US inflation surprise sends dollar soaring

( 5 min )

- Go back to blog home

- Latest

The peak in US inflation has been getting pushed into the future for some time, and June was no exception.

All eyes now are on the ECB meeting on Thursday. With a 25 bp hike baked in and markets pricing a 10% chance of a 50 bp surprise, there will be some room for appreciation if the ECB decides to jolt markets. The Bank of Japan also meets, and it’s expected to remain the odd one out in monetary policy, hanging on to its pre-inflation extreme accomodation. Inflation in the UK (Tuesday) and July PMI leading indices across most major economies will round out an extremely busy week.

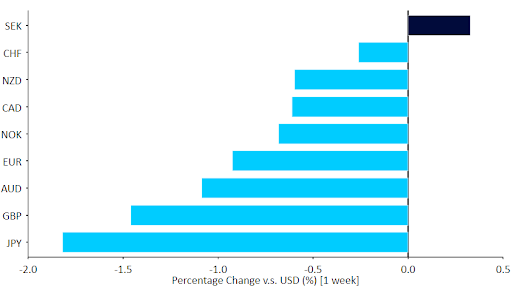

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 18/07/2022

GBP

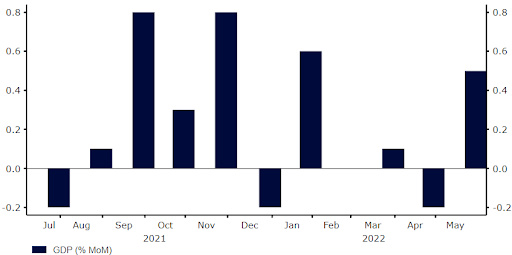

Solid economic data for May published last week in the UK, notably the May GDP print (Figure 2), did little to help the pound, which fell against every G10 peer, except the Japanese yen. CPI data out on Wednesday is likely to rise to yet another multi-decade record, which together with the hawkishness suggested by recent Bank of England speeches would validate our expectation for a double-sized 50 bp hike in August.

Figure 2: UK GDP [MoM] (2021 – 2022)

Source: Refinitiv Date: 18/07/2022

The labour market report this week will also tell us whether second round inflationary effects are becoming evident in the wage-setting process. The PMIs of business activity will bookend this extremely busy week, and consensus expects them to all remain safely within expansionary levels.

EUR

New out of the Eurozone economy last week was mixed, with a sharp contraction in car registration but a positive surprise in May industrial production. Markets roundly ignored these second-tier reports, and are focused on two key events. In addition to the European Central Bank meeting on Thursday, the Nord stream one gas pipeline is scheduled to restart gas deliveries on the same day, which could make for some seriously volatile trading. Investors are concerned that the 10-day maintenance period could be delayed beyond this date.

The market is set on a 25 bp hike on Thursday, which would open a window for the ECB to surprise markets and begin to restore its inflation-fighting credibility. But perhaps more important than the actual policy move will be the level of unanimity that is achieved around the anti-financial fragmentation toolkit, which is a euphemism for restarting the purchase of weak peripheral bonds using freshly printed euros. This promises to be one of the busiest trading weeks in many months for the common currency.

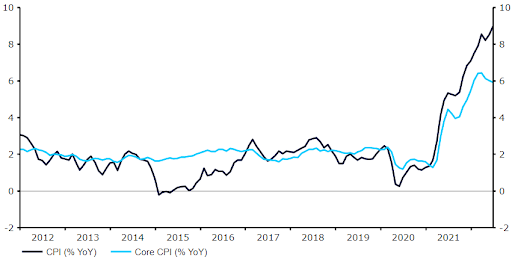

USD

The hopes that inflation in the US has seen its peak, which were fanned by last month’s PCE report, were dashed by another unpleasant surprise in the June CPI report. However, we think that hikes of more than 75 bps are unlikely, and markets have got ahead of themselves in pricing their likelihood, and the scorching dollar rally is becoming vulnerable to a correction in those expectations.

This week, the dollar will cede the spotlight to other currencies, particularly the euro, as only second-tier data gets published. For once, the dollar should trade off of developments elsewhere.

Figure 3: US Inflation Rate (2012 – 2022)

Source: Refinitiv Datastream Date: 18/07/2022

CHF

The Swiss franc reached another high against the euro last week and was the third best-performing G10 currency, just behind the US dollar. There was little news from Switzerland, and the EUR/CHF exchange rate seems to have largely reflected euro weakness.

