UK wages accelerate, BoE Governor Carney to stay on until 2020

- Go back to blog home

- Latest

Sterling briefly touched its strongest position against the US Dollar since the beginning of August on Tuesday, although gains were capped due to higher US yields and doubts over whether the Bank of England would raise interest rates any time soon.

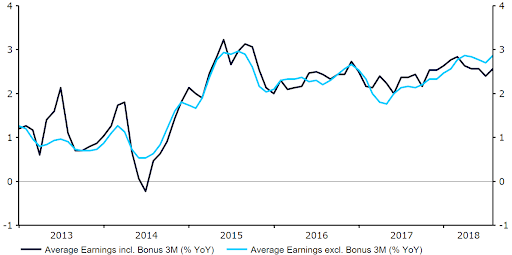

Surprisingly, yesterday’s UK labour report was not enough to prevent the Pound ending London trading lower against the US Dollar. The labour report for July was an impressive one, showing an increase in earnings growth to 2.6% including bonuses and 2.9% excluding (FIgure 1), both comfortably above consensus.

Figure 1: UK Wage Growth (2013 – 2018)

, The reason for the lack of Sterling support was likely due to the fact that even these positive numbers will not encourage policymakers to vote for an immediate interest rate hike when the Bank of England announces its latest monetary policy decision tomorrow.

US bond yields rise, ECB to meet tomorrow

An increase in US Treasury yields back towards the 3% mark helped the US Dollar to rally on Tuesday. The currency was also helped on its way by limited appetite for risk amid ongoing concerns over an escalating trade conflict. Asian equity markets slumped for the 10th consecutive day as a result of the uncertainty, while the sell-off in emerging market currencies continued, led by the Indian Rupee. FX traders will now look ahead to a couple of speeches from Federal Reserve members Bullard and Brainard this afternoon. With the market fully pricing in another interest rate increase from the Fed later this month, investors will be hoping for a clearer idea as to a further hike in December.

Meanwhile, we saw a modest uptick in the latest ZEW confidence index in the Eurozone yesterday, although the measure remained soft and deep in negative territory at -7.2 from -11.1. Attention now shifts to this Thursday’s European Central Bank meeting. We don’t expect any changes in policy from the ECB, with Mario Draghi likely to reiterate plans to begin winding down the bank’s QE programme from September. The key to the common currency will likely be comments over the looming trade war, and its possible impact on the Euro-area economy.