Bank of England announces emergency interest rate cut and SME lending scheme

- Go back to blog home

- Latest

The Bank of England slashed interest rates by 50 basis points on Wednesday morning, a preemptive move aimed at protecting the UK economy from the downside risks posed by the COVID-19 virus.

According to the bank, the above measures should free up an additional £190bn for UK banks to lend. In a statement, the bank noted the easing measures would ‘help UK businesses and households bridge across the economic disruption that is likely to be associated with Covid-19’. It also stated that it would help ‘keep firms in business and people in jobs and help prevent a temporary disruption from causing longer-lasting economic harm’.

A 50 basis point cut was mostly priced in for this month, although the hastiness of the move caught the market slightly wrong-footed. It should, however, not come as a total surprise, particularly given there were rumours of such a move late last week. This does, at least, allow the bank to get ahead of the curve and provide adequate stimulus to the market before the growth in the number of cases of the virus begins to accelerate, as it is expected to do so. 382 people have now been confirmed to have contracted the virus in the UK, including the Health Minister Nadine Dorries.

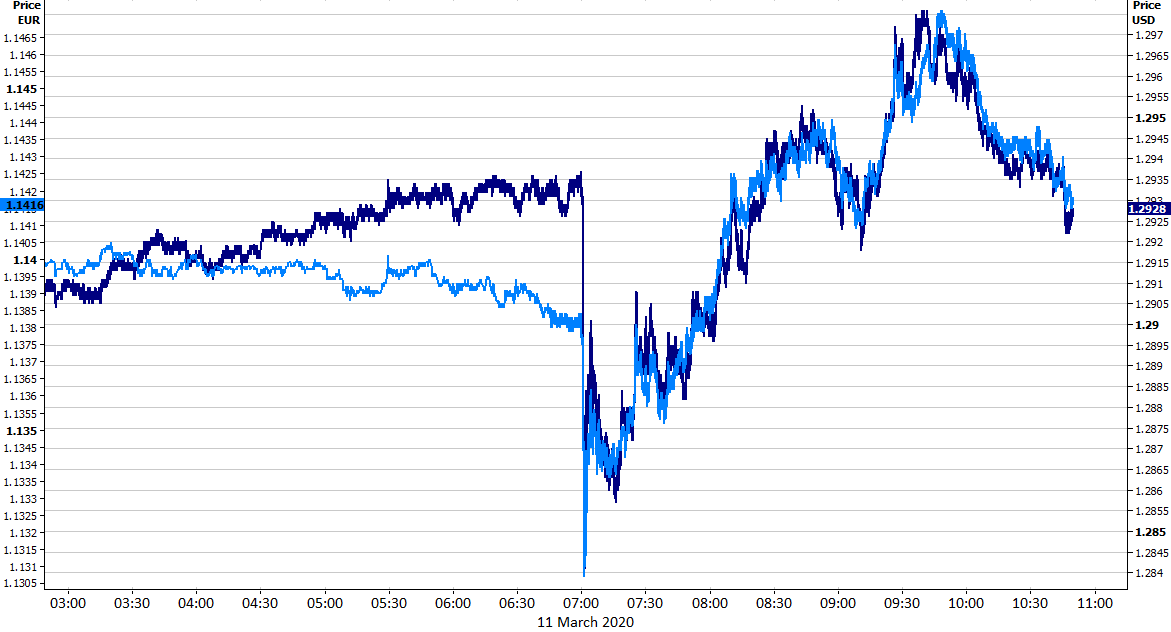

Given the timing of the move, sterling immediately shed around half a percent or so of its value versus the dollar in a knee-jerk sell-off this morning. It has, however, since retraced all of these losses and is now trading higher for the day at the time of writing (Figure 1). The limited nature of the move and the subsequent rebound can be attributed to the fact that the cut was already fully priced in for this month, it just came slightly sooner than investors had expected. We think that there is now a real possibility that the BoE could cut rates all the way down to zero when it meets for its next scheduled meeting on 26th March.

Figure 1: GBP/USD & GBP/EUR (11/03/20)

Financial markets stabilise following Black Monday rout

Financial markets stabilised across the globe yesterday, with the foreign exchange market returning to at least some sense of calm following the frantic moves of ‘Black Monday’. Equity markets rebounded from their lows for the most part, while bond yields crept higher. This came off the back of hopes that central banks and governments around the world would ramp up stimulus measures to protect the global economy from the downside risks stemming from the coronavirus outbreak.

Much of the recovery in risk appetite can also be attributed to positive news out of China, where the spread of the virus continues to abate. The number of new cases rose by just 19 in China on Monday, the lowest since the outbreak began. Even in Hubei, where the virus is said to have originated, there has been the return to some form of normalcy, with the most optimistic reports suggesting that the country could return to regular capacity by the end of the month. Remarkably, all of the 16 temporary hospitals opened to treat the virus have now been closed.

The virus has, however, continued to spread at an aggressive rate outside of China. The number of new daily cases excluding China increased to its highest yet on Monday (4,371). As long as this number continues to accelerate, which looks likely to be the case at least for the next few days, investors will continue to favour the safe-havens and steer clear of those assets deemed as higher risk, emerging market currencies being one such example.

Euro gives up gains, ECB meeting in focus

The euro gave up almost one percent versus the dollar on Tuesday, reversing all of its gains from the day previous. To some extent, the sell-off in the euro can be attributed to the extreme containment measures now in place in Italy. The country is currently under a complete lockdown in an attempt to control the virus that has now claimed 631 lives in the country, up from 431 a day previous. This will undoubtedly come at a seismic economic cost. We think it is now a certainty that the Italian economy will enter into a recession in the first quarter, with a Eurozone-wide recession in the first half of 2020 also now pretty much inevitable.

Currency traders are now fully focused on what kind of response we can expect to see from the major central banks. At present, futures markets are fully pricing in a 75 basis point rate reduction from the Fed at its March meeting next week. In the meantime, investors will be paying close attention to any measures announced by the ECB tomorrow. With very little room for them to follow suit, we think that the Governing Council will focus mostly on providing ample liquidity to the sectors that need it, with President Lagarde to call again on European governments to increase fiscal spending.

UK budget set to unveil historic spending increases

Following the BoE’s rate cut this morning, attention in the UK will be firmly on today’s budget from the new chancellor Rishi Sunak.

The budget is usually a non-event for the currency markets, although will take on much more importance this time around, for a number of reasons. Firstly, there was no budget at all in 2019, a direct result of the snap election. This will also be the first spending announcement since the UK officially left the European Union and comes right in the midst of the rapidly spreading coronavirus outbreak. Investors are bracing for announcements on a massive increases in spending on infrastructure and the NHS. Given that this is, we believe, mostly priced in to the value of sterling, we don’t expect too big of a reaction in the currency markets, although a knee-jerk move in either direction cannot be ruled out.