US dollar rally stalls in spite of hawkish Federal Reserve

( 5 min )

- Go back to blog home

- Latest

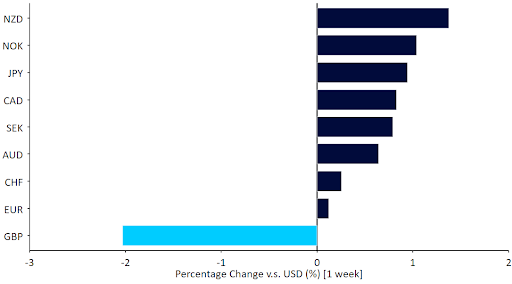

Currency market volatility continues to rise, and signs are emerging that the dollar rally is running out of steam.

All eyes turn now to the critical October CPI inflation report out of the US (Thursday). Headline prices will probably drop further as energy prices continue to moderate, but the key will be once again the more persistent core rate. UK third-quarter GDP growth (Friday) may be important for sterling. Beyond economic news, it will be important to see whether signs of China easing its COVID policies are confirmed. As this is written, signs are emerging that last week’s rally in Chineses assets may have been premature.

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 07/11/2022

GBP

The Bank of England hiked rates by 75 basis points last Thursday as expected, but then surprised markets with one of its periodic pivots, this time a dovish one. The Bank of England appears to be taking a blasé view of inflation and focusing on recessionary risks instead. The reference to markets overestimating the terminal rate was unusually blunt, and sterling did not like it one bit, losing significant ground against every major currency worldwide.

Third-quarter GDP growth data will be in focus this week. The MPC warned last week that the UK economy may already be in a recession, and this week data is indeed expected to show that contraction on a quarterly basis. This is, however, a backward looking number, and we expect sterling to react as much or more to the US inflation data out this week.

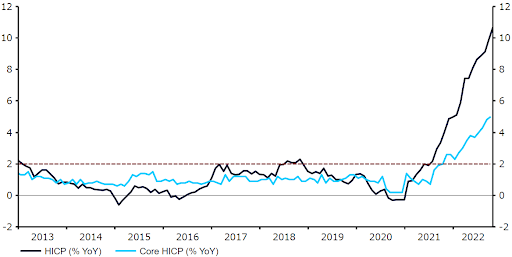

EUR

Another month, another blow out inflation report out of the Eurozone. This one came just a few days after the muddled attempt at a dovish pivot from the ECB at its meeting the previous week, thereby contributing to the developing credibility gap at the institution. In addition to double digit headline inflation, sticky core inflation continues to march higher.

Figure 2: Euro Area Inflation Rate (2013 – 2022)

Source: Refinitiv Datastream Date: 07/11/2022

On the plus side, the worst fears about a winter energy crisis continue to fade. On the negative side, early Monday morning reports from Asia suggest that hopes for an easing of Chinese lockdowns may have been premature, and hence the recovery of European exports to China may be further delayed. This week’s main event in the Eurozone will be a number of ECB official speeches, including President Lagarde.

USD

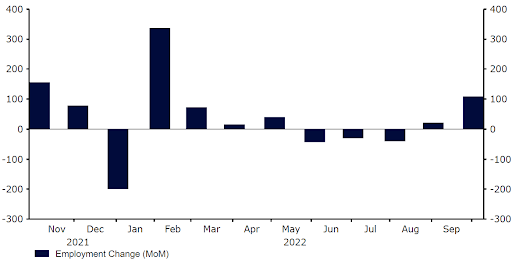

The hopes for a Federal Reserve pivot to a more dovish stance failed to materialise last week, and in fact Chair Powell indicated that rates may have to go even higher than markets were pricing in before the meeting. Bonds fell, as did stocks, but the dollar failed to follow the script and actually ended the week slightly down in trade-weighted terms following Friday’s nonfarm payrolls data. The labour market report was mixed, but still consistent with a very tight market that is yet to feel the impact of monetary tightening in any significant way.

Figure 3: US Nonfarm Payrolls (2021 – 2022)

Source: Refinitiv Datastream Date: 07/11/2022

The inflation report this week is expected to show another easing of headline annual price pressures on the back of lower energy costs. However, the key will be the core index that strips out the volatile food and energy components. The Fed needs to see a downward trend in these numbers before it can think of pausing hikes in interest rates, and is unlikely to see that in this report.

JPY

The yen was one of the better performers in the G10 last week, ending modestly higher on the US dollar. The currency remains by far the worst performing major this year, though recent intervention efforts by the Bank of Japan appear to have put a temporary floor under the yen. According to Japan’s Ministry of Finance, intervention totalled more than ¥6 trillion last month, by far the largest ever. The 150 mark on the dollar seems to be a line in the sand for the BoJ, so we would expect fresh intervention to prop up the currency should the yen make another move towards this level.

Tentative signs that the Bank of Japan is open to tweaking its monetary policy stance also provided a bit of assistance to JPY. During a speech mid-week, Governor Kuroda noted that changing the bank’s yield curve control policy could be an option should inflation pick-up. Japanese inflation remains far more contained than in most other countries, though it is expected to test three decade highs in the coming months, which could force the BoJ’s hand.

CHF

EUR/CHF ended last week little changed, and the pair continues to hover below parity. The abundance of domestic economic data had little impact on the franc. Soft prints, for the most part, continue to point to a slowdown ahead. An indicator of consumer confidence, for instance, plunged to its lowest level since its inception in 1972. Retail sales, however, continue to show healthy consumer activity, expanding by another 0.9% in September. This resembles the situation in many other economies, where sentiment indicators and hard data are at odds.

