ECB holds fire, UK retail sales surge higher in March

( 3 min )

- Go back to blog home

- Latest

Thursday’s European Central Bank meeting was largely a non-event for the FX market, as we had anticipated prior to the announcement.

While we are more upbeat than we were regarding the Euro Area’s vaccination rollout, clear downside risks to the growth and inflation outlook remain and the ECB will, in our view, be in no rush whatsoever to unwind its accommodative policy stance. We may see the bank announce that it will begin slowing the pace of asset purchases in June, but we certainly don’t expect any talk on the programme’s end date until at least the September meeting. At this point the bank will have a much clearer idea as to the state of the health crisis and, in particular, its impact on Euro Area inflation.

UK retail sales jump sharply even before lockdown easing

The euro received little support from the ECB yesterday, but it has rallied this morning following a better-than-expected set of PMI data. Both the Euro Area manufacturing and services indices increased in April, with the composite PMI rising to 53.7 versus the 52.8 priced in – its highest level since July. This has helped lift the common currency back towards the 1.205 level versus the dollar and just shy of Tuesday’s five-week high.

The big data surprise this morning has, however, come out of the UK. Retail sales in Britain jumped far more-than-expected in March, up 5.4% month-on-month versus the 1.5% that economists had pencilled in, its largest increase since June. Excluding fuel this increase was even greater, with sales up by 7.9% MoM. The strength of the data is all the more surprising given that high street shops were not reopened in the UK until 12th April. Clearly consumers in the UK are in a buoyant mood, which bodes very well for growth in the second quarter, which looks likely to show a sharp rebound following the expected contraction in Q1.

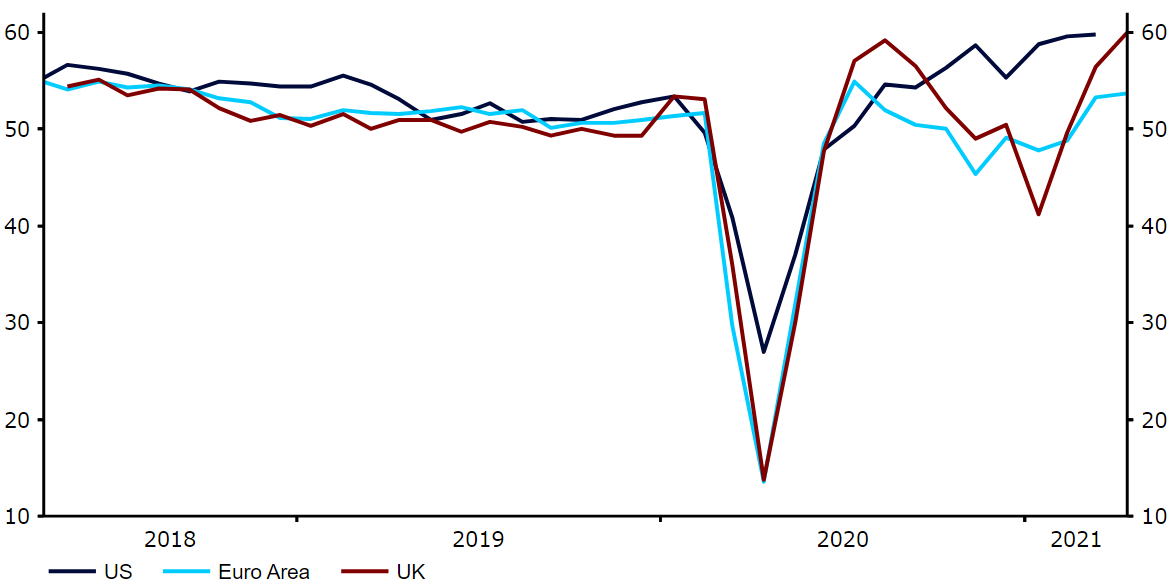

This morning’s UK PMI data was similarly impressive. The index covering the UK’s dominant services index rose to 60.1 in April – the indicators highest reading since August 2014. Investors will now be awaiting PMI data out of the US later this afternoon. As evident in the chart below, the divergence between this indicator in the US and Europe at the beginning of the year is now closing, which we think can partly be attributed to the recent retracement in the dollar that has seen it lose almost 3% versus the euro since the end of March.

Figure 1: G3 PMIs (2018 – 2021)

Source: Refinitiv Datastream Date: 23/04/2021

🎙 Listen to our FX Talk podcast to get your 20-minute financial update on Spotify, Google Podcast, Apple Podcast or simply choose your favourite podcast app here.