Federal Reserve Chair Yellen hints at imminent interest rate hike

- Go back to blog home

- Latest

Chair of the Federal Reserve Janet Yellen stoked hopes of multiple interest rate hikes in the US this year, claiming on Tuesday that a rate increase at an upcoming FOMC meeting would be “appropriate”.

Fellow Federal Reserve member Jeffrey Lacker also spoke in the US yesterday, striking an equally hawkish tone. Lacker claimed that the market was underestimating the pace of Fed hikes in 2017, suggesting that it could be necessary for the central bank to raise rates more than three times this year. Financial markets are now currently pricing in around a 45% chance of three interest rate hikes in the US in 2017, compared to just 33% on Monday.

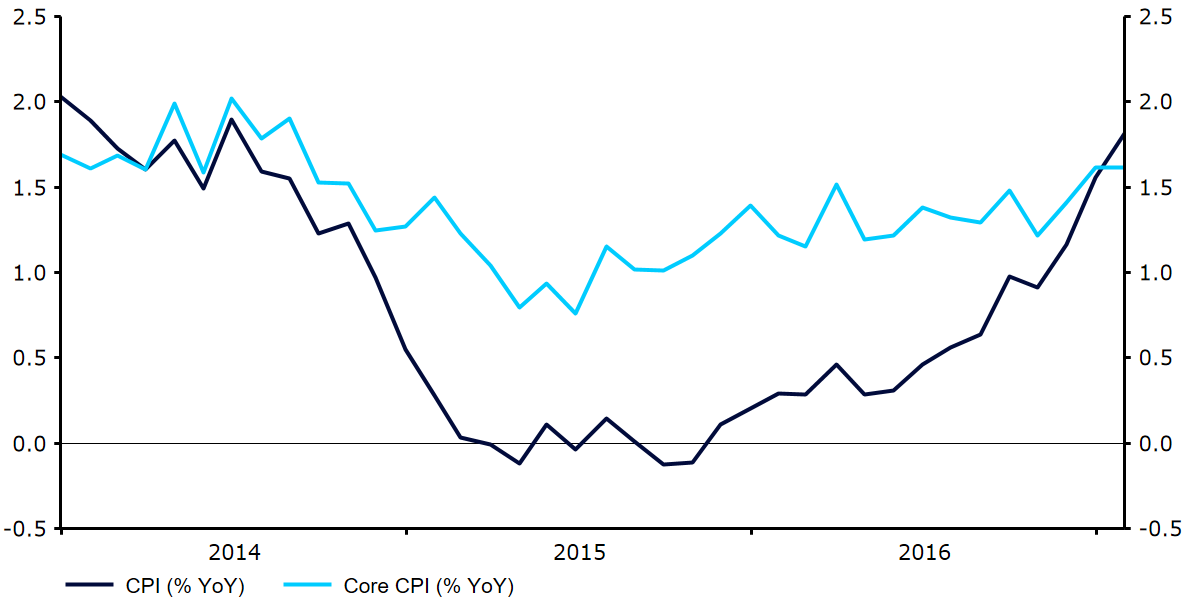

In the UK, Sterling slipped up from its one month high against the Euro after inflation missed expectations, although still rose to its highest level in three years (Figure 1). Fourth quarter growth data in the Eurozone was also revised lower.

Figure 1: UK Inflation Rate (2014 – 2017)

Economic announcements continue to come thick and fast today. The latest labour report in the UK this morning is expected to show wages grew at a healthy 2.8% pace year-on-year. US inflation this afternoon and the second day of Janet Yellen’s appearance in front of Congress are likely to shift the US Dollar this afternoon.

Major currencies in detail

GBP

Sterling fell 0.6% against the US Dollar on Tuesday following the release of a below expectation set of inflation figures.

Headline inflation in the UK rose 1.8% in the year to January, slightly less than the 1.9% consensus priced in by the market. This was, however, the highest rate of inflation for two-and-a-half years, with a rise in global oil prices and the recent sharp depreciation in the Pound sending price growth higher for the fourth consecutive month. Core inflation, which strips out the volatile energy and food components, also came in marginally below expectations at 1.6% versus the 1.8% consensus.

This morning’s labour report, including the latest unemployment and earnings data, will be released this morning.

EUR

A hawkish set of comments from Janet Yellen sent the Euro 0.4% lower yesterday to its weakest position against the Dollar since 11 January.

The market mostly overlooked Tuesday’s GDP numbers out of the Eurozone, which showed that growth in the currency bloc came in slightly below the original estimate in the final quarter of 2016. The Eurozone’s economy grew by 0.4% in the quarter and by 1.7% on a year previous, marginally below the 1.8% preliminary estimate.

Industrial production data released yesterday was mixed, suggesting that economic activity in the Euro-area remains subdued. Output in the industry contracted 1.6% in December.

The Euro will largely be driven by events elsewhere today, with this morning’s trade balance data the only major economic release in Europe on Wednesday.

USD

The US Dollar rose 0.5% against its major peers yesterday following Janet Yellen’s appearance at Congress.

Economic data out of the US was also very positive on Tuesday. Producer prices rose more than expected in January, boosted by an increase in energy prices. Prices recorded their largest gain in four years, accelerating to 1.6% year-on-year.

Inflation data at 13:30 UK time is expected to show consumer prices grew by 2.4% in the year to January. The latest retail sales data, closely watched by the Federal Reserve when deciding on monetary policy, will also be released this afternoon, although is expected to be mostly flat on a month previous.