US dollar bounces back as traders adjust positions

( 3 min read )

- Go back to blog home

- Latest

The sharp move upward in the US dollar last week was somewhat counter intuitive, as inflation and wage data out of the US were both reassuring for the Federal Reserve and consistent with a slow downward trend in inflationary pressures.

We now go into an unusually quiet week in terms of macroeconomic data, where only the April employment report out of the UK stands out. The monetary policy calendar is more crowded, with an unusually large number of speakers from the Fed, the ECB and the Bank of England who will be expected to clarify their respective institutions’ outlook. A number of second-tier indicators worldwide should be followed closely for confirmation of the apparent slowdown we have seen in economic data over the past few weeks.

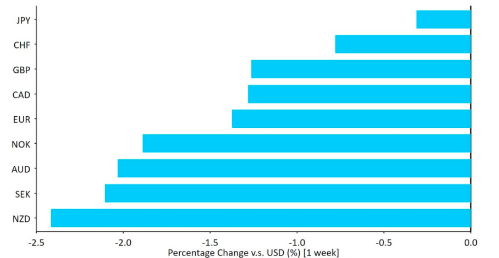

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Bloomberg Date: 15/05/2023

GBP

The Bank of England executed yet another communications turnabout at its meeting last week. There were no large surprises in the actual decision to hike rates by 25bps, while the forward guidance was left unchanged in an apparent sign that at least one more hike is on the way at the next MPC meeting in July. The bank did, however, issue the largest ever upgrade to its macroeconomic outlook since the GDP projections began in 1997, stressing that it now no longer expects a recession. Moreover, the BoE revised upward its projected inflation path, suggesting that the terminal UK rate may end higher in 2023 than previously anticipated.

The pound should remain well supported in the coming weeks. A cheap valuation and a relatively hawkish Bank of England should remain tailwinds, and sterling does not have the same positioning issues that the euro suffers from in the short-term.

EUR

The euro is back at the middle of the trading range that has held so far in 2023, in spite of the significant narrowing in interest rate differentials that we have seen with the US. Some weakness in volatile economic indicators out of the Eurozone, like German industrial production and factory orders, have dented sentiment somewhat, but we think that the main driver of the dollar rebound has been short covering.

This week, the main market mover for the common currency should be a barrage of speeches by ECB Council members, including President Lagarde. We expect no real change in the bank’s tone of communications, with Lagarde likely to reiterate that the bank remains in ‘data-dependent’ mode. As things stand, markets are almost fully pricing in two more 25bp rate hikes from the Governing Council in the coming months, though additional upside surprises in Euro Area inflation data could ensure that this is somewhat of a conservative estimate.

USD

US inflation data for April was marginally weaker than expected, helping cement the view that the Federal Reserve is done hiking interest rates and will pause at its June FOMC meeting. A downtick in the best measure of US wages, the Atlanta Fed wage tracker, also points in the same direction, as does the clear uptrend in weekly jobless claims and the loosening in the labour market that can be seen in the JOLTs open positions indicators.

For now, these hints of a slowdown in the world’s largest economy are driving a short-covering rally in safe-havens generally, and the US dollar in particular. We may have to wait for the May inflation data and June central bank meetings before the trend downward in the US dollar is re-established. In the meantime, industrial production and retail sales data will be released this week, and could receive some attention among market participants.

JPY

Aside from the US dollar, the yen was the best performing currency in the G10 last week in a clear sign that risk aversion drove much of the activity in the FX market. The USD/JPY pair edged modestly higher once again, extending the upward move that commenced in late-March. In that time, the dollar has actually sold-off against every other major currency, ensuring that the yen has been a clear outlier.

We suspect that risk aversion will continue to drive much of the activity in the yen in the immediate-term, though the longer term outlook for the Japanese currency remains firmly dependent on the timing of Bank of Japan rate hikes. This week’s Q1 GDP (Wednesday) and April inflation (Friday) data could be key in shaping expectations for the long-awaited BoJ policy pivot. Investors are bracing for a fairly marked easing in the latter, so the bar for an upside surprise here seems rather low.

CNY

The yuan came under selling pressure last week. USD/CNY edged closer to the psychological 7.0 level, and the currency dropped further in trade-weighted terms. In addition to the broad dollar strength, weakness in domestic data appears to have added to the sell-off. Inflation data surprised to the downside, with headline consumer price growth printed at 0.1%, while producer prices extended their decline to -3.6% in April. Credit data also disappointed, showing a sharp decline in new loans to 718.8 billion CNY in April, about half of the expected level. Total financing data was similarly weak.

The aforementioned news, alongside weak import data, has raised questions about the strength of the recovery and the extent to which it damages the global economic outlook. It also adds to speculation about the potential for more policy support. The PBOC kept its MLF rate unchanged today, while rolling over 100 billion yuan worth of one-year loans expiring this month and topping it up with 25 billion yuan of additional liquidity. Looking ahead, we’ll focus primarily on Tuesday’s data package for April, which will include retail sales and industrial production data.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports

🔊 Stay up to date with our podcast FXTalk