US rally comes to a halt amid rising market volatility

( 5 min )

- Go back to blog home

- Latest

The past week has been another extraordinary one in the foreign exchange market, with many currencies hitting new lows and volatility levels spiking to multi-year highs.

Most emerging market currencies also recovered ground against the dollar in the second half of the week, led by the Chinese yuan, which rebounded off record lows following verbal intervention from the People’s Bank of China. Volatility levels among a number of major and EM currency pairs spiked to multi-year highs last week. This includes both the euro and sterling, which saw their 6-month implied volatility levels jump to 10- and 13-year highs respectively.

Investors will be bracing for another hectic few days in financial markets this week, as attention pivots to a string of major macroeconomic data releases. We will be keeping a particularly close eye on revised PMI numbers out of the G3 economies (Monday and Wednesday) and, of course, Friday’s US nonfarm payrolls report for September. Meanwhile, focus in the UK will remain squarely on the fallout from the mini-budget. This morning’s announcement from UK Chancellor Kwarteng that the government would be scrapping its plans to remove the 45p tax rate has supported the pound, though we think that it is unlikely to have a lasting impact.

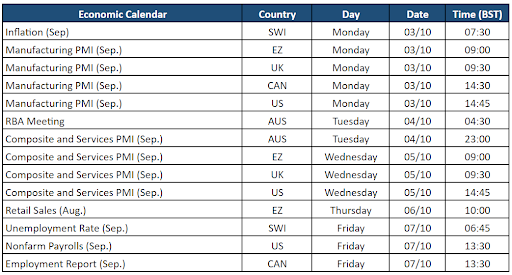

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 03/10/2022

GBP

Sterling behaved like an emerging market currency suffering a crisis last week, as it continued to experience violent gyrations off the back of the recent budget. The pound actually ended the week as the best performer in the G10, with investors buyed by news that the Bank of England plans to use its reserves to purchase unlimited amounts of gilts through to the end of October in order to allay the turmoil in bond markets.

Figure 2: GBP/USD (September – October 2022)

Source: Refinitiv Date: 03/10/2022

Whether this intervention puts a floor under sterling, or merely provides some short-term relief, remains to be seen. The BoE has already indicated that it is unlikely to deliver an emergency rate hike, and direct FX intervention is off the table, in our view, given the UK’s insufficient FX reserves (less than 2 months’ of imports). The government’s U-turn on the 45p tax rate is a positive sign for UK assets. We would, however, argue that sterling may not be out of the woods just yet, particularly given this only accounted for around 4% of the total cost of the tax cuts over the next two years.

EUR

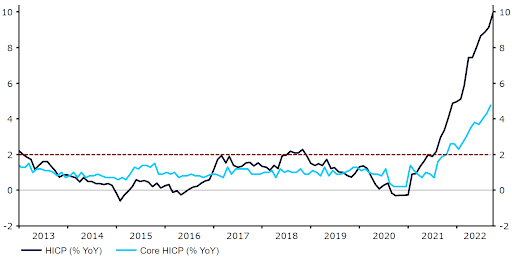

A sizable surprise to the upside in Euro Area inflation data, which rose into double-digits for the first time in September, supported the euro against most currencies last week. Unlike in the US, we are yet to see signs of a peak in price pressures in the common bloc. This reinforces our view that the European Central Bank still remains behind the curve in raising interest rates, and will likely have to tighten policy into 2023 considerably more than its US counterpart – a medium-term bullish signal for the euro.

Figure 3: Euro Area Inflation Rate (2013 – 2022)

Source: Refinitiv Datastream Date: 03/10/2022

In the meantime, expectations for the next ECB meeting later this month will be key for the common currency. Swap markets are now fully pricing in a 75bp rate hike, with a full one percentage point move likely to be in the cards should economic data in the interim come in above expectations.

USD

Macroeconomic news out of the US was mostly bullish for the dollar last week, namely a sharp drop in initial jobless claims, and larger-than-expected increases in new home sales and personal spending. The US Dollar Index did, however, retreat from its 20-year highs amid a broad improvement in risk sentiment, and perhaps an element of profit-taking and month-end portfolio rebalancing.

