US dollar jumps after Fed’s ‘dot plot’ points to two rate hikes in 2023

( 4 min. )

- Go back to blog home

- Latest

The US dollar soared by 1% against the euro after the Federal Reserve members signalled they see two interest rate hikes before the end of 2023 in what appears to be a hawkish turn for the US central bank that sent ripples through the US treasury market.

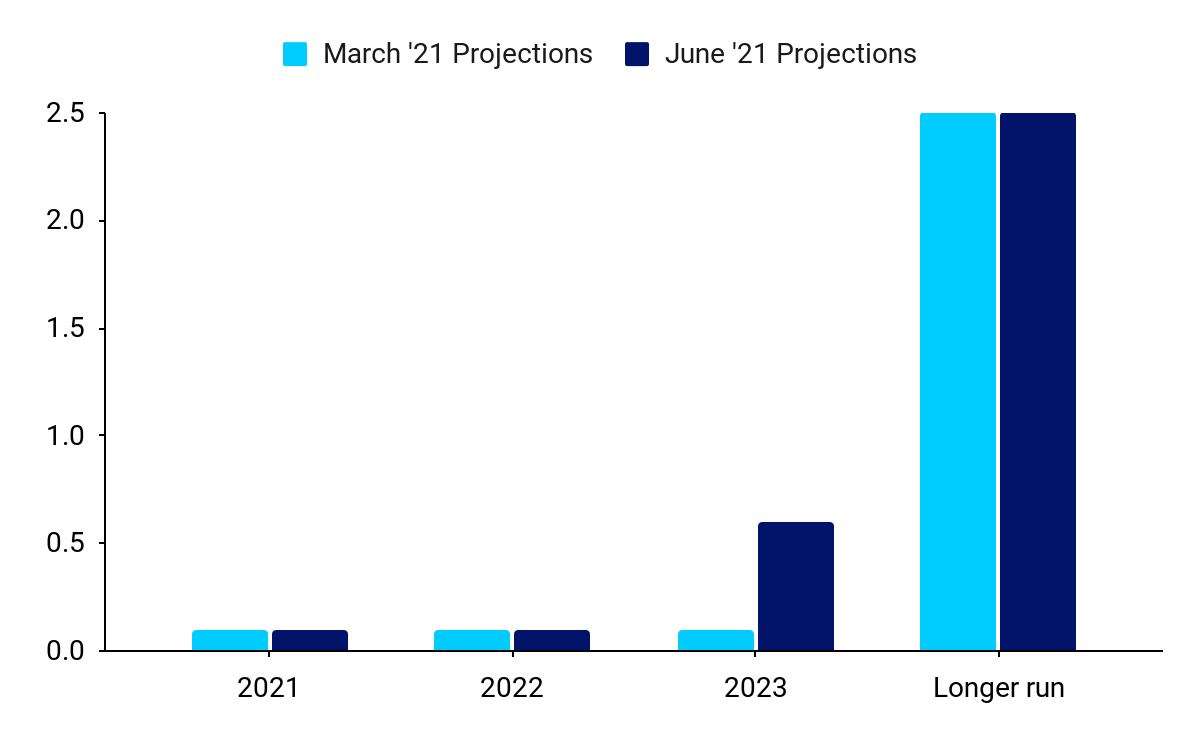

The bank’s latest ‘dot plot’, which shows where each committee member expects rates to be at the end of each year, was revised higher from March. The market was particularly focused on the median dot for 2023, as we expected it to show policymakers anticipating higher interest rates compared to unchanged forecasted in March. The median voting member now expects rates to be hiked twice in 2023. The shift caught the market off-guard, leading to a surge in the US dollar immediately following the release. 2021 and longer-run projections were left unchanged, while 2022 showed minor increases in individual dots, but no change in the median (Figure 1).

Figure 1: FOMC March ‘Dot Plot’ Median Projection

Source: Federal Reserve Date: 16/06/2021

In addition, the Board of Governors hiked an interest paid on the required and excess reserve balances and an offering rate for overnight reverse repo operations by 5 bp., effective today. The change was described by Powell as a ‘technical adjustment’ that could have some impact on the money market. The latter has been under pressure in recent weeks, demanding increasing operations from the Fed to keep a floor under the short-term rates.

