US dollar retraces gains after strong start to 2023

( 3 min )

- Go back to blog home

- Latest

Summary:

- Currencies broke out of their narrow ranges on Tuesday. The US dollar rose sharpy against most of its peers, although there was no clear catalyst for the move.

- German inflation data falls well short of expectations, while Euro Area PMI data for December is revised sharply higher.

- Risk sentiment improves on Wednesday morning, as investors optimistic on China growth outlook.

- FOMC December meeting minutes to be released at 7pm BST this evening.

The FX market has been awoken from its Christmas slumber in the past 24 hours or so.

Most of the major currencies were stuck in very narrow ranges in the final two weeks of 2022, perhaps to the relief of market participants as last year was one of the more eventful and volatile we’ve seen for some time. 2022 was characterised by the sharp US dollar rally against almost every major and emerging market currency. The US Dollar Index ended last year more than 8% higher, although it has fallen to its lowest level since June as investors dial back fears over recessions, while the Federal Reserve indicates that an end to its hiking cycle may be on the way at one of its upcoming meetings.

The greenback did, however, kick off 2023 on a solid footing, rallying by approximately 1% in trade-weighted terms on Tuesday. There was no clear catalyst for the move, which we think was driven more by technical factors, as thin liquidity and year-end flows had perhaps left the dollar at rather weak levels. Yesterday’s German inflation miss can be seen as a bearish signal for the euro, though this was released after the big move in EUR/USD. While this had little immediate impact on currencies, it may partly explain the slight underperformance in the euro so far on Wednesday.

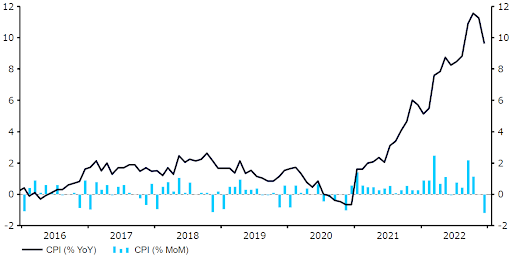

Figure 1: German Inflation Rate (2016 – 2022)

Source: Refinitiv Datastream Date: 04/01/2023

Most other currencies have recovered the majority or all of their losses on the USD so far today. Expectations that an easing in covid restrictions in China will boost global economic activity have partly been behind the improvement in risk sentiment. China appears to have effectively called time on its ‘zero-covid’ strategy, as it moves towards learning to live with the virus. Meanwhile, this morning’s revised Euro Area PMI data came in much stronger-than-expected. The composite index for December was raised to 49.3, from the initial 48.8 flash estimate, suggesting that the downturn in the bloc’s economy may not be as bad as previously anticipated. This is a theme that we expect to be a prevalent one worldwide in 2023.

Attention later today will turn to developments in the US, notably the release of this evening’s FOMC meeting minutes at 7pm GMT. Should the minutes hint at an end to the Fed’s aggressive hiking cycle at either of the February or March meetings, then the dollar could come under additional downward pressure.