US dollar rally falters in spite of higher Treasury yields

( 5 min )

- Go back to blog home

- Latest

There is definitely a feel in FX markets that the dollar rally has run its course for now.

This week the key ECB meeting for October takes place on Thursday. Another huge 75bp hike is expected by markets, the consensus of strategists, and ourselves, but the key to the market reaction should be President Lagarde’s communications at the press conference. The flash PMIs of business activity on Monday in the US, Eurozone and the UK will compete with the ECB meeting for the spotlight. The key PCE inflation report in the US will close out a busy week on Friday. This is perhaps the inflation number that the Federal Reserve pays the most attention to.

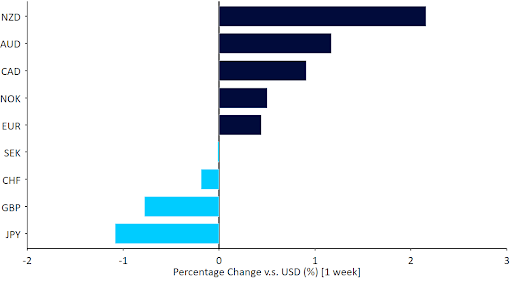

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 24/10/2022

GBP

As stability is restored to Gilt markets following Liz Truss’ resignation, sterling is tentatively finding its footing after an extremely challenging month. News on Sunday that Boris Johnson was giving up on the leadership contest, and thus opening the way for Rishi Sunak, seemed to cheer investors on early Monday trading in Asia, lending further support to the pound.

The biggest downside risks seem to have been removed for now, and the key is the Bank of England’s reaction at its next meeting in early November. A 100bp hike would dispel any further notions that UK authorities intend to inflate their way out of trouble and be a significant positive for the pound. This may, however, be a rather high bar to hurdle.

EUR

This week is shaping up to be a critical one for the common currency. In addition to the ECB meeting on Thursday, the PMIs are published on Monday. Expectations are fairly pessimistic, for a move further down in contractionary territory. However, recent pullbacks on energy prices and the extremely generous state support packages for households and businesses that have been announced could set up markets for a positive surprise.

As for the ECB, in addition to the expected 75bp hike, we may get further clarity from Lagarde on what the central bank expects its terminal rate to be. Current market pricing has that well below 3%, which stirks us unrealistically low. As expectations move towards a more reasonable level, the euro could gain some support.

USD

Market expectations for the Federal Reserve’s terminal rate of interest, i.e. the level at which it expects to at least pause the hiking cycle, finally breached the 5% level last week, in spite of a dearth of macroeconomic news. Daly and Evans were the first Fed official to speak after this psychological level had been breached, and he seemed to suggest that it was high enough or perhaps even a bit too high for their taste.

The next milestone for this unprecedented hiking cycle will be the release of the Personal Consumer Expenditures inflation report on Friday. All eyes are on the core number for the month, where an unacceptably high annualised level of near 6% is expected. A downward surprise here could have a disproportionate negative impact on the US dollar, given the consensus and market positioning for an ever stronger US dollar.

JPY

Direct intervention in the FX market from the Bank of Japan has triggered sharp recovery rallies in the yen in the past couple of trading sessions. On Friday, the USD/JPY pair rebounded over 3% against the US dollar at one stage on news of likely stealth intervention. During Asian trading this morning, USD/JPY briefly dropped below the 146 level on suspected further intervention, though this was quickly reversed and at the time of writing the yen is back trading around the 149 level. While the Bank of Japan has plenty of ammunition to continue intervening in the market this week, recent action reinforces the view that this is unlikely to be sufficient to reverse the currency’s fortunes without a change in stance on monetary policy.

Figure 2: USD/JPY (1 week)

Source: Refinitiv Datastream Date: 24/10/2022

The BoJ will be announcing its latest policy decision on Friday, with the committee expected to reaffirm its easing stane. Until we see signs of even a modest hawkish shift, we think that it may be difficult for the yen to post any meaningful gains, even in the event of continued FX intervention.

CHF

An improvement in risk sentiment, partly due to a further decline in European natural gas prices, helped the euro to edge higher against the franc last week. The Swiss currency was, in fact, among the worst performers in the G10, alongside its fellow safe-havens, the US dollar and Japanese yen.

Last week brought a continuation of recent themes. The Swiss National Bank continued to take advantage of its dollar swap lines with the Federal Reserve, drawing on around $20 billion so far this month. While this is another significant draw on the Fed’s swap line, as mentioned in last Monday’s weekly, this doesn’t appear to be particularly worrisome to us. SNB sight deposit also declined again last week. There’s not much macroeconomic news on tap this week, besides soft data. The EUR/CHF pair will likely largely react to outside news, notably Thursday’s ECB meeting, which could prove particularly market-moving.

AUD

The Australian dollar ended last week as one of the best-performing currencies in the G10, with an improvement in risk sentiment and hawkish comments in the Reserve Bank of Australia’s latest meeting minutes allowing the currency to outperform most of its peers. Despite the fact that the RBA raised rates by a less than expected 25 basis points, the minutes of the October meeting showed that the bank expects to continue raising rates with more frequent, albeit smaller, hikes in the coming months.

