Will Powell hint at negative US interest rates today?

( 3 min read )

- Go back to blog home

- Latest

The US dollar eased against its major peers yesterday amid a decline in inflation data and jitters ahead of a speech by Federal Reserve Chair Jerome Powell later today.

There is now real speculation in the markets that Powell could hint at the possibility of the Fed cutting rates into negative territory in response to the crisis – we believe that this reaction is unfounded and do not expect Powell to entertain such a notion when he speaks at 2pm BST today. This could provide a bit of a boost to the dollar, which spent almost all of Tuesday on the back foot versus the euro. The dollar was particularly fragile after data showed that US inflation dropped by its largest amount since 2008 in April. While the magnitude of the drop was larger than expected, this comes as no real surprise given the inevitable sharp drop in spending activity triggered by the lockdown.

In the meantime, this morning’s Euro Area industrial production data could shift EUR/USD today, although it may be overlooked given that it runs on a bit of a lag. Of more importance to the common currency will be German inflation data (Thursday) and the revised Q1 GDP figures (Friday).

UK economy contracts at fastest pace since 2008

Sterling fell for the second straight session yesterday, even ending the day lower against the broadly weaker US dollar.

Tuesday’s announcement from Chancellor Rishi Sunak that the UK’s furlough scheme will be extended by another four months is an encouraging development and should, in our view, help Britain’s labour market emerge from the crisis less scathed than many of its peers. While we think the scheme should help the UK economy get back on its feet at a much switfter pace than it would have otherwise, the programme clearly comes at a very high price. Public sector net borrowing is expected to hit its highest level relative to GDP since WW2 this year. Combined with the UK’s sizable current account deficit, this leaves the UK and the pound particularly exposed to outflows of capital during times of heightened uncertainty.

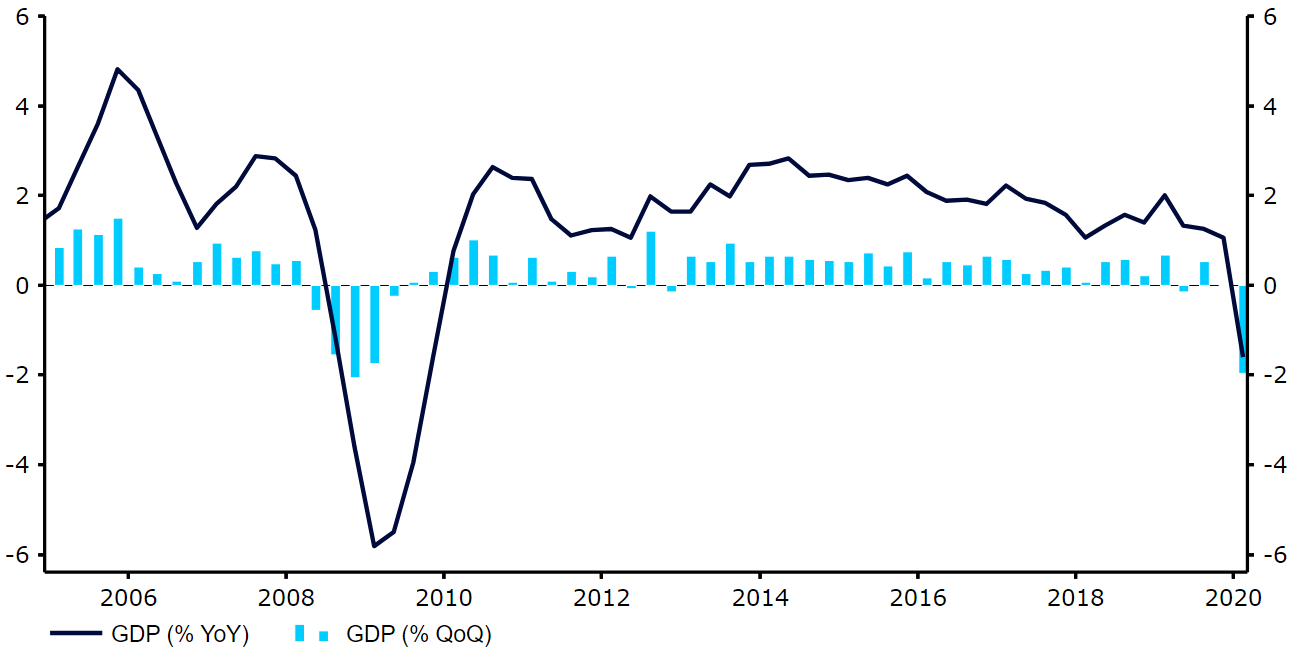

The lack of understanding regarding Boris Johnson’s lockdown announcement among some sections of society has far from helped Sterling’s cause so far this week, nor has the reemergence of fears that the UK will be unable to strike a Brexit deal by the end of the year. A slightly better-than-expected set of GDP numbers out today provided little comfort for the UK currency, with the economy still contracting by its largest amount since 2008 in Q1, -2% quarter-on-quarter (Figure 1).

Figure 1: UK GDP Growth Rate (2005 – 2020)

Source: Refinitiv Datastream Date: 13/05/2020

With the lockdown measures not in place until very late in the quarter, it doesn’t take any expert analysis to realise that the Q2 number will be significantly worse.