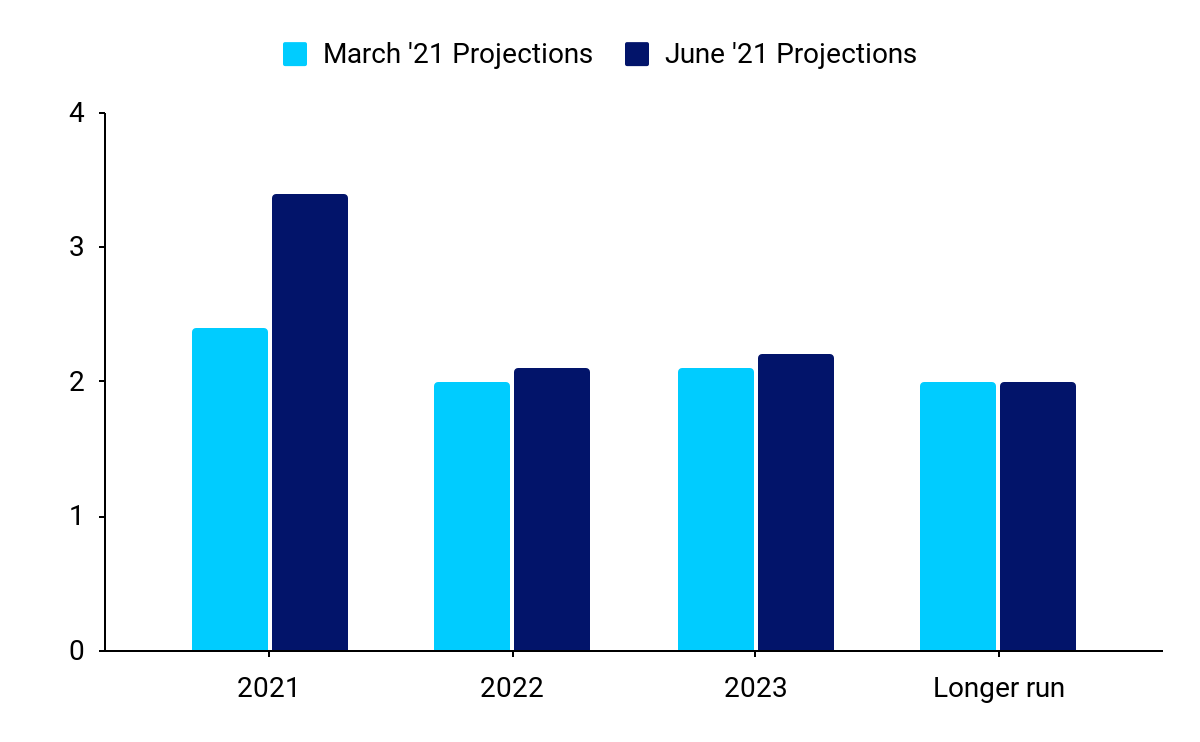

There were significant changes to the bank’s economic projections. Most importantly, a revision to the PCE inflation projection for 2021 with Fed members now seeing price growth of 3.4% compared to 2.4% in March. Most of that increase is expected to come off the back of non-volatile components, as indicated by the shift in the core PCE inflation forecast (up to 3.0% from 2.2% in March). Looking further ahead, PCE inflation is foreseen to decrease to 2.1% in 2022 and 2.2% in 2023, being only slightly more elevated than previously anticipated (Figure 2). Policymakers expect continued progress in the US labour market, but unemployment rate projections were little changed. GDP growth projections were also similar to those in March, with members foreseeing somewhat higher growth in 2021 and 2023.

Figure 2: FOMC June PCE Inflation Median Projection

Source: Federal Reserve Date: 16/06/2021

Jerome Powell, struck an optimistic, yet cautious note during his press conference, citing expectations of strong job creation in the summer and a ‘very strong labour market’ 1-2 years out. He also touched on inflation, pointing out that it’s expected to trend down after an increase in 2021, but adding that it ‘could turn out to be higher and more persistent’ than expected. He also commented on the ‘dot plot’ trying to tame expectations by stating that ‘dots are not a great forecaster of future rate moves’ and that they should be taken ‘with a big grain of salt’. He further emphasised on that point by adding that ‘liftoff is well into the future’.

