US dollar hits new highs as rampant inflation heightens global growth concerns

( 3 min )

- Go back to blog home

- Latest

The relative calm witnessed in markets in the first half of the week was brought to a swift and abrupt end on Thursday.

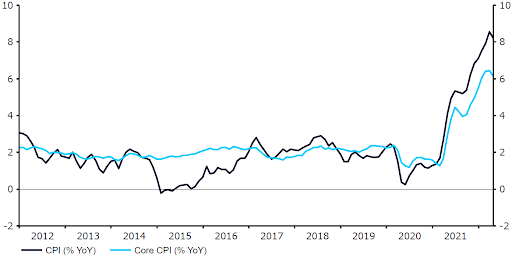

Figure 1: US Inflation Rate (2012 – 2022)

Source: Refinitiv Datastream Date: 12/05/2022

The news has had two major consequences. Firstly, investors were back ramping up bets in favour of higher Federal Reserve interest rates. Markets now see a reasonable chance of a 75 basis point rate hike at the next FOMC meeting in June, with moves of at least 50 basis points fully priced in for the next two (almost three) meetings. The data has also heightened concerns that rampant inflation could weigh on the global economy this year, triggering renewed flows into the safe-havens. The US dollar benefited on both accounts on Thursday, with almost every other currency incurring pretty heavy losses. Arguably the most noteworthy development was the move lower in EUR/USD, which briefly sank below the 1.04 level and just above its weakest position in almost twenty years. While the common currency found a bit of footing during afternoon trading, calls of possible parity in the pair appear to be spooking investors.

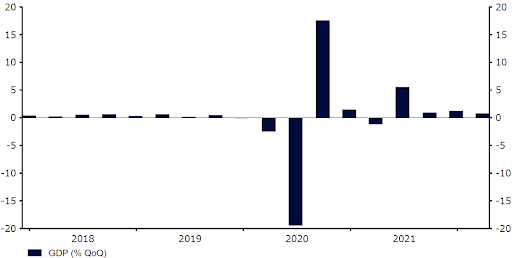

Sterling fared slightly better yesterday, although still fell to fresh May 2020 lows below the 1.22 mark on the greenback. Yesterday morning’s UK GDP figures were partly to blame, although the react in the pound was muted given the time lag in the data. According to the preliminary data, the UK economy expanded by just 0.8% in the first quarter of 2022. While this would be viewed as strong expansion in pre-pandemic times, this marks the slowest pace of growth in a year and printed below expectations – economists’ were eyeing growth around the 1% mark.

Figure 2: UK Growth Rate (2012 – 2022)

Source: Refinitiv Datastream Date: 12/05/2022

Interestingly, just about the only currency to outperform the US dollar on Thursday was the Japanese yen, which was back as the go-to safe-haven currency among investors. It will be interesting to see how long these growth concerns linger in markets, but so long as China continues to adopt its super strict ‘zero-covid’ approach, we could continue to see bouts of risk aversion. The World Health Organisation has warned this week that the strategy is unsustainable – we have been saying this for some time. So far, however, authorities in China have been unmoved, and that’s making the safe-haven trade an increasingly appealing one at present.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports

🔊 Stay up to date with our podcast FXTalk