US Dollar sell-off continues, suffers worst month in a decade

( 3 min )

- Go back to blog home

- Latest

The aggressive sell-off witnessed in the US dollar continued last week, with the currency posting its worst monthly performance in trade-weighted terms in ten years.

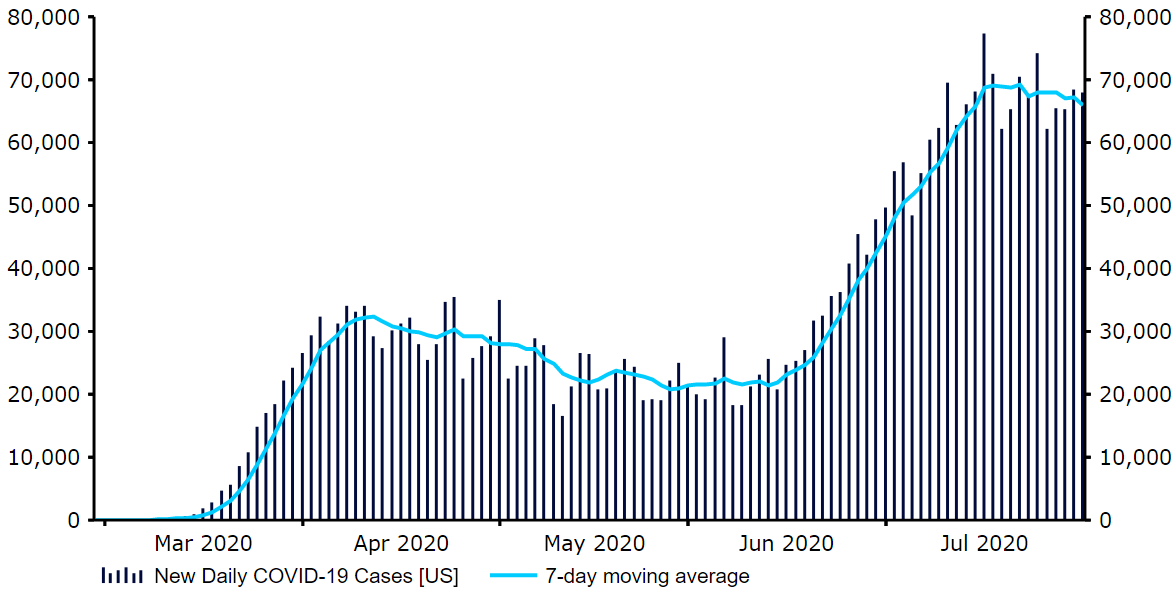

Figure 1: US New Daily COVID-19 Cases (March ‘20 – July ‘20)

Source: Refinitiv Datastream Date: 03/08/2020

Every G10 currency ended last month higher versus the greenback, led by the higher-risk Swedish krona and sterling, the latter continuing to rally even amid the ongoing uncertainty surrounding Brexit. Most emerging market currencies also ended July higher versus the dollar. We did, however, see a handful sell-off violently again last week, notably the South African rand and Russian ruble, which ended the week as the two worst performers.

Attention this week will remain on Congress and whether we’ll see an agreement to extend income support measures. Investors will also be eagerly awaiting a host of economic data releases this week, notably the July US payrolls report on Friday.

GBP

No news was good news for sterling last week. With hardly any economic data releases or political announcements of note, the UK currency was able to extend its gains versus the broadly weaker dollar. Even Friday’s announcement that the re-opening of some parts of the UK economy would be delayed was not enough to derail the pound, which ended the month roughly where it was prior to the market panic at the beginning of March.

It will be interesting to see whether this trend continues this week when investors will have much more UK data and policy announcements to digest. We will be paying close attention to the revised PMI numbers (today and Wednesday) and the Bank of England’s latest monetary policy decision on Thursday. We expect the BoE to keep policy unchanged, with attention instead likely to be on comments regarding the expected pace of the recovery.

EUR

The euro continues to go from strength to strength, ending last week around its strongest position since mid-2018. The latest virus numbers out of Europe have raised some concerns regarding the possibility of a second wave of infection in the common bloc, notably in Spain where new infections rose to their highest level since 11th May. While this was reflected in a sell-off in European equity indices last week, the resilience of EUR/USD is a good indication of just how sour sentiment has turned towards the dollar of late.

We should get a better idea as to how well the Euro Area economy is rebounded from the worst of the downturn this week, with both the composite PMI and retail sales figures set for release on Wednesday. The former is a revision to the July data, so investors may focus their attention on the latter.

USD

As mentioned, July was the worst month for the dollar since 2010, with rising virus numbers, political bickering and falling yields causing investors to abandon the US currency en masse.

This week could be a very important one for the dollar. Not only could we get news out of Congress, but there will also be a host of economic data releases for investors to digest, most of which will cover the period after the reintroduction of lockdown measures in a handful of states. We will be paying closest attention to Wednesday’s non-manufacturing PMI from ISM and Friday’s nonfarm payrolls report for July. Given the latest worsening in weekly jobless claims data, we think there is a chance that the latter surprises to the downside.

🔊 Get updated in 20 min on the latest financial market news with our podcast FX Talk

– This week’s topics: Sharp sell-off in USD, FOMC meeting

– Spotlight Currency: Swedish Krona (SEK)