Euro jumps to two-week high after ECB meeting

- Go back to blog home

- Latest

The euro jumped to its strongest position in a fortnight versus the US dollar on Thursday evening, buoyed by comments from Christine Lagarde following the ECB’s April monetary policy meeting.

Policymakers also announced a new loans programme known as the Pandemic Emergency Long Term Refinancing Operation, PELTRO for short. This will provide loans to banks at ultra-low interest rates of -1%. While this is not quite as big of a headline stealing announcement as many market participants had expected, investors were suitably satisfied that the bank has enough tools at its disposal to continue supporting the Euro Area economy in the coming months. This, combined with the typical volatility induced by month-end flows, sent the euro around one percent higher during the course of trading yesterday.

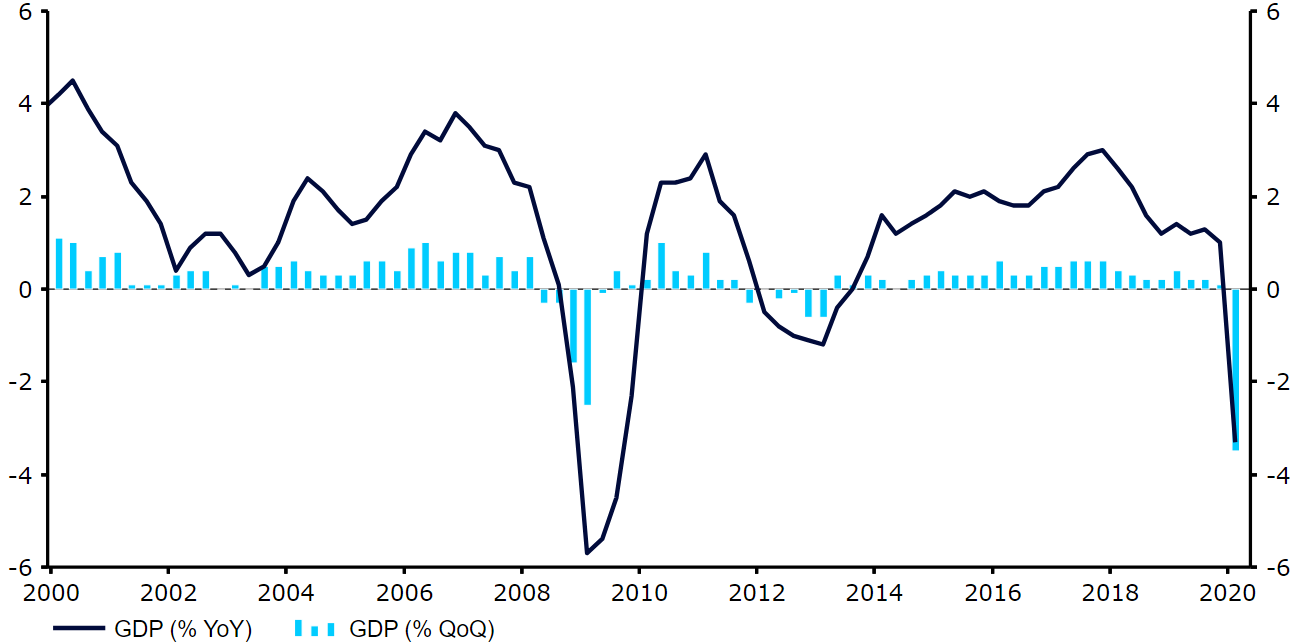

Last month was probably the worst month for the global economy ever, with widespread lockdowns bringing activity to a screeching halt. This was reflected in the Q1 GDP data for the Euro Area released yesterday, which showed that the bloc contracted by 3.8% quarter-on-quarter, its fastest pace of contraction on record. Italy and France have now both officially entered into recession, with it merely a matter of time before the rest of Europe follows suit.

