GBP volatility soars past Brexit levels on investor panic

- Go back to blog home

- Latest

Monetary authorities around are continuing to battle hard to combat the economic risk posed by the coronavirus pandemic.

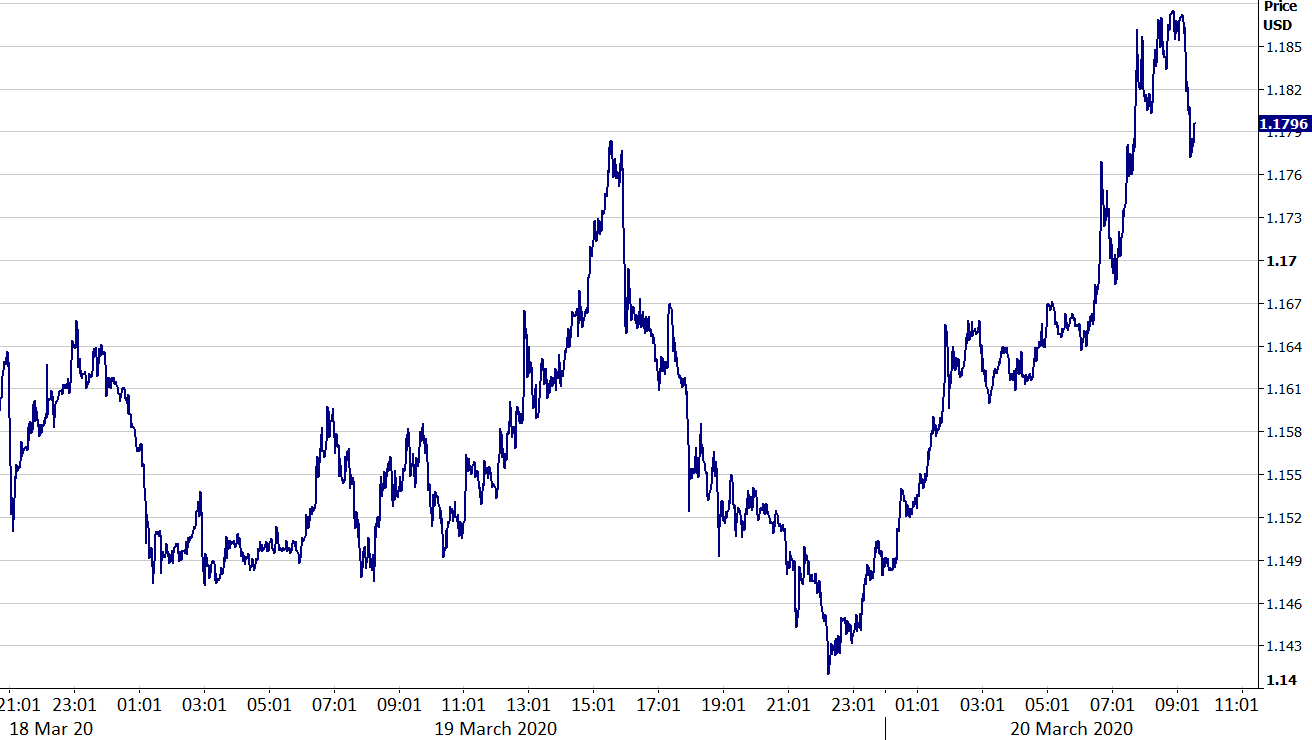

But just as quickly as the pound rallied, it was sent sharply lower again soon after. The GBP/USD cross erased all of its gains for the day in late-afternoon London trading, as investors recommenced their flock to the safety of the dollar – briefly sending the pound to fresh 1985 lows. In yet another twist, the currency was on the front foot again this morning, soaring from around the 1.145 level versus the dollar to 1.19 in a matter of hours. News out this morning that the UK chancellor was planning to announce employment and wage subsidy packages later today may have been behind the move, although at this stage it is very hard to tell.

Figure 1: GBP/USD (18/03 – 20/03)

It is clear that the market is now in full-on panic mode, with the uncertainty surrounding the virus causing some violent and unprecedented moves in almost every currency. Volatility levels remain sky-high, with almost every duration of GBP implied volatility, somewhat incredibly, rising above June 2016 Brexit levels in the past few days (Figure 2).

Figure 2: GBP Implied Volatility (2015 – 2020),

Euro hits April 2017 lows as US relief package signed

The moves witnessed in the other major currencies have been no less dramatic in the past 24 hours. The euro, for instance, ended London trading over 2% lower versus the dollar, briefly sent below the 1.07 level before stabilising just above 1.08. This marked the common currency’s weakest position since April 2017. Unsurprisingly, yesterday German IFO sentiment index far from helped, with the measure tumbling to its lowest level since August 2009 in March.

Yesterday’s rally in the US dollar can, at least in part, be attributed to the signing off of the US’s Families First Coronavirus Response Act by President Trump. The stimulus measures will see $1 trillion pumped into the US economy, including $1,000 cash handouts to American citizens. This, we think, should be more effective in supporting households than a simple interest rate cut. It is, however, still unlikely to be enough, particularly for those families who lose one, or even both, income streams due to the pending jump in unemployment that the crisis is set to trigger.

Elsewhere, the RBA cut rates again as expected by 25 bp to 0.25%, a fresh record low. They also unveiled their QE programme, which will last for three years. The Swiss National Bank, as we thought they would, kept rates on hold, but instead reaffirmed their intention to continue intervening in the FX market to stem franc appreciation. The Swiss franc has been one of the best performers this month as investors continue to flock to the safe-havens – we expect this trend to continue in the immediate-term.