Federal Reserve raises rates, signals gradual path of future hikes

- Go back to blog home

- Latest

In line with the overwhelming market consensus, the Federal Reserve hiked interest rates in the US for only the third time in a decade at its monetary policy meeting on Wednesday evening.

With a hike fully priced in, attention was firmly on the statement and ‘dot plot’. The statement itself was fairly optimistic, claiming that business investment had firmed and acknowledging that inflation was “moving towards the committee’s 2 percent longer-run objective”.

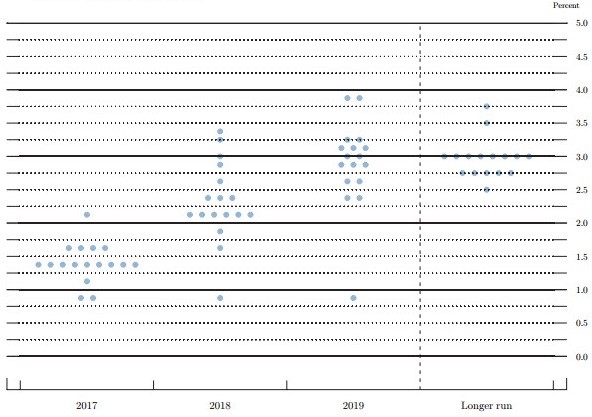

However, the ‘dot plot’ was of slight disappointment, and was largely unchanged from December (Figure 1). The FOMC continue to expect an additional two hikes this year and a further three hikes in 2018, a moderately slower path of hikes than our and indeed the market expectation.

Figure 1: FOMC March 2017 ‘Dot Plot’

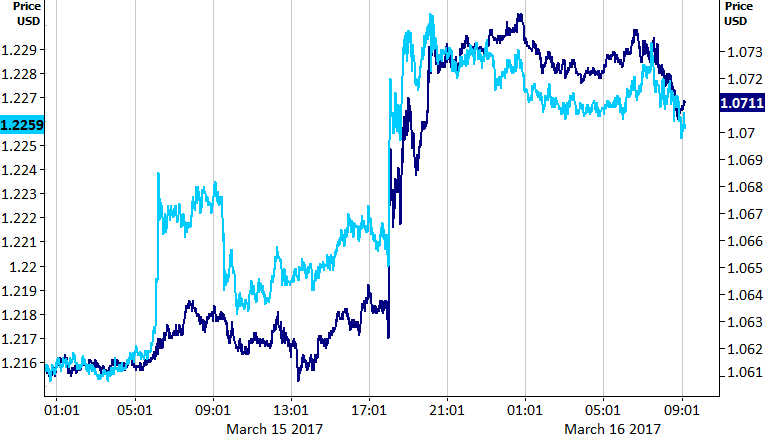

Meanwhile, yesterday’s Dutch Presidential Election yielded a resounding victory for Mark Rutte’s VVD Party which, with 95% of the votes counted, had won 33 out of the 150 seats available. Geert Wilders’ anti-EU Freedom Party, PVV, lagged in second place with just 20 seats, considerably lower than many of the recent polls had suggested. The slightly less hawkish than expected Fed, and defeat of Geert Wilders sent the US Dollar almost one percent lower against most of its major peers last night (Figure 2).

Figure 2: EUR/USD & GBP/USD (15/03/17 – 16/03/17), Today bodes to be another particularly busy day in the currency markets, with a host of announcements likely to lead to another volatile session of trading. The Bank of England will be announcing its own interest rate decision at midday, although the MPC is almost certain to keep monetary policy unchanged amid the pending triggering of Article 50.

Major currencies in detail

GBP

Sterling appreciated 0.4% against a broadly weaker US Dollar yesterday.

Yesterday’s labour report in the UK was fairly mixed, although investors viewed it as a more of a Sterling negative. The unemployment rate ticked downwards again, falling to its joint lowest level since 1975, matching 2005 levels at 4.7% in the three months to February. This suggests that Britain’s labour market hasn’t yet been hit as badly by the Brexit vote as many had expected. Earnings growth did, however, slow. Average earnings including bonus slipped to 2.2% from 2.6%.

The BoE’s interest rate decision and meeting minutes will be released at midday today. We think the BoE is likely to continue voicing its tolerance for an overshoot in inflation, which it has attributed almost entirely to last year’s sharp decline in Sterling. Given the uncertainty over what the upcoming Brexit negotiations will mean for the UK economy, communications from the Central Bank could remain fairly neutral.

EUR

The Euro soared 0.8% to a five week high yesterday amid a slightly less hawkish than expected Fed.

The Dutch Election, in the end, yielded a result that provided a further moderate boost for the common currency, with Wilders’ PVV Party comfortably short of mounting a realistic challenge. This resounding rejection of populism is likely to be seen as a bad omen for anti-EU National Front Leader Marine Le Pen ahead of the French Election next month.

This morning’s updated inflation data is expected to remain unrevised. Fallout from last night’s Fed meeting and Dutch election will likely be the main driver of the Euro today.

USD

The US Dollar index slumped 0.8% after last night’s Fed meeting.

Prior to last night’s announcement from the Federal Reserve, data out of the US economy showed a slight uptick in inflation and slowdown retail sales growth. Headline inflation soared to 2.7% in February, its highest level in five years. This, in our view, fully justifies that Fed is hiking interest rates relatively aggressively this year. By contrast, retail sales were a slight disappointment, rising by just 0.1% in February, although this was made up by an upward revision in January numbers.

Market expectations for future hikes in the US this year will be the main driver of the US Dollar today.