US dollar slides, equities rally on virus vaccine hopes

( 3 min read )

- Go back to blog home

- Latest

A ‘risk on’ mode prevailed in financial markets on Monday, sending the safe-haven US dollar lower and global equity markets sharply higher.

It is clear that the mass production of a vaccine is absolutely key to enabling the global economy to bounce back to pre-crisis levels. Until that time, the recovery will be gradual, as some form of social distancing will likely remain in place. Fed Chair Jerome Powell warned over the weekend that the US economy could shrink by 20-30% due to the virus, although he ruled out negative rates and reassured investors that the economy would return back to pre-crisis levels.

Attention in the markets today will remain on Mr Powell, who will be speaking at the Senate Banking, Housing, and Urban Affairs Committee later this afternoon.

UK unemployment claims jump by most on record

The pound also benefited from the broad rally in riskier currencies on Monday, soaring more than one percent higher to back above the 1.22 mark versus the dollar.

Investors brushed aside comments over the weekend from Bank of England chief economist Andy Haldane that the bank was considering the possibility of lowering rates into negative territory. This may be due to the fact that this is merely the opinion of one of the committee members – governor Andrew Bailey appeared opposed to such a move during his remarks earlier in the week. Currency traders have instead been encouraged by the fairly sharp decline in UK virus deaths, which fell to a near two month low 160 on Monday.

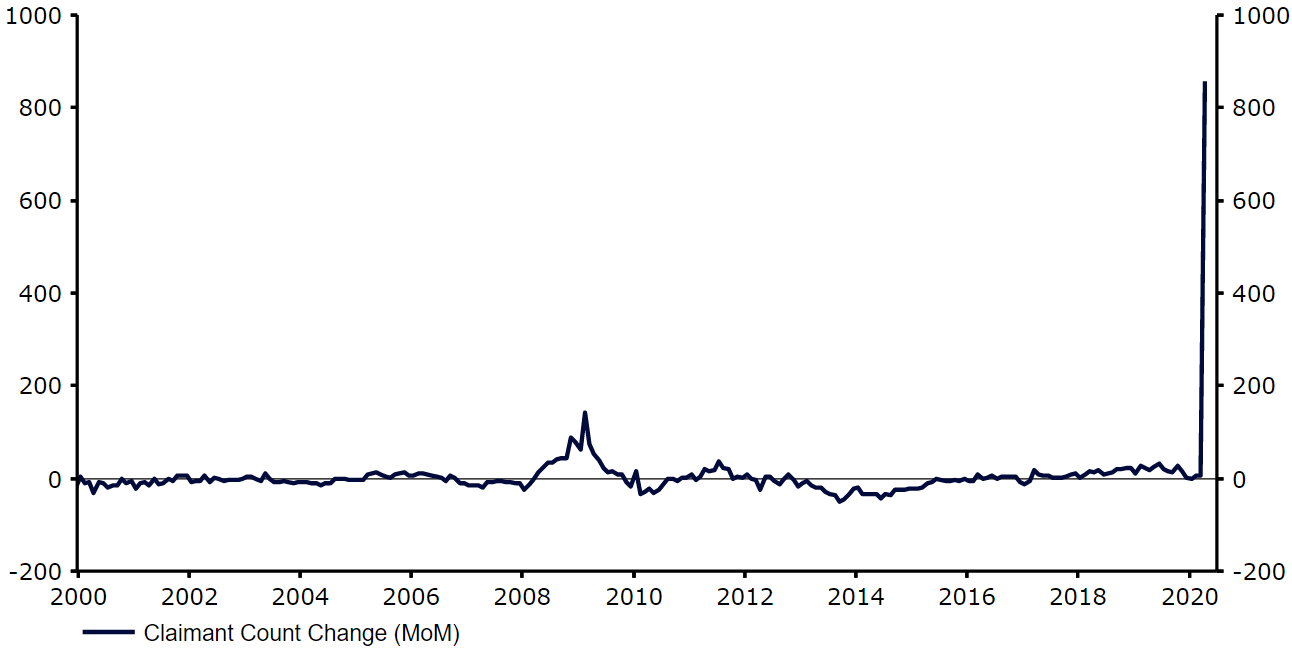

This morning’s UK labour report did little to dampen the optimism, although the April claimant count change number did come in worse-than-expected. The number, which represents the monthly change in the number of people claiming unemployment benefits, spiked to a record high 856,500 last month, with the virus-induced lockdowns leading to mass layoffs across a range of sectors.

Figure 1: UK Claimant Count Change (2000 – 2020)

Source: Refinitiv Datastream Date: 19/05/2020

The labour market has, however, been spared from a complete meltdown by the UK’s Job Retention Scheme, which has enabled around 7.5 million employees to remain formally employed that would otherwise have been laid off. As it stands, only around 2.6% of all UK jobs were lost in March and April combined. While this would be an extraordinarily high number under normal circumstances, it is nowhere near as catastrophic as the 20%+ levels of jobs lost in the US. This heavy focus on job retention in the UK is one of the main reasons why we think the UK economy will bounce back sharper than its US counterpart once the lockdowns are lifted.