on the government’s borrowing costs, but it also has a knock-on effect on mortgage rates, which are set to rise sharply. This risks making housing increasingly unaffordable, and will further erode disposable incomes.

Figure 3: UK 10Y Gilts Yield (2021 – 2022)

Source: Refinitiv Datastream Date: 27/09/2022

Bank of England to raise interest rates more aggressively.

We think that the government’s fiscal package is a very risky one, as there is no real empirical evidence to suggest that countries with lower tax rates grow more quickly, nor do studies suggest that ‘trickle-down’ economics promotes growth either. The reaction in sterling suggests that the market clearly believes these measures will fail, and that the UK economy is now on a more fragile footing than it was prior to the announcement.

Against the US dollar, the pound plunged by almost 4% on Friday, and was down another 4% at one stage during Asian trading on Monday, and an all-time low in GBP/USD, before recovering its losses. We think that the recovery in the pound so far today has to do with growing speculation that the Bank of England will intervene, either verbally or by raising interest rates in an unscheduled meeting. The outlook for the UK currency has, however, deteriorated quite significantly, in our view, and we will be updating our view accordingly in the coming days. Needless to say, we will be making sharp downward revisions across our forecast horizon, as we believe that the long-term outlook for the UK economy is less favourable than prior to the budget announcement.