Figure 1: Euro Area GDP Growth Rate (2000 – 2020)

Source: Refinitiv Datastream Date: 01/05/2020

As mentioned yesterday following the US data, this is but the tip of the iceberg, given that lockdown measures were not put in place until relatively late in the quarter. Data for Q2 is likely to be much worse, with the ECB warning yesterday that the bloc’s economy could contract by anywhere between 5 to 12% this year.

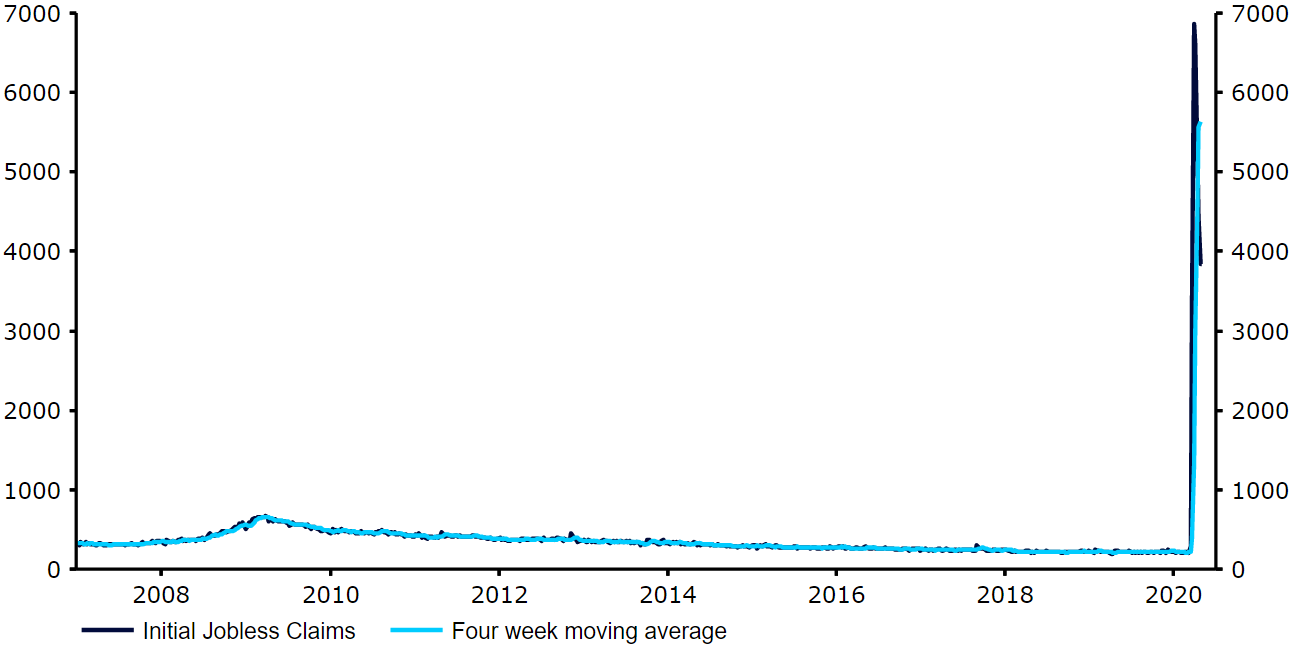

US jobless claims top 30 million since start of crisis

The situation in the US labour market continued to go from bad to worse yesterday, perhaps another factor behind the move higher in the euro and sterling yesterday and broad sell-off in the greenback.

Initial claims for US unemployment benefits rose by another 3.84 million last week. While the number of new weekly cases eased once again, it remains sky-high, pushing the overall number of claims since the onset of the crisis to north of 30 million. Remarkably, this translates into around 19% of the US labour force becoming newly unemployed in the past six weeks alone.

Figure 2: US Initial Jobless Claims (2007 – 2020)

Source: Refinitiv Datastream Date: 01/05/2020

We now await the April nonfarm payrolls report, due out next Friday. We expect this to show record levels of job losses and post-WW2 high unemployment levels. In the meantime, this afternoon’s US PMI data from ISM could prove a market mover, although volatility may be limited by the fact that this will only show activity in the country’s relatively small manufacturing sector.