Wobbly stock markets bring rush to safe havens

( 5 min )

- Go back to blog home

- Latest

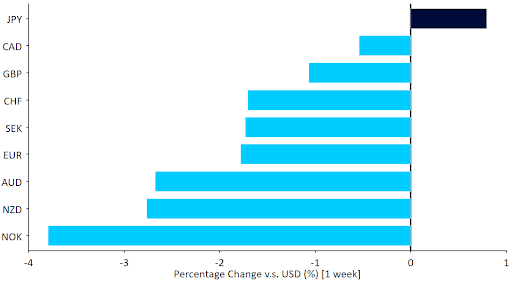

Another week of risk asset sell offs had a predictable effect on currency markets.

The key concern driving markets is the extent to which central banks can bring inflation back in line with targets without serious damage to growth prospects. High-frequency data like US retail sales on Tuesday will take on added importance. Nevertheless, it will be a data light week and therefore communications from central bank officials will be in the spotlight. In addition to a slate of ECB speakers, watch out for the publication of the minutes from the ECB April minutes. Meanwhile, the UK inflation print on Wednesday will be key for the pound.

Figure 1: G10 FX Performance Tracker [base: USD] (1 week)

Source: Refinitiv Datastream Date: 16/05/2022

GBP

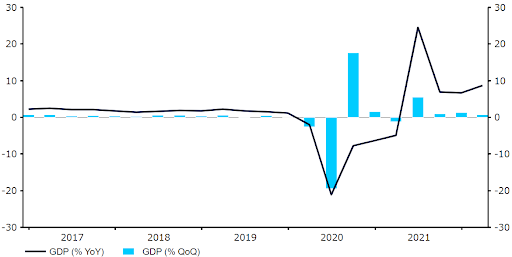

First-quarter GDP data last week was softer-than-expected, though some details of the number (strong investment, weak public and private consumption) were more positive at the margin. This week, inflation data should see the headline number vault to yet another multi-decade high, probably above 9%, and also strong gains on the core index, expected to print above 6%.

Figure 2: UK GDP Growth Rate (2017 – 2022)

Source: Refinitiv Datastream Date: 16/05/2022

Sterling appears to have stabilised recently, at least against other European currencies. However, it is hard to see any significant recovery against the US dollar until the Bank of England shifts its rhetoric towards more aggressive tightening. This week’s line-up of no fewer than six MPC speakers provides a chance for that to happen, though it may be still early.

EUR

In the absence of major data, traders last week fret over issues like natural gas supplies and their effect on industrial production. Aside from that, sentiment data was not good but we note that the more informative PMIs continue to hold up well in growth territory. It is hard to see high risks of recession with the composite index well above 55 (50 indicates flat performance).

The hawkish rhetorical shift in the ECB has not yet helped the common currency, but we think it is a matter of time before it does. With a slate of speakers and the April meeting minutes on tap this week, we may be looking at an opportunity for a countertrend euro rally.

USD

Second-tier economic data out of the US last week did not significantly change the picture of an economy at full employment, struggling with supply side constraints but still growing. Manufacturing and retail sales data out this week will provide the latest read on the health of the US economy, but they are unlikely to move the needle much.

Currency trader focus will remain on the gyrations in the bond and equity markets. We think the flight to safety knee jerk move looks overdone and a stabilisation in stock markets could be enough for the US dollar to give up some of its recent gains.

CHF

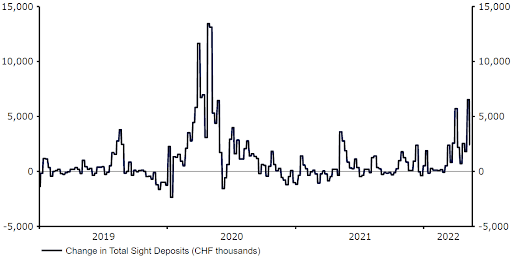

The Swiss franc significantly underperformed its safe-haven peers that topped the G10 rankings last week, and fell to parity against the US dollar for the first time since 2019. While a significant portion of this underperformance seems to be down to outside factors, some of it may be due to SNB interventions designed to weaken the franc. A proxy for FX intervention, SNB total sight deposits, increased by the most since May 2020 in the seven days to 9th May, with the bank also more active than usual last week.

Figure 3: SNB Change In Total Sight Deposits (2019 – 2022)

Source: Refinitiv Datastream Date: 16/05/2022

AUD

The Australian dollar depreciated to its lowest level in almost two years against the US dollar last week, with the AUD/USD pair falling back below the 0.70 level.

Due to the absence of relevant local macroeconomic data releases, AUD was mostly driven by shifts in global market sentiment. Risk aversion in markets, due to rising concerns about a possible global economic slowdown, coupled with heightened bets that the Federal Reserve will have to tighten its monetary policy at a more aggressive pace this year, caused the US dollar to appreciate against most major currencies. Concerns over an economic slowdown in China have also weighed disproportionately on Australian dollar, given the country’s heavy reliance on demand from Asia’s largest economy.

The most important event for AUD this week will likely be the release of the April employment report on Thursday.

CAD

The Canadian dollar traded near to its lowest level since late-2021 against the US dollar last week, although it has been one of the most resilient currencies in the G10 in the past seven days.

Risk aversion, coupled with expectations that the Federal Reserve will have to undertake an aggressive tightening cycle, triggered a flight to the US dollar last week. However, the markets also expect that the Bank of Canada will have to tighten policy more aggressively than most this year, which has allowed CAD to hold up better than other currencies. Global oil prices also ticked higher last week, which can also partly explain the outperformance in CAD.

The most important event for CAD this week will likely be the release of the April inflation report on Wednesday. The data is expected to show that Canadian inflation remained at multi-decade highs last month, which would reinforce expectations of another 50 basis point hike at the Bank of Canada’s June meeting.

CNY

The Chinese yuan continued to sell-off last week, with the currency losing nearly 2% against the US dollar and dropping to its lowest level since September 2020.

China has continued to enforce strict lockdowns in many of its major cities, although the situation in Shanghai has, however, improved, with authorities allowing a partial reopening of some of the previously closed facilities. Unfortunately, the lockdowns are having an increasingly material impact on the economy, as confirmed by today’s retail sales and industrial production data for April. Both prints were noticeably worse-than-expected and among the worst on record. Industrial production fell by 2.9% year-on-year, while retail sales collapsed by 11.1%.

China could cushion the blow with more monetary policy easing, although the PBoC appears reluctant to engage in strong and broad steps. The rate on the 1-year Medium-Term Lending Facility was left unchanged today and the bank rolled over maturing loans. The bank’s cautious approach is possibly a response to the yuan’s weakness and an increase in inflation. Last week’s data showed that consumer prices grew 2.1% in April, beating consensus.

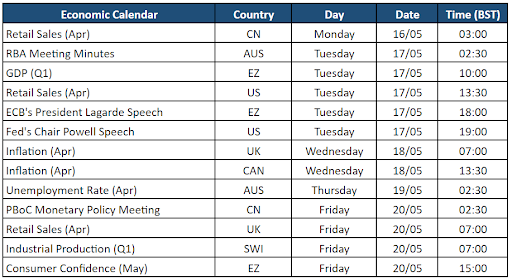

Economic Calendar (16/05/2022 – 20/05/2022)

To stay up to date with our publications, please choose one of the below:

📩 Click here to receive the latest market updates

👉 Our LinkedIn page for the latest news

✍️ Our Blog page for other FX market reports