US Dollar rally resumes, markets await Hammond’s Autumn Statement

- Go back to blog home

- Latest

Another impressive set of economic data in the US helped the Dollar resume its upward trend on Tuesday afternoon, with the currency continuing to trade around its strongest position against its trade-weighted basket of currencies in nearly 14 years.

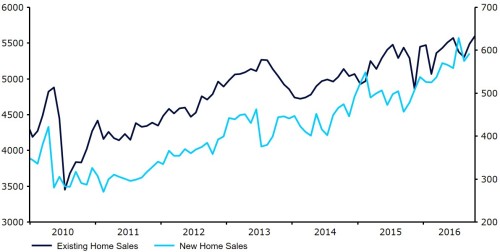

Figure 1: US Existing Home Sales (2010 – 2016)

This helped the Dollar recover from an earlier dip following an earthquake of magnitude 7.4 and subsequent tsunami warning in northern Japan which, paradoxically, led to a strengthening in the safe-haven Yen.

Earlier, the Pound slumped across the board, defying a relatively strong industrial trends report that showed conditions among UK manufacturers had registered its best month since the Brexit vote. Consumer confidence in the Eurozone also rose yesterday, although concerns over the political stability of the Euro-area continued to dominate trading and the Euro remained close to a one year low against the US Dollar.

Attention in the currency markets today will be firmly on this evening’s meeting minutes from the Federal Reserve, set for release at 19:00 UK time. We expect the minutes to remain in line with the hawkish message from the November meeting and confirm that the central bank is edging towards its first rate hike since December last year.

However, with the Thanksgiving holiday on Thursday, consolidation is likely to be a key driver in the FX market today and even a strong signal for a December hike is unlikely to materially shift the US Dollar.

Major currencies in detail:

GBP

The Pound retraced around a half of its Monday gains yesterday, falling 0.4% against the Dollar on the back of broad USD strength.

With no economic data to be released in the UK today, attention will be squarely on Chancellor Philip Hammond’s Autumn statement, his first opportunity to outline priorities for taxes and spending following the Brexit vote. Investors will also be watching closely for the updated growth, inflation and unemployment forecasts from the Office for Budget Responsibility (OBR).

While expectations for Hammond’s statement are at present pure speculation, he is forecast to announce an increase in infrastructure spending and possibly plans to slash corporation tax.

Hammond will begin his first budget speech at around 12:30 UK time in Westminster this afternoon following Prime Minister’s questions.

EUR

A lack of significant announcements in the Eurozone meant the Euro traded within a relatively narrow band yesterday, ending 0.1% higher against the US Dollar.

Consumer confidence surprised to the upside on Tuesday. The monthly index from the European Commission rose to an eleven month high this month, although remained in negative territory at -6.1 compared to October’s -8.

The Euro remained under pressure from comments by ECB President Mario Draghi on Monday ahead of next month’s crucial central bank meeting. Draghi made it clear that interest rates in the Eurozone would remain at their historic low levels for the immediate future.

Focus in the Eurozone this morning will be firmly on the release of the latest business sentiment PMIs from Markit, with services, manufacturing and composite PMIs due for release.

USD

The US Dollar was well supported for another day, ending 0.2% higher against its major peers on the back of Monday’s impressive new existing home sales data.

Manufacturing data also provided a pleasant upward surprise yesterday, defying the recent run of poor data in the sector that has been hampered by weak external demand and a strong US Dollar. The Richmond Fed manufacturing index rose to a four month high level of 4 from October’s -4.

Ahead of tonight’s FOMC minutes, durable goods orders are likely to receive some attention when released at 13:30 UK time. Orders are forecast to have picked up strongly in October following their September slump. Initial jobless claims are also expected to remain solid, having last week fallen to their lowest level in more than four decades.

Receive these market updates via email