US dollar falls as investors bet of Biden election victory

( 3 min )

- Go back to blog home

- Latest

The dollar sold-off against its major peers on Friday morning as investors continued to bet in favour of a fairly comfortable victory for Democrat Joe Biden at next month’s US presidential election.

Investors have reacted by selling the US dollar against most currencies, and buying higher risk assets. The reason for these flows are two-fold: firstly, a comfortable Biden victory in which the results in the key swing states are next to indisputable would quash any likelihood of Trump contesting the election. The market is also increasingly of the view that Biden’s administration would ensure larger fiscal stimulus. While both candidates have pledged more spending post-election, the very high probability that the Democrats will keep control of at least the US House of Representatives means that of the two, Biden will likely be able to force through a greater fiscal package. This has buoyed financial markets in general, leading to an unwinding in safe-haven flows and sell-off in the dollar.

Euro, sterling rally despite jump in new COVID cases

The recent resilience witnessed in both the euro and the pound has been fairly remarkable given the sharp increase in COVID cases in the European continent.

New daily infections jumped to record highs in France and the UK yesterday, while cases in Italy and Germany are also now at around six month peaks. Curfews, regional lockdowns and hospitality closures are being implemented across the continent. This is almost certain to be reflected in weaker overall levels of economic activity in the coming weeks, most pressingly the PMI sentiment indices out in a couple of weeks. Somewhat surprisingly, investors have largely overlooked this jump in cases, at least for now. Whether this will remain the case would be increasingly unlikely should authorities put in place stricter containment measures in the coming days.

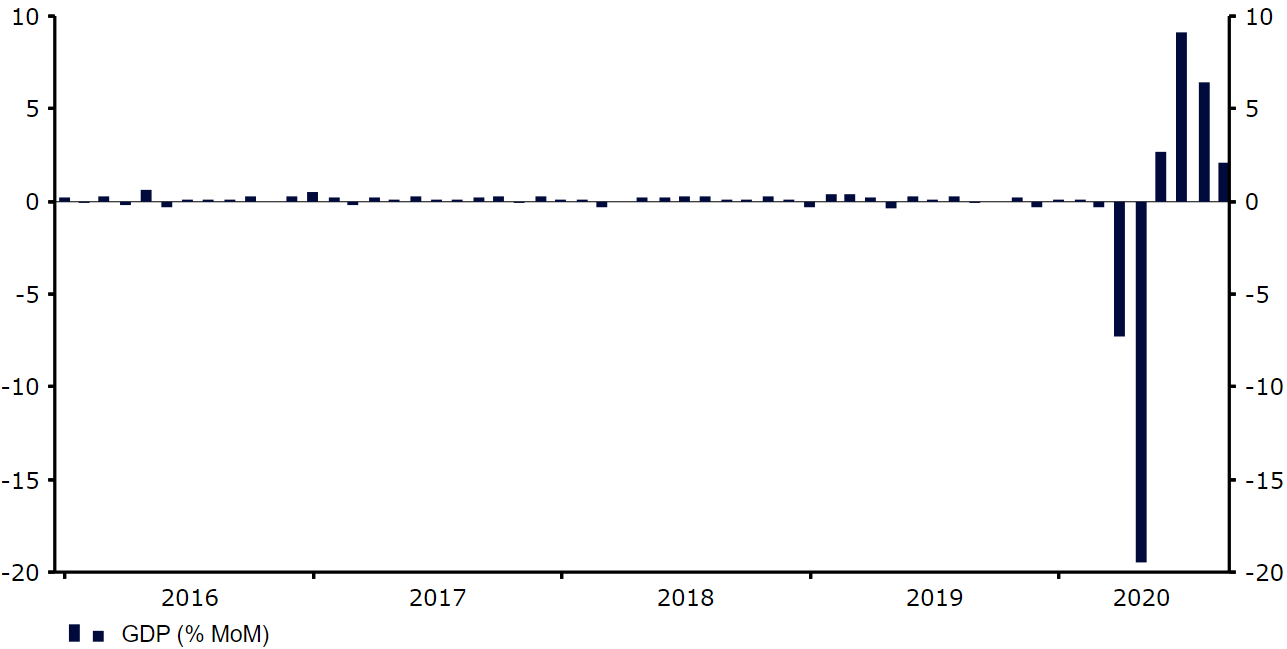

With new virus restrictions likely in Britain this month, this morning’s UK GDP data for August will come as a bit of a blow. The UK economy expanded by just 2.1% month-on-month in August. Under ordinary circumstances, this would have been one of the largest expansions or record, but it was well short of the 4.6% that economists’ had pencilled in.

Figure 1: UK GDP Growth Rate (MoM) (2016 – 2020)

There’s very little macroeconomic data out at all today, so we think attention in the markets will be on both the election and the latest virus numbers out of Europe.