In terms of the latest macroeconomic data, the September employment report released last week showed that the Australian economy created only 900 jobs last month, well below the 25k expected, perhaps justifying the central bank’s decision to slow the pace of hikes. Inflation data for Q3 will be published on Wednesday. Aside from that, without any more domestic data out this week, we think that risk sentiment and USD dynamics will be the main drivers of AUD.

NZD

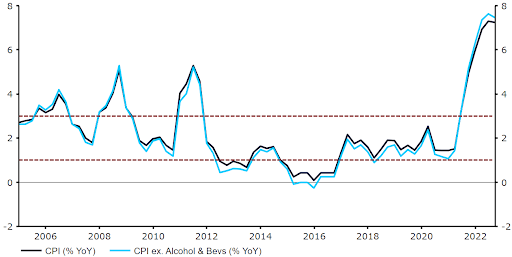

The New Zealand dollar was the best performer in the G10 last week, up over 2% on the US dollar, as the broad retracement in the latter led to an outperformance in high-risk currencies. Last week’s much stronger than expected CPI print provided an additional boost to NZD. Headline inflation in New Zealand jumped by 2.2% QoQ in the third quarter, well above the 1.6% expected. The more broad based and entrenched increase in consumer prices will be a big concern for policymakers at the RBNZ, and markets are now fully pricing in a 75bp rate hike from the central bank when it next meets in late-November.

Figure 3: New Zealand Inflation Rate (2005 – 2022)

Source: Refinitiv Datastream Date: 24/10/2022

There’s no major macroeconomic data out of New Zealand this week, so markets are unlikely to materially change their view on the above interest rate expectations. Consumer confidence data on Thursday is also unlikely to rock the boat.

CAD

In line with most currencies, the Canadian dollar appreciated against the US dollar last week, trading around the 1.37 level on the USD at the time of writing. This week will be an important one for the Canadian dollar, as the Bank of Canada is set to meet this Wednesday.

Last week’s inflation report showed that Canadian inflation slowed for the third consecutive month in September, but still came in above expectations at 6.9%. Inflationary pressures remain elevated, and we think that the Bank of Canada will respond by raising rates by another 75 basis points at its meeting this week – anything less would be a big disappointment. In addition to the rate decision, the tone of communications during the press conference will also be important. Should Governor Macklem make it clear that the BoC will continue to do whatever is necessary to bring down inflation, this would likely support the Canadian dollar.

SEK

Despite the general improvement in risk appetite, the Swedish krona has continued to find gains hard to come by, ending largely unchanged on the dollar last week and earning the mantle as the worst performer in the G10 in the past three months. The Riksbank raised interest rates by 100bps in September, but it’s dovish remarks, which suggested that the bank won’t need to raise rates much further, have done the krona few favours in recent weeks.

Riksbank members are clearly concerned about the recent sell-off in SEK, but they have so far failed to effectively communicate this to markets. Deputy governors Ohlsson (Wednesday) and Jansson (Thursday) will both be speaking this week, and markets will be closely watching for any hawkish tilt. Should either member hint at a 75bp rate hike at the bank’s November meeting, and/or attempt to talk down the currency, then the krona could receive some support later in the week.

NOK

A rather uneventful trading week for NOK ended with it trading roughly in the middle of the pack in the G10. Somewhat uncharacteristically, Brent crude oil futures were largely rangebound last week around $89-94 per barrel levels, which can partly explain the limited volatility in the krone. The sharp drop in European natural gas prices is, however, a clear positive for the currency, and we are slightly surprised not to see a more meaningful reaction in NOK.

This week will be void of major macroeconomic news out of Norway until Thursday, when we’ll get Q3 unemployment data. September retail sales (Friday) could also shift the krone towards the end of the week.

CNY

The USD/CNY pair continued its relentless move higher last week, breaking its previous high from late-September, with the yuan also lower in trade-weighted terms. Focus last week was squarely on the 20th National Congress of the Communist party. Perhaps the most important consequence was confirmation of the third term for Xi Jinping as general secretary of the party. He’ll lead the Politburo Standing Committee, which will now consist only of his close allies.

As expected, there was no change in the key loan prime rates last week, while delayed macroeconomic data painted a mixed picture. A quarterly rebound in GDP of 3.9% (from -2.7%) was stronger than expected, but a string of other readings were far less optimistic. Industrial production and exports both surprised to the upside, but the jobless rate unexpectedly jumped, retail sales were rather weak and house prices declined further. This mixed data put Chinese assets under pressure today, as did investor concerns about the consolidation of leadership and the ongoing zero-covid strategy.

Figure 4: China GDP Growth Rate (2017 – 2022)

Source: Refinitiv Datastream Date: 24/10/2022

Economic Calendar (24/10/2022 – 28/10/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports

🔊 Stay up to date with our podcast FXTalk