His language regarding the potential for ‘tapering’ was vague and noncommittal, but he acknowledged that conversation regarding the timing of scaling off bond purchases had begun. We continue to expect the Fed to be more precise with the messaging on that front in coming months, with an official announcement coming later this year, possibly September. Overall, there was a clear sense in the press conference that the Fed now sees supply constraints as the main obstacle to growth in the US, which we see as a hawkish development.

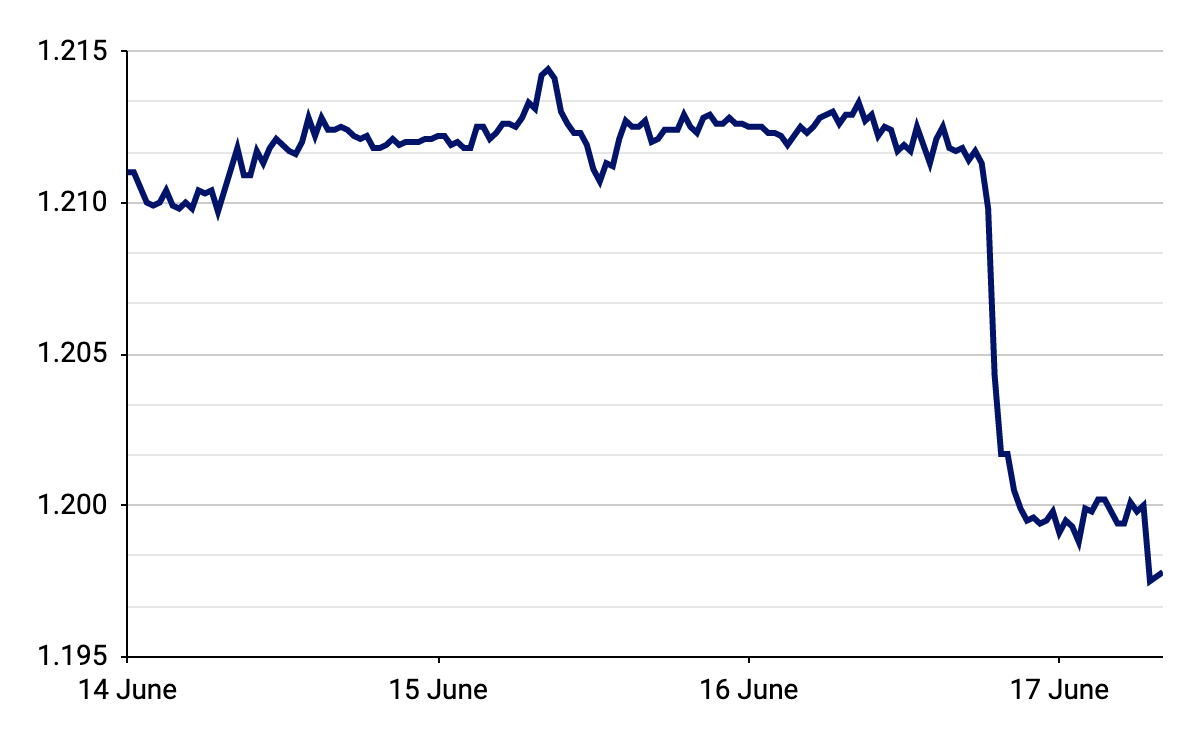

The US dollar reacted in unsurprising fashion to the Fed’s hawkish tone, soaring against every other major currency, while rising to its strongest position in 8 weeks against the euro (Figure 3). We also saw a rather significant sell-off in the sovereign bond market, with the 10-year US yield jumping to 1.59% on the back of the announcement, from below 1.50% prior to the meeting.

Figure 3: EUR/USD (14/06/21 – 17/06/21)

Source: Bloomberg Date: 17/06/2021

Wednesday’s meeting turned out to be quite an interesting one. A notable shift in the members’ expectations regarding the interest rates in 2023 and a sharp increase in inflation projections for 2021 were more pronounced than expected by the market. Nonetheless, the core message of the Fed seems to be that higher inflation is a surprising, but most likely transitory phenomenon. In light of the above we continue to expect stable US interest rates and weaker US dollar throughout 2021 and 2022, although we could see some volatility close to the upcoming Fed meetings, particularly one in September.