Over the weekend, Swiss newspaper Schweiz am Wochenende reported that the SNB is planning to raise interest rates by another 50 basis points in September, but may go with an even larger 75 bp hike if inflation edged higher. We think it’s very early for such considerations, but for now we are erring more towards a 50 bp rate increase. Either way, an exit to sub-zero rates in Switzerland seems just around the corner. This week, we’ll focus primarily on outside news, which should be key for the EUR/CHF rate. The second part of the week looks especially busy, as the ECB meets, Nord Stream 1 maintenance is set to end and PMI prints for the main economies will be out.

AUD

Last Thursday’s scorchingly hot Australian labour report provided good support for the Aussie dollar towards the end of last week, with AUD opening London trading this morning back above the 0.68 level on the USD. A net 88.4k jobs were added to the Australian economy last month, well above the 25k consensus and the fastest pace of hiring since the boom in employment following the end of the delta lockdowns in November. The unemployment rate also dropped sharply, falling to a fresh record low 3.5% from 3.9%.

Clearly, the Australian labour market is in a good place, and that has translated into investors ramping up expectations for tighter RBA monetary policy. We think that another 50 basis point rate hike from the RBA at its August meeting is now effectively a done deal – swap markets are even pricing in a near 50% chance of a 75 basis point move. A number of central bank speeches, including from governor Lowe, are scheduled for this week. Should they tee up the possibility of a 75 bp hike, and Thursday’s PMI number print well above the level of 50, then these expectations would rise further, and AUD would likely perform well.

CAD

The Bank of Canada shocked markets last week, raising interest rates by a full one percentage point to 2.5%, after investors had expected a 75 bp hike. In justifying the bank’s decision to frontload the tightening cycle, governor Maklem noted that Canadians ‘are getting more worried that high inflation is here to stay. We [the BoC] cannot let that happen.’ We think that this is a clear acknowledgement the BoC has underestimated the extent of the inflation overshoot, and now needs to correct this by getting rates closer to neutral levels much faster than they had originally anticipated. Markets are bracing for another 50 bp hike at the next meeting in September, but another surprise to the upside in inflation in the interim could again trigger a larger move.

Somewhat surprisingly, however, the Canadian dollar only received fleeting support from the bumper hike, and fell sharply on Thursday before recovering towards week-end. This week will be a very busy one for the currency, with inflation data (Wednesday) and retail sales (Friday) expected to be closely watched by market participants.

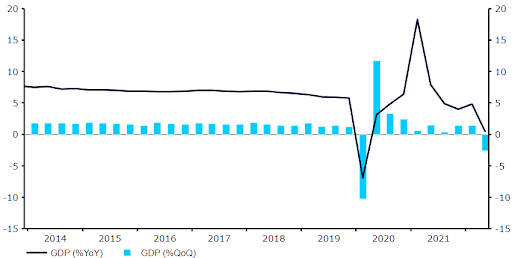

CNY

The Chinese yuan fell against the dollar last week, and USD/CNY soared to its highest level since mid-May. Despite some negative headlines from China, notably an extension or introduction of fresh pandemic restrictions in some cities, this was more a consequence of broad US dollar strength. The trade-weighted CFETS RMB index continued to increase, if only marginally. Last week’s economic data from China were mixed. The second-quarter GDP print came in far below expectations, with the economy posting annual growth of just 0.4%. Some of the readings covering the end of the period, such as exports and retail sales were noticeably better than expected, while others disappointed. A particularly ominous trend seems to be an increase in youth unemployment, which hit a record high of 19.3% in June. The data defied the broad survey-based unemployment rate, which actually declined in June.

Figure 4: China Annual GDP Growth Rate (2021 – 2022)

Source: Refinitiv Date: 18/07/2022

Looking ahead, we’ll continue to focus on the pandemic news. A further deterioration here could shift sentiment towards the yuan and Asia as a whole, which has been relatively shielded from recent global recession fears. Aside from that, the PBoC will announce the loan prime rates (LPR) this Wednesday. Any change here would be a big surprise. Last week, the rate on the one-year medium-term lending facility (MLF) was left unchanged, and the PBoC renewed 100 billion yuan of maturing loans, in line with expectations.

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports