What will Germany’s leap into the unknown mean for the euro?

( 6 min. )

- Go back to blog home

- Latest

After more than a year of almost exclusively focusing on the pandemic, attention among investors has returned to the more conventional topics of macroeconomics, central bank monetary policy and politics.

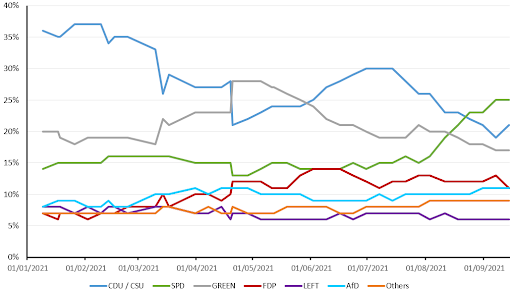

The German political landscape has become more fragmented in recent years, as both main parties lost supporters that have instead turned to smaller parties and political movements. The ones that have benefitted, according to the polls, are the Greens and the Free Democratic Party (FDP). The far-right Alternative for Germany (AfD) and the Left have picked up the remaining support.

Figure 1: Poll of Germany’s Federal Election [Forsa] (as of 17/09)

Source: Wahlrecht.de Date: 17/09/2021

What are the potential outcomes of the election?

Polling currently indicates that the SPD is likely to come out on top, taking approximately 25% of the votes, followed by the CDU/CSU with approximately 20%. The latter was expected to gain the most votes throughout most of the past twelve months, although support for the party has declined from more than 35% at the beginning of the year, in large part a result of a series of PR disasters. One of the relatively recent ones took place during Germany’s floods in July, where CDU/CSU Chancellor candidate Armin Laschet was seen laughing during the President’s speech mourning flood victims. This inappropriate behaviour resulted in public outrage and a further decline in support of the Christian Democrats. Since late-August, most of the polls have indicated that the party is now unlikely to win the most votes.

The most likely scenario is that the new German government will include three parties. With both the CDU/CSU and SPD ruling out a potential coalition with the AfD, a combination of five parties could create a coalition. Based on the recent opinion polls, there are five likely three-party coalition scenarios, all of which have been anointed names by the media corresponding to the combination of colours of the political parties:

- Germany (CDU/CSU+SPD+FDP)

- Kenya (CDU/CSU+SPD+Greens)

- Jamaica (CDU/CSU+Greens+FDP)

- Traffic Light (SPD+Greens+FDP)

- R2G (SPD+Greens+Left)

The first two would be the closest to the current ‘grand coalition’ and, therefore, the status quo. We think that they are not particularly likely as the potential for cooperation between the main parties seems to have decreased substantially. A recent, major critique from Angela Merkel of the SPD Chancellor candidate, Olaf Scholz, was viewed as a strong attack on the center-left and seems to further dismiss the prospect of a coalition including the SPD and the CDU/CSU, with both parties seemingly of the preference to go separate ways. On the other hand, the Jamaica and Traffic Light coalitions would mean a replacement of the CDU/CSU or the SPD with the Greens and the FDP party, which could also be relatively close to the status quo.

The last two coalitions seem to be most likely to occur and the last one presents the most significant change to the current state of affairs. The R2G, the coalition of the left-leaning parties, could provide the biggest shift, as it would likely support looser fiscal policy oriented towards redistribution. This partnership could, however, prove problematic, considering the rather radical stance adopted by some of the members of the Left that, as is the case with the far-right AfD, wants closer ties with Russia. At the same time, the main opposition to Russia’s influence comes from the Greens. The latter has also been critical of China, potentially risking a deterioration in relations with Germany’s largest trade partner.

The above is a good example of the possible conflicts that could occur post-election that make coalition and policy predictions particularly hard at this point. They do not only regard international relations but also, and perhaps primarily, economic policy. The R2G coalition would be the clearest in that regard, as all of the parties seem to favour more spending and redistribution. A coalition including the left-leaning parties (SPD, Greens) and FDP would likely bring some disagreements on the fiscal front.

Climate change and Germany’s relationship with the EU could be further points of contention. The parties differ on a number of issues, including fiscal rules and the extent of integration. Vaguely speaking, it seems that there is a potential upside risk to the European integration considering the SPD and Greens seem to be favouring closer ties and fewer restrictions, particularly in regards to economic relations within the EU.

