US economy sinks into recession, but dollar holds firm

( 3 min )

- Go back to blog home

- Latest

The US economy contracted for the second straight quarter in Q2 according to data released on Thursday, falling into what is traditionally classed as a technical recession, though US government officials have attempted to deny it.

Summary:

- US GDP data falls short of expectations, with the world’s largest economy tipping into a technical recession in Q2 (though the White House denies it).

- The dollar fails to react too much to the weak data, having earlier recovered its post-FOMC meeting losses against the euro.

- This morning’s Euro Area GDP and inflation figures will be closely watched by both market participants and ECB policymakers alike.

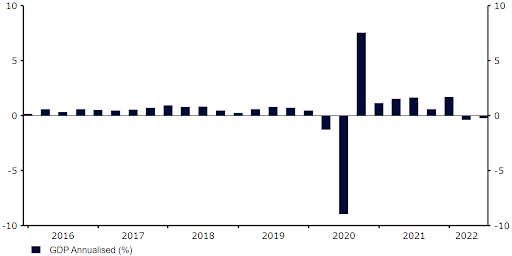

Markets had braced for modest expansion and the narrow avoidance of a recession in the second quarter, but yesterday’s data was much weaker than economists had expected. US GDP contracted by 0.9% annualised (following the 1.6% drop in Q1), well below the 0.5% growth that had been pencilled in. The dollar sold-off modestly following the release of the data, though its losses were rather minimal, and EUR/USD still managed to end the London trading session lower than where it began.

Figure 1: US GDP Growth Rate Annualised (2016 – 2022)

Source: Refinitiv Datastream Date: 28/07/2022

The lack of reaction in the FX market may perhaps reflect both the time lag in the data, and its limited impact of US interest rate expectations. Following Wednesday’s FOMC meeting, markets were already resigned to the notion that a slowdown in the pace of Federal Reserve interest rate hikes is likely on the way at upcoming meetings. Thursday’s data merely confirmed such suspicions, with futures markets now seeing a reasonable chance of an end to the hiking cycle in November.

Attention in markets today will quickly turn to Europe, with both German and Euro Area Q2 GDP numbers also set for release this morning. There’s no risk of a recession in either just yet, and economists are actually pencilling in modest growth for both. While the recent increase in EU natural gas prices, which have jumped towards fresh record highs again this week, is providing a big cause for concern, signs of resilience in the hard activity data would at least calm some of the market concerns, and could support the euro.

Today’s Euro Area inflation numbers for July will be equally, if not more, important. Investors were left disappointed by the European Central Bank’s lack of commitment to another 50 basis point rate hike in September at its meeting last week, although an upside surprise in this morning’s inflation print could bring another large hike into view. With US recession headlines dominating the narrative, and plenty of room for the ECB to catch up with the Fed in raising interest rates, we continue to see EUR/USD as undervalued at current levels.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports

🔊 Stay up to date with our podcast FXTalk