Will this afternoon’s US payrolls report disappoint?

( 2 min )

- Go back to blog home

- Latest

The major currencies were relatively range bound during the course of London trading on Thursday as investors awaited this afternoon’s all-important US nonfarm payrolls report.

Arguments in favour of a strong NFP number:

– Continuing jobless claims have fallen, down to a post-lockdown low 16.1 million in the week to 25/07.

– The four-week moving average of initial jobless claims fell to its lowest level since 27/03 last week.

Arguments against a strong NFP number:

– New daily virus numbers hit fresh highs throughout July, leading to widespread re-introduction of lockdown measures and the closure of workplaces.

– Initial jobless claims ticked up in the two weeks to 24/07, albeit fell to a post-lockdown low last week.

– Wednesday’s ADP employment change number massively undershot expectations (167k vs. 1.5 million projected).

– Employment component of ISM’s non-manufacturing PMI eased to 42.1 in July from 43.1.

Aside from being a busy data day, today also marks Congress’ self-imposed deadline for coming to an agreement on an extension to its additional unemployment insurance benefits. Despite a few upbeat comments from some sides of the discussions, both the Republicans and Democrats appear to be at loggerheads over the actual sum of weekly payment. A lack of an agreement here, combined with a worse-than-expected payrolls report, could spell doom for the US economy and would likely trigger another bout of weakness in the dollar later this afternoon.

The payrolls report will be released at 13:30pm BST (14:30 CET).

Pound gives up gains after BoE’s Bailey comments

Sterling received a bit of a lift from yesterday’s more upbeat economic assessment from the Bank of England. The rally in the currency was, however, short-lived, with the pound opening this morning lower than where it was prior to the bank’s announcement. This upbeat mood was tarnished somewhat by comments from Governor Andrew Bailey later in the day, who dismissed the idea that the bank’s outlook was too optimistic. He instead backed the end of the government’s furlough scheme in October, noting that some parts of the UK economy were no longer viable post-covid.

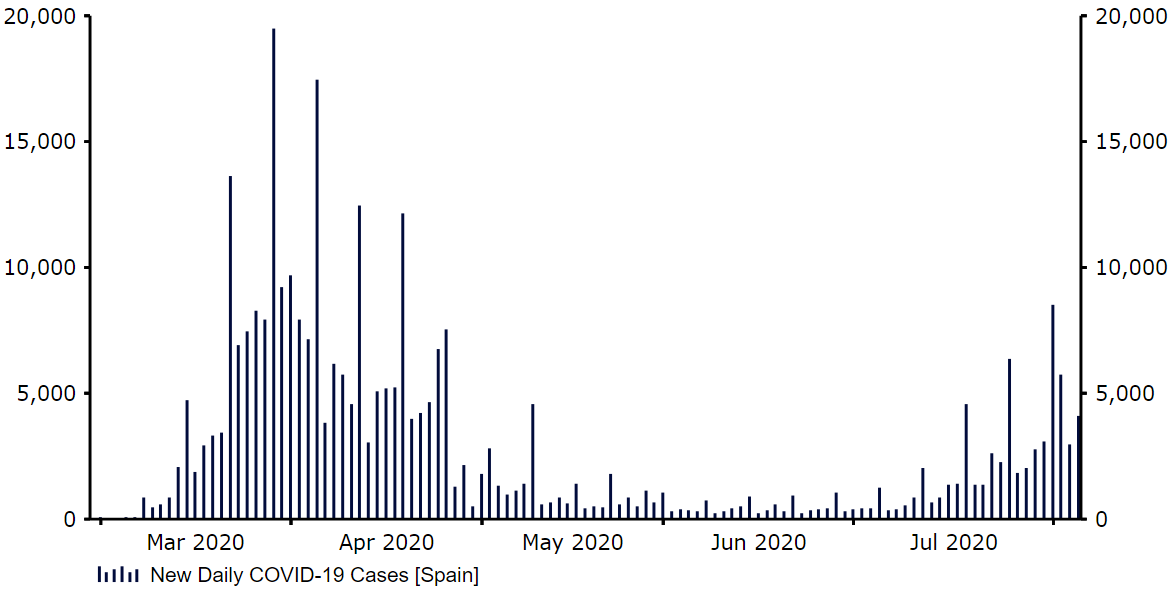

Meanwhile, the euro was stuck mostly in a narrow range on Thursday amid a lack of major market moving information. We did have some data out of Germany that was actually highly encouraging, although mostly overlooked by investors. Factory orders in Europe’s largest economy leapt by 27.9% in June versus the 10% forecast, providing more evidence that the recovery in the bloc was taking place at a faster pace than initially anticipated. With no economic news out of the Euro Area today, investors will be paying close attention to the latest virus numbers, particularly out of Spain, which appears to be experiencing the beginning of a second wave of virus infection (Figure 1). Aside from any major developments here, the euro is likely to be driven largely by this afternoon’s US payrolls report.

Figure 1: Spain New Daily COVID-19 Cases (March ‘20 – August ‘20)

Source: Refinitiv Datastream Date: 07/08/2020