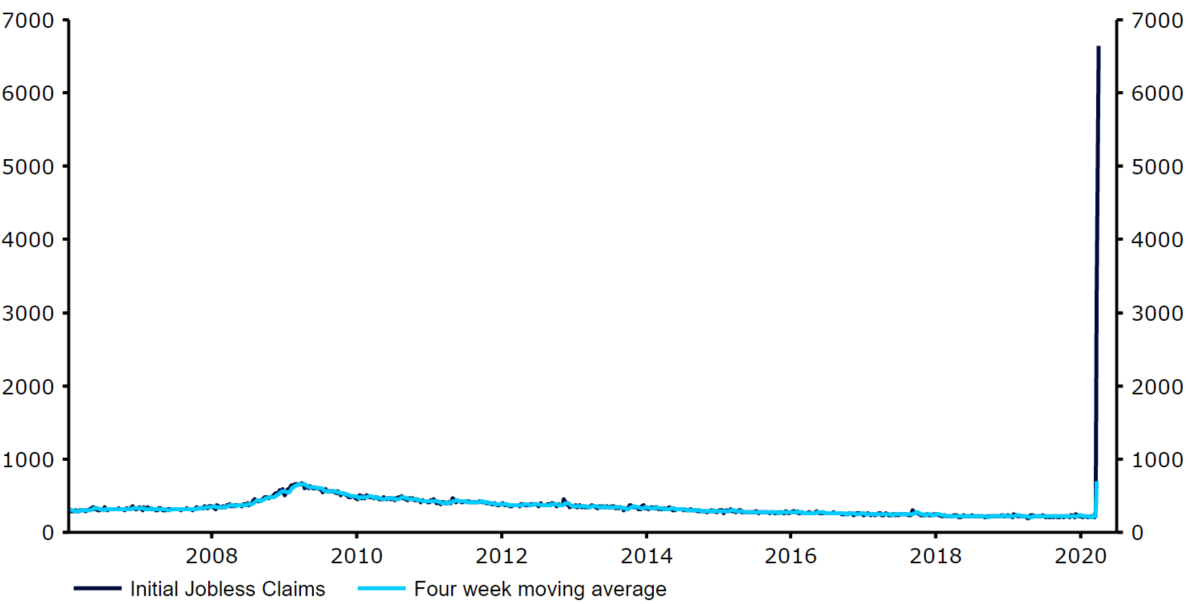

US jobless claims double to record high 6.6 million

- Go back to blog home

- Latest

Fresh labour data out of the US economy this afternoon showed just how significant of an impact the COVID-19 virus was already having on the country’s labour market.

We compared the spike in jobless claims in the previous week to the equivalent of the entire population of both Chicago and Las Vegas claiming unemployment benefits in just seven days. In the last two weeks, 10 million people have filled for such benefits, roughly the population of New York city and Philadelphia combined. This is the equivalent of around 6% of the entire US labour force losing their employment in a fortnight. If we were to take into account those already unemployed prior to the crisis and assume zero hiring during that time, this would already take the overall jobless rate to north of 9% – just shy of the 08/09 peak.

Figure 1: US Initial Jobless Claims (2002 – 2020)

The reaction in the FX market was limited to a modest and temporary rally in the safe-haven yen. There is already a general feeling that there is now a good chance the jobless rate could rise to post-WW2 highs in the next couple of months and that it is now just a question of how long it will take to reach those highs. Judging by today’s data, it may not take long at all.

Attention will now turn to tomorrow’s nonfarm payrolls report. The issue here is that the data will only cover the period up to 12th March. Given that this was prior to the implementation of the large-scale containment measures across much of the US it will be largely outdated and somewhat irrelevant. We’ll get the first true indication of the impact on the overall unemployment rate at the following labour report for April, scheduled for release in the first Friday of May.