Virtual IBAN Accounts for Businesses

Open virtual IBAN accounts with Ebury in 29+ currencies for seamless global payments, multi-currency transactions & faster international collections.

CURRENCY & COLLECTION ACCOUNTS

The account your business needs, in the currency and countries your clients want

Get account details in your name, including the account number and other necessary information to make or receive payments in a given currency. You can also convert your balances from one currency to another or use them to make payments.

Learn moreFAST AND RELIABLE

Get the most out of your online payments and collections

Ebury’s multiple payment connections mean we can deliver your payments as fast as possible, with most currencies arriving on the same day.

CAPABILITIES

Explore our payment and collection capabilities all around the world

Discover our capabilities and learn where you can pay and receive funds worldwide.

Download our full list of payment and collection capabilities

FAQs

Got a question? We are here to help you.

If you can’t find answers to your questions, our team would be more than happy to assist you.

Ebury does not charge upfront or subscription fees to open an account. However, we do charge a spread on currency conversion. A spread is the difference between a currency pair’s bid (sell) price and the ask (buy) price. Since we partner with 15+ liquidity providers worldwide, we provide competitive and transparent exchange rates to help you save money on transfers and trade confidently.

Ebury offers end-to-end payment solutions for businesses of all sizes across many industries. Whether you are an SME, online seller, fund manager, NGO or a large corporation, our payments solutions are tailored to fit your business needs and goals and help you trade and scale internationally with ease, speed and security.

With Ebury, you can open your accounts in 44 countries worldwide

When you source from another country, paying your suppliers or other partners in their local currency can help them reduce their FX risk. This helps you negotiate better pricing and maximise profitability. Also, if you have offices worldwide, paying your employees in their local currency helps them save money on conversion costs. In both cases, you win their trust and build loyalty.

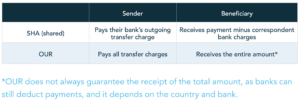

To explain this, let’s dive deep into who pays the transfer charges.

A local payment method allows you to pay via local payment schemes in a given country.