Dollar claws back ground after worst month in 10 years

( 3 min )

- Go back to blog home

- Latest

The recent sell-off in the US dollar abated on Monday, with most major FX crosses fairly stable ahead of a busy week of announcements and economic data releases.

Figure 1: Euro Net Longs vs. EUR/USD (2016 – 2020)

Source: Refinitiv Datastream Date: 04/08/2020

The issue for the dollar is that very little appears to be in its favour at the moment. New daily US virus cases appear to be easing, although deaths caused by the virus are now showing a visible uptrend. A deal over extending the additional unemployment insurance benefits scheme also remains elusive in Congress. Talks were reportedly productive on Monday and we remain confident that a deal will be struck, albeit the extra benefits are set to be significantly watered down from the previous $600 a week payments. It will be interesting to see whether this will be enough to lift the flagging dollar and calm concerns that the US recovery is set to lag that of Europe.

Aside from news out of Congress, investors will be awaiting this Wednesday’s non-manufacturing PMI data from ISM and Friday’s payrolls report. Yesterday’s manufacturing PMI from ISM beat expectations, although a similar indicator from Markit painted a totally different picture. Regardless, given the small contribution of the sector to US output, markets were largely unmoved following the releases.

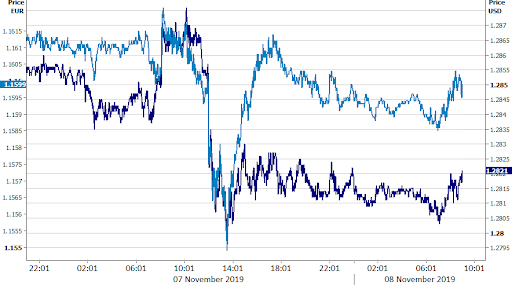

Pound holds above 1.30 ahead of Thursday’s BoE meeting

Sterling consolidated its gains yesterday, holding firm just above the 1.30 level versus the dollar.

Not only was last month the worst month for the greenback in a decade, but it was also one of the pound’s best Julys in around three decades. Whether this move higher can continue will depend on a number of factors, namely Brexit and the UK’s economic recovery post-lockdown. We’ll get more news this week on the latter with the revised UK PMI numbers. Yesterday’s manufacturing index was revised slightly lower, although remained comfortably in expansionary territory at 53.3 from the initial 53.6 estimate. Wednesday’s services index should receive much more attention from currency traders.

The main focal point this week will, however, be Thursday’s Bank of England meeting. We expect policy to be kept unchanged, with investors to instead focus on governor Bailey’s comments on the pace of the economic recovery. The market will also be looking for clues as to whether the bank is keeping its options open to lower interest rates into negative territory at a later date, should it deem appropriate.