Volatile FX market hits UK charity investment in Sub-Saharan Africa

- Go back to blog home

- Latest

- Ebury analysis shows in 2022, UK charities allocate most funds in local currencies to countries in Sub-Saharan Africa

- Most traded currencies see the pound lose purchasing power throughout the year, weakening investment potential

- Volatility of up to 27% emphasises the need for charities to put effective hedging strategies in place to lower currency risk, minimise fees and maximise funds

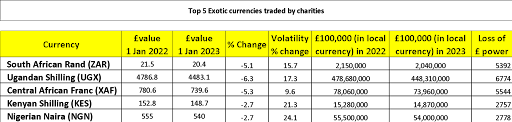

Data from Ebury, reveals the top 5 most traded currencies traded by Ebury on behalf of UK-based charities and, therefore, the countries receiving the highest volume of payments.

All five currencies are used by countries in Sub-Saharan Africa: Uganda, South Africa, Kenya and Nigeria. The following countries use the Central African Franc: Cameroon, Central African Republic, Chad, Republic of the Congo, Equatorial Guinea and Gabon.

Analysis of the currency markets finds that all five currencies have posted improvements against the pound sterling in 2022. This means that UK charities sending money overseas to pay for charitable projects face a major challenge in optimising their fundraising to achieve their aims.

Charities deploying funds in Uganda will have seen a decrease of 6% in what they can buy for that money in nations using that currency, with a 5% drop for the Central African Franc.

This has a tangible impact on aid provision – a £100,000 spend in these countries respectively will buy £6,774 and £5,544 less in goods and services than a year ago.

Moreover, the currency pairs also experienced significant volatility throughout the year, with the Nigerian Naira seeing a swing of 24% between its high and low value against the pound. The South African Rand (16%), Kenyan Shilling (21%) and Uganda Shilling (17%) also all saw double-digit differences between their best and worst spot rate.

Even though many charities use the US Dollar to avoid significant price swings, 2022 saw volatility across the GBP/USD pair of 29.5%, outstripping all five local currencies where charities are deploying most capital.

Cornelius Clarke, Head of Desk at Ebury and specialist in the NGO and charity sector, said charities must regularly reassess their FX strategy regardless of whether they are using USD or local currency, with the volatility demonstrating the huge price increases that can be incurred from spot trading.

“The sector has long experienced challenges in sending money overseas effectively to maximise the potential of the money they raise from the public, corporates and the government,” he said.

“Without specialist knowledge and hedging solutions, charities and NGOs are left exposed to high conversion costs and transaction fees as well as volatility in currency markets.

“The whipsawing value of the pound at times last year has left a tangible impact on what their money can achieve in many nations, potentially leaving them thousands of pounds short of what they initially raised in the first place. Such margins are enough to endanger flagship projects and ambitious regeneration aims.

“An effective FX strategy does not only significantly reduce the cost of inefficient conversions. It also frees up more time for charities to focus on more important matters whilst benefiting from protection against negative market moves with a locked-in forward rate and opportunity.

“With rising energy and running costs as well as difficulties in recruiting and retaining staff amid a cost-of-living crisis, taking the stress out of their FX policy will give charities one less headache in 2023.”