This Friday’s nonfarm payrolls report will be the highlight of the US trading week, with markets bracing for another solid month of jobs gains and positive nominal earnings growth. A handful of Fed members (Williams, George, Barkin et al) will also be speaking at the beginning of the week. We will be paying particularly close attention to their thoughts on the recent easing in US inflation data, and its ramifications for the size of the next rate hike at the November FOMC meeting.

CHF

The Swiss franc traded more than one percent lower against the broadly stronger euro last week, with the EUR/CHF pair bouncing off its lowest level on record. We see this move as largely driven by euro strength, as domestic news was rather light on the ground. Fresh comments from SNB chair Thomas Jordan hit the newswires over the weekend, as he stressed that the franc no longer remains highly valued. This isn’t new information, however, and markets have taken his communications in stride.

Macroeconomic news out this morning was rather mixed. The latest manufacturing PMI jumped to 57.1 in September, well above the 54.6 expected, although September inflation data fell short of expectations. Headline price growth eased to 3.3% last month (down from 3.5% in August). This may ease pressure on the SNB to deliver another sizable rate increase at its next meeting in December – markets are currently pricing in around a three-in-four chance of another 75 basis point hike.

AUD

The Australian dollar was one of the worst-performing currencies last week, ending the week around its lowest level in two years against the US dollar. Rising interest rate expectations ahead of the Reserve Bank of Australia’s meeting on Tuesday have, however, allowed AUD to recover slightly so far this week, with markets eyeing up the possibility of another 50bps hike.

That said, we believe that there is a possibility that the central bank will raise rates by a smaller amount, given that previous comments that the central bank was looking for opportunities to slow the pace of hikes at some stage. RBA Governor Lowe noted last month that the case for outsize rate hikes had ‘diminished’ as the cash rate was approaching ‘more normal settings’. This indicates to us that a 25bp move could be delivered on Tuesday, which would be a disappointment for markets and could trigger a move lower in the Australian dollar. We will also be paying close attention to the revised PMIs for September (Tuesday), although the market reaction could be limited.

CAD

The Canadian dollar has been weighed down by the broad strength of the US dollar of late, with the USD/CAD pair trading around the 1.38 level this morning, just shy of its lowest level in two years. The recent fall in oil prices has also hurt the Canadian currency – Brent crude oil is currently trading around 20% lower since the start of the second quarter of 2022.

The most important macroeconomic data this week will be the September employment report out on Friday. Employment is expected to rise by 20,000 in September after three months of consecutive contractions. In addition, Bank of Canada Governor Macklem will be speaking on Thursday, which will be closely watched for clues about the BoC’s next steps. We expect another hawkish message from Macklem that may tee up another 50bp hike at the next policy meeting in October, which may be bullish for CAD. That said, any hint of heightened concerns about the slowing economy could hurt the currency.

CNY

Last week was another highly volatile one for the Chinese yuan, which is an unusual development given how closely the currency is managed by the People’s Bank of China. CNY crashed to a record low around the 7.25 level on the dollar in the middle of the week, before recovering almost 2% of its losses in the second half following efforts from the central bank to prop up the yuan. The PBoC stepped up its verbal interventions last week, warning on its official website against a one-sided appreciation or depreciation in the yuan exchange rate. Reports also suggested that the PBoC had told state owned banks to prepare for direct intervention in the FX market, with the central bank seemingly willing to delve into their massive reserve holdings in order to prop up the beleaguered currency.

While these warnings appear to have put a temporary floor under the yuan, ongoing concerns over the state of the Chinese economy and the diverging policy stances between the PBoC and Federal Reserve remain nagging downside risks to the outlook. There’s no major macroeconomic data releases in China this week, so expect attention to be firmly on any further communications from the PBoC on yuan strength.

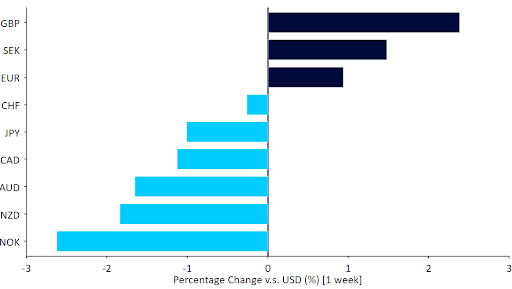

Economic Calendar (03/10/2022 – 07/10/2022)