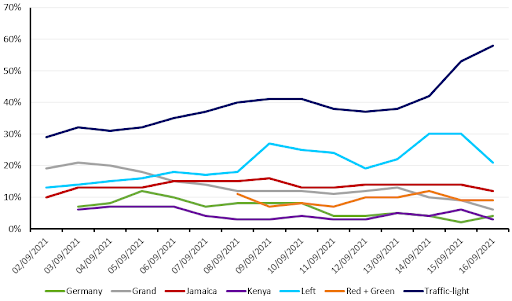

Based on the online political prediction website Predictit, the implied probability of a coalition including the Social Democrats stands at close to 90%, while one including the CDU/CSU is currently around 20%. The most likely coalition is the ‘Traffic Light’, with (more than 50% implied probability). ‘R2G’ is expected to have the second-highest chance of occurring (~20%), with Jamaica third (~10%). Interestingly, the two-party coalition of SPD+Greens is estimated to be more likely to occur than either Germany or Kenya. The ‘grand coalition’ is assessed as highly unlikely (Figure 2).

Figure 2: Implied Probability of German Election Coalitions [PredictIt] (as of 17/09)

Source: PredictIt.org Date: 17/09/2021

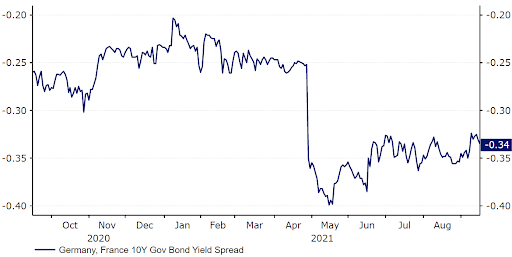

How have financial markets reacted?

So far we’ve seen little to no reaction in the FX market to the German election. Germany’s equity and bond markets seem to be much more influenced by other factors, particularly global and European trends. Nonetheless, the spread between the 10-year government bond yields in Germany and France has increased since late-August and remains somewhat higher than it has been throughout most of the past five months or so. This could, at least in part, be as a result of the election (Figure 3). There might be room for a further increase as there’s still some time before election day.

Figure 3: Germany, France 10-year Government Bond Spread (September ‘20 – September ‘21)

Source: Refinitiv Datastream Date: 17/09/2021

We think that the election will come under greater market scrutiny closer to the date of the vote. It’s quite hard to predict the exact impact, given the difficulty in assessing what’s currently priced-in, the variety of possible outcomes, and a high likelihood that the process may not be immediately clear and could drag on. A potential three-party representation would need to agree on the common blueprint, which could prove difficult and might take weeks if not months, delaying the creation of a new government.

How could the euro react to the election outcome?

The R2G coalition scenario is the one that has the greatest potential for changing the status quo. This scenario might provide for better integration within the EU and a more significant focus on climate change. Furthermore, it would provide the greatest chance of loosening Germany’s traditionally tight fiscal policy and supporting low and middle-income families. At the same time, the changes could be viewed as too radical and threaten market sentiment.

We, therefore, expect a mostly stable euro if the voting results and incoming news indicate that we should expect a coalition resembling the status quo. The prospects of the R2G coalition could bring some volatility in both directions, although we’re leaning towards a scenario in which it would be positive for the euro. We think the Red and Green coalition (SPD + Greens), although unlikely, would also be positive for the euro, but perhaps to a more limited extent than the R2G.

| Coalitions | FX reaction |

| Germany, Kenya, Jamaica, Traffic Light,

Grand Coalition |

EUR/USD changed by no more than 0.3% due to high enough resemblance to the status quo |

| SPD + Greens | EUR/USD most likely higher by ~0.5% |

| R2G | EUR/USD most likely higher by 0.5-1% due to strongest prospects for fiscal loosening |

That being said, we may not know the most likely outcome even after the results have been announced. The process may drag on, particularly as the coalition would require participating forces to bridge gaps and agree on the common proposition. After the September 2017 election, the ‘grand coalition’ government took office in March 2018 after failed coalition talks between the CDU/CSU, Greens, and Free Democrats.

Additionally, one other point of potential risk in the context of the election is the performance of the AfD party, deemed to be the most radical of them all. Should the AfD party outperform the polls by a significant margin, investors may be spooked, fearing a strengthening of populist movements in Europe ahead of the presidential and legislative election in France next year, which we think is set to be the most important political event in 2022.