US Dollar falters on Donald Trump tax reform concerns

- Go back to blog home

- Latest

The US Dollar lost ground across the board on Thursday, with comments from new US Treasury Secretary Steven Mnuchin dampening hopes of an imminent tax overhaul in the US under the Trump administration.

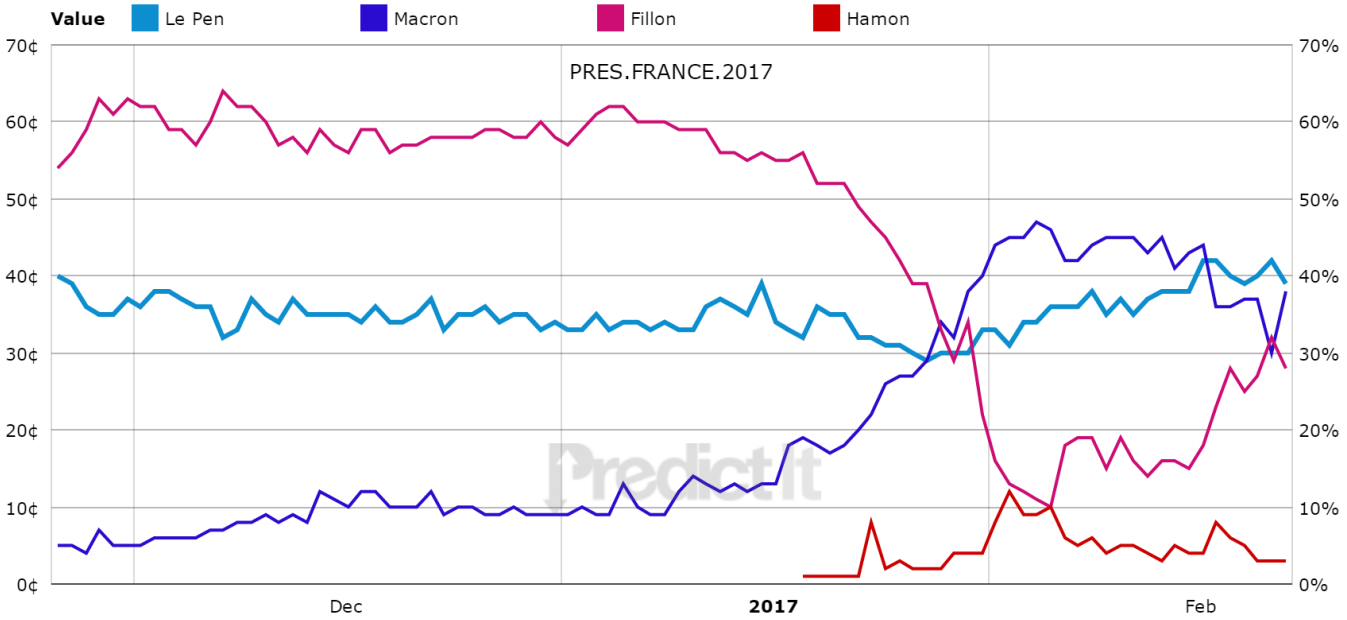

The latest Presidential election poll in France showing growing support for Eurosceptic National Front leader Marine Le Pen failed to derail the Euro yesterday. Le Pen increased her lead in the first round poll from BVA to almost 10% over both Emmanuel Macron and Francois Fillon, up around 2.5% from early February. Prediction website PredictIt now gives her around a 40% chance of winning the election in May (Figure 1).

Figure 1: PredictIt French Presidential Election Odds (November ‘16 – February ‘17)

Sterling also edged higher against a broadly weaker US Dollar. The Pound has been stuck in a narrow range throughout much of the past month, consolidating between the 1.24-1.255 levels since the Bank of England signalled it was in no rush to hike interest rates at the beginning of February. Investors have mostly overlooked the generally positive economic data since then as they await news on whether Theresa May will be able to follow through with her pledge to trigger formal EU exit talks before the end of March.

Elsewhere, the Mexican Peso rallied to its strongest position against the US Dollar since the US Presidential election after the release of a hawkish set of meeting minutes from the Bank of Mexico. The minutes revealed that the committee voted unanimously for an immediate 50 basis point hike at their 9 February meeting.

Today bodes to be a relatively quiet day in terms of economic announcements with focus remaining firmly on political developments.

Major currencies in detail

GBP

Sterling soared 0.8% versus the US Dollar to its strongest position in a fortnight on Thursday.

Retail sales in the UK rebounded this month according to the latest survey from the Confederation of British Industry. The CBI’s index rose to 9 from -8 in January when the index suffered its largest decline since records began in 1983. The report also showed that retail prices increased at their fastest pace in six years, with further price rises likely on the way following the sharp depreciation in the Pound post-Brexit vote.

With no major economic data releases in the UK today, investors will await next week’s business activity PMI’s.

EUR

Yesterday’s news out of the US helped lift the Euro 0.25% against the US Dollar on Thursday.

Economic growth out of Germany came in right in line with expectations. Europe’s second largest economy grew by a fairly sluggish 0.4% in the fourth quarter of the year and by 1.7% on a year previous. However, there are signs that the country’s economy has begun picking up pace again following the impressive set of PMI’s released earlier in the week, and the Euro was subsequently unmoved by the data.

Consumer confidence in France and Italy are unlikely to shift the Euro today. The latest polls and news out of the French election will remain key to the Euro going into the weekend.

USD

The Dollar fell 0.3% against its major peers following comments from Trump’s Treasury Secretary.

Senior Federal Reserve policymaker Dennis Lockhart continued the trend of resoundingly hawkish comments out of the US central bank in the past few weeks, keeping the possibility of a March interest rate hike firmly on the table. Lockhart claimed that a March hike remained “live” and recent economic data has been supportive of considering a move then.

Economic data yesterday was also broadly impressive. Initial jobless claims rose, although remained around a four decade low. The four week moving average of claims fell to its lowest level since 1973, suggesting that the labour market in the US is continuing to go from strength to strength.

New home sales are expected to show a solid improvement when released this afternoon. News out of the Trump administration and expectations for Fed rate hikes remain the main drivers to the US Dollar at present.