There’s not much on tap from Switzerland this week. Speeches by SNB chairman Thomas Jordan and fellow member Andrea Maechler could prove the most noteworthy. Last week, chairman Jordan suggested that further rate hikes may be needed in Switzerland, confirming our view that another rate increase is on the way in December.

AUD

The Reserve Bank of Australia mostly met expectations during its meeting last week. Interest rates were raised by another 25 basis points to 2.85%, the second in consecutive meetings, having become the first major central bank to revert back to ‘standard’ sized hike in October. Governor Lowe struck a balanced tone in his presser, keeping the door open to additional hikes of a larger magnitude, as it waits to gauge the impact of its tightening cycle on domestic activity. The growth forecast for next year was downgraded, though there was an upward revision to its inflation forecast. All in all, there were no real surprises of note, and AUD largely tracked global risk sentiment and news out of the US.

Meanwhile, news out of the Australian economy last week was mixed, with surprises to the upside in business activity and housing data offset by Friday’s soft retail sales print. This week is set to be a relatively quiet one in Australia, so we expect the dollar to be driven largely by goings on elsewhere.

NZD

A stronger-than-expected labour report helped propel the New Zealand dollar to the top of the FX performance tracker last week. Employment rose strongly in the third quarter (+1.3%), following three quarters of essentially flat net employment gains, with the participation rate also up more than anticipated. News that China plans to stick by its zero-covid policy led a bit of a retracement in the dollar during Asian trading this morning, although a general improvement in market risk sentiment has kept the currency well bid.

Developments out of China may be the main driver of NZD this week, as the domestic economic calendar is relatively light. We also think that expectations for the RBNZ’s next meeting in a couple of weeks time will remain key. Markets are torn between a 50bp and 75bp hike, though surprises to the upside in this week’s PMI and/or inflation expectations data could tip the balance in favour of the latter.

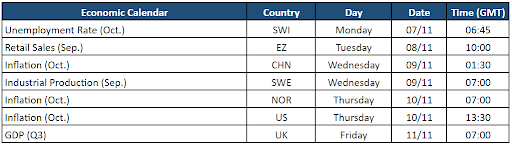

CAD

Friday’s stellar employment report out of Canada helped trigger one of the most violent rallies in CAD witnessed since the extreme volatility of the global financial crisis in ‘08-’09. The employment change number blew all expectations out of the water, as 108k net jobs were created last month, above the 21k consensus and the fastest pace of job creation since February 2020. Investors reacted by immediately raising expectations for Bank of Canada policy tightening, with markets now seeing a two-in-three chance of another 50bp rate hike in December.

Figure 4: Canada Employment Change (2021 – 2022)

Source: Refinitiv Datastream Date: 07/11/2022

A speech by BoC governor Macklem (Thursday) could be key in shaping the aforementioned rate expectations, and confirm whether this is indeed enough to delay a dovish pivot. Should the Bank of Canada follow in the footsteps of the Fed in prolonging its hiking cycle, then CAD would likely be dragged higher along with the US currency against most majors.

SEK

The Swedish krona appreciated against the euro last week, extending the rally in SEK to almost 2% against the common currency since the recent peak in mid-October. The latest data out of Sweden continues to be mixed. The manufacturing PMI released last week decreased to 46.8 in October, pointing to the most significant contraction in factory activity since May 2020. However, the services PMI increased to 56.9 from a more than two-year low of 55.1 in the previous month.

eptember industrial production data, which will be released this Wednesday, will complete the picture of the economy’s performance, although it has to be said that this data point runs on somewhat of a lag, and is not expected to have too much impact on the currency.

NOK

Norges Bank has become the latest G10 central bank to begin slowing its tightening cycle. At its meeting last week, interest rates were raised by only 25 basis points, below the 50bps expected by markets. This weighed on the Norwegian krone, which fell to its lowest level in two years against the euro, although it has since recovered some of these losses.

According to its communications, Norges Bank anticipates further hikes ahead, but at a slower pace due to cooling in some areas of the economy and expectations of lower inflationary pressures. This decision is at odds with core inflation, at an all-time high 5.3%, and a labour market that is almost at full employment. In the words of Norges Bank, a larger rate hike would have been needed had only these two variables been taken into account, but the board has put more weight on risks to growth and a tightening in financial conditions. The October inflation rate, to be released on Thursday, is expected to continue its upward trend. This could cause the terminal base rate to be revised upwards, which would likely support the krone.

CNY

Traders certainly couldn’t complain about a lack of volatility last week. The yuan ended the week higher against the broadly weaker dollar, and the drop in the USD/CNY pair on Friday was among the biggest on record. Looking beyond the FX market, last week was extraordinarily positive for equities, with the key indices rallying sharply on rumour-fuelled hopes that China may soon embark on a path to exit its controversial zero-Covid policy. On Saturday, however, officials quashed speculation, stressing that China would ‘unswervingly’ stick to zero-Covid. Chinese equities have extended their gains today, but this could tell more about their relative cheapness than the validity of reopening hopes.

Just before the weekend, China’s new Covid cases surged to six-month highs. Rising infection numbers don’t bode well for the economic outlook, and domestic consumption has already taken a hit, as shown by last week’s soft PMI numbers. Looking ahead, news on the covid front and October’s inflation data (Wednesday) could prove market moving this week.

Economic Calendar (07/11/2022 – 11/11/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports