What to look out for at this Thursday’s Bank of England meeting

- Go back to blog home

- Latest

The Bank of England will announce its latest policy decision this Thursday. No change is expected, but there may be a number of key takeaways that could move the pound this week.

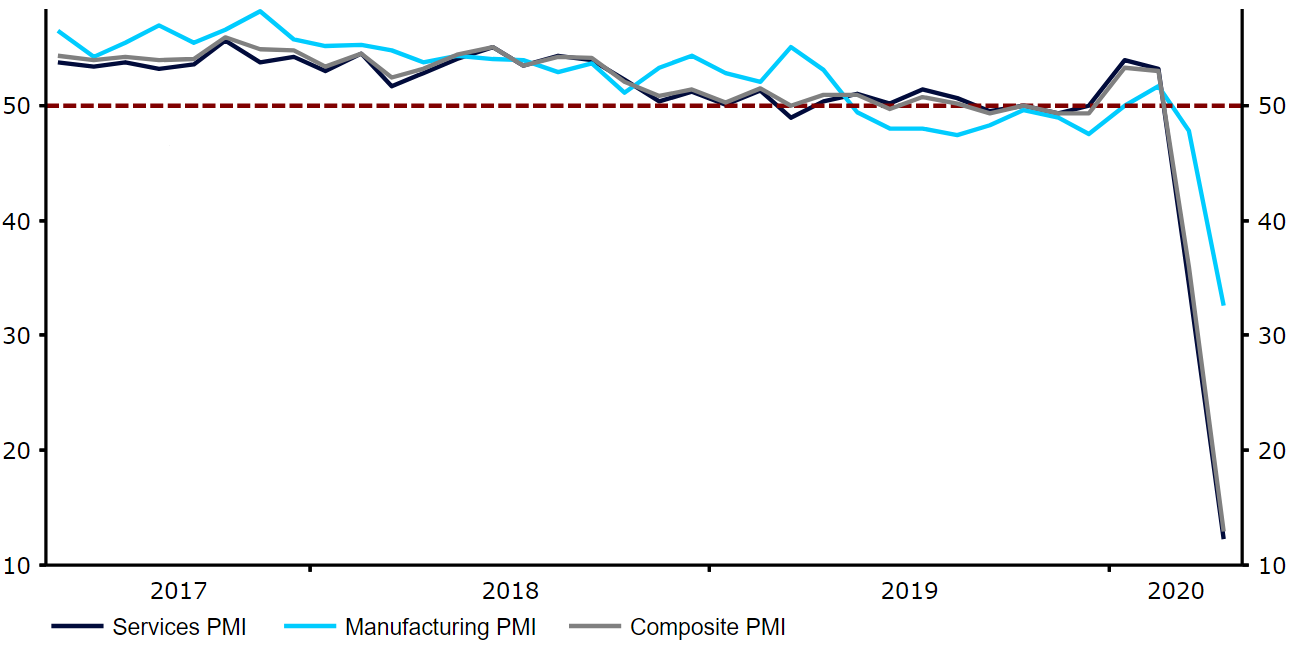

The aggressive spread of the COVID-19 virus in Britain, and the subsequent strict containment measures implemented by Boris Johnson’s government, are already having a meaningful impact on UK macroeconomic data. The PMIs have tumbled to all-time lows (Figure 1), retail sales fell by the most on record in March and Q2 GDP forecasts have been slashed to a worst-case scenario of 35% quarter-on-quarter contraction by the Office for Budget Responsibility (OBR).

Figure 1: UK PMIs (2017 – 2020)

Source: Refintiv Datastream Date: 05/05/2020

In an attempt to soften the economic blow, the BoE has announced a wide range of measures since the beginning of the crisis, including slashing rates down to record lows and ramping up its quantitative easing programme to £645 billion. Given the large-scale easing measures already rolled out by the BoE, we do not expect any new stimulus to be unveiled on Thursday. The key to the reaction in the FX market is likely to be the bank’s updated macroeconomic projections and comments regarding the possibility of a further increase in the QE programme down the line.