The US dollar continued its recent trend lower last week, falling modestly against every G10 currency save the Australian dollar. The moves there were, however, modest and most of the action took place in emerging markets. It was hard to discern a theme, since the Brazilian real rose strongly but other Latin American currencies like the Chilean and Colombian peso struggled. The worst performer was the Turkish lira, down over 4% as investors continue to vote with their feet on Erdogan's unorthodox monetary policy.This week focus will be squarely on the Federal Reserve April meeting on Wednesday, although markets are not expecting any significant changes either in policy or communications from the Fed. US GDP growth (Thursday) and PCE inflation (Friday) are also key, as will be the Euozone flash inflation report for April and Q1 GDP data, both released Friday.

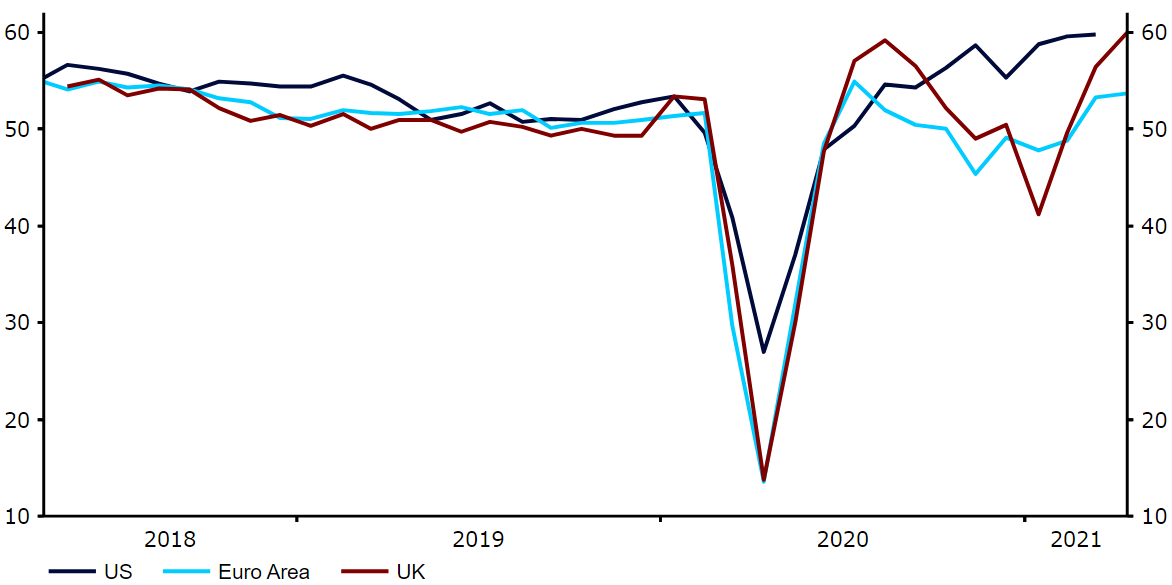

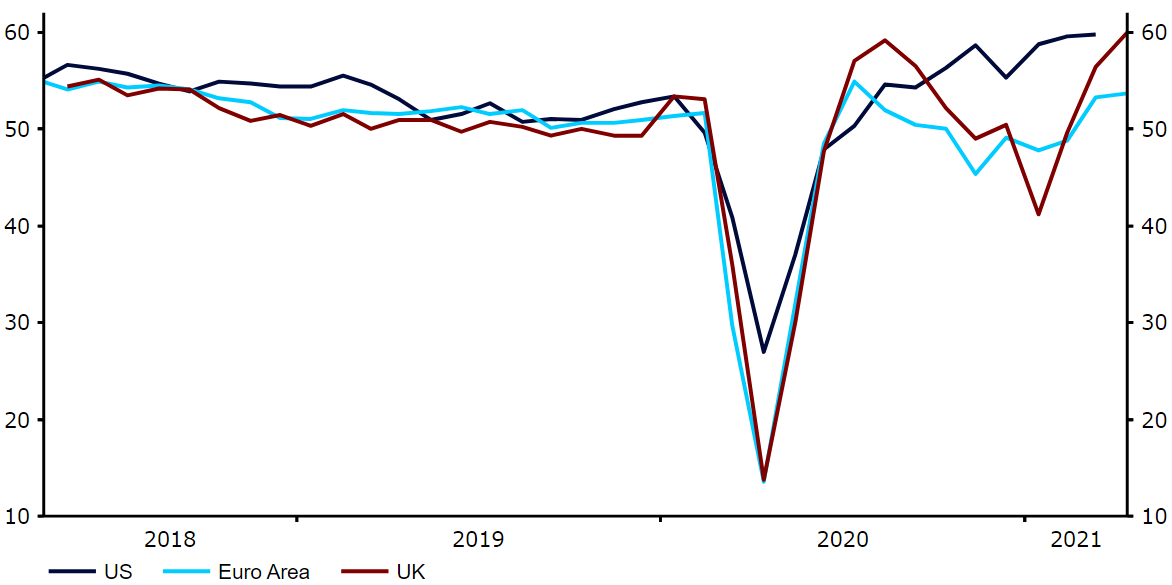

Source: Refinitiv Datastream Date: 23/04/2021Overall, we think that the string of very positive economic surprises that we have seen in the US will now have its counterpart in the Eurozone, as lockdowns are progressively lifted and consumer pent up demand is felt, particularly in the services sector. Consequently, we think that the euro rally has a way to go yet.

Source: Refinitiv Datastream Date: 23/04/2021Overall, we think that the string of very positive economic surprises that we have seen in the US will now have its counterpart in the Eurozone, as lockdowns are progressively lifted and consumer pent up demand is felt, particularly in the services sector. Consequently, we think that the euro rally has a way to go yet.

GBP

Sterling largely looked past last week's strong data out of the UK, which saw higher rates of inflation, house prices and positive surprises in the April PMI indices of business activity and March retail sales. The latter, in particular, came in much stronger-than-expected, which bodes very well for growth in the second quarter of the year. The pound's rally has been cut short for now by jitters over the upcoming Scottish parliament elections and the potential for a second independence referendum there. Little news of any note this week means that sterling will probably take its trading cues from elsewhere, notably the Federal Reserve meeting on Wednesday.EUR

The improving tone in Eurozone economic data was confirmed last week by a very strong PMI report for the month of April and continued improvement in vaccination rates. The ECB also stayed out of the way of the euro rally by adding little new information in its April meeting. Figure 1: G3 PMIs (2018 - 2021) Source: Refinitiv Datastream Date: 23/04/2021Overall, we think that the string of very positive economic surprises that we have seen in the US will now have its counterpart in the Eurozone, as lockdowns are progressively lifted and consumer pent up demand is felt, particularly in the services sector. Consequently, we think that the euro rally has a way to go yet.

Source: Refinitiv Datastream Date: 23/04/2021Overall, we think that the string of very positive economic surprises that we have seen in the US will now have its counterpart in the Eurozone, as lockdowns are progressively lifted and consumer pent up demand is felt, particularly in the services sector. Consequently, we think that the euro rally has a way to go yet.

.svg)

.svg)

.svg)