FOMC December Meeting Preview: Faster taper on the way, despite omicron risk

( 5min )

- Go back to blog home

- Latest

The detection of the highly mutated strain of COVID-19, omicron, has heightened uncertainty among investors heading into this week’s Federal Reserve meeting.

Prior to the omicron development, investors were almost universally of the opinion that an announcement on a further increase in the pace of tapering was on the way at this month’s FOMC meeting. These bets were tempered somewhat in the immediate aftermath of the omicron news, as traders fret that additional lockdown measures and a slowdown in global growth could be on the cards. Since then, concerns surrounding the economic impact of the new variant have eased. While omicron appears to be spreading at a faster rate than its predecessors, reported cases of the variant have so far triggered only mild symptoms and its spread has not yet led to a sharp increase in hospitalisations and deaths in those areas worst affected. Vaccine producer Pfizer has also calmed nerves by suggesting that three doses of its jab provides sufficient protection against the new strain.

Speaking in early-December, FOMC chair Jerome Powell struck a hawkish tone. While he warned over the risks to employment and economic activity posed by omicron, he didn’t appear overly concerned, nor did he indicate that it would materially alter the bank’s plans. In a significant development, Powell also said that it was time to ‘retire the word transitory’ regarding inflation, in a clear confession that the Fed had grossly underestimated the extent to which price growth would exceed the central bank’s target. Communications from most of Powell’s fellow FOMC members have been equally hawkish in recent weeks. Members Bullard, Bostic and Clarida, to name a few, have all indicated that they are likely to vote in favour of a faster taper this month.

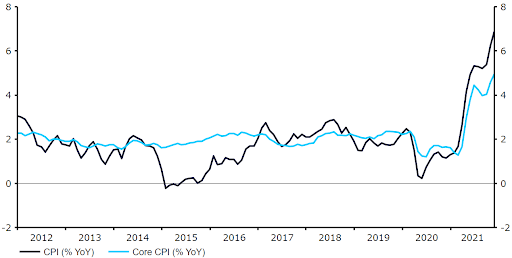

The rationale for a quicker removal of monetary stimulus is clear. US inflation continues to run extremely hot and has almost entirely surprised to the upside in the past few months, rising to 6.8% in November – its highest level in thirty-nine years. The US labour market is also performing well, with the November nonfarm payrolls report suggesting that we may be nearing, or already at, levels that the Fed deems as full employment. What is less clear, however, is whether the Fed will consider the omicron risk as sufficient to delay their tightening plans – we are of the opinion that it won’t.

Figure 1: US Inflation Rate (2012 – 2021)

Source: Refinitiv Datastream Date: 13/12/2021

What to expect from the FOMC’s policy announcement?

We think that attention among market participants on Wednesday will be firmly on the Fed’s tapering decision. The timing of when the QE programme comes to an end is a rather inconsequential detail in itself. What it does do, however, is inform market participants as to the approximate timing of the Fed’s first interest rate hike in the pandemic era. Policymakers have already indicated that the bank won’t raise rates until after tapering is done, i.e. not until the second half of 2022 as things stand. Futures markets are currently pricing in the first hike in May, and clearly think that an accelerated pace of tapering is on the cards. The real question is, therefore, not whether or not the Fed will speed up tapering, but when and to what extent.

As mentioned above, we think that the Fed will indeed increase the speed of tapering at this week’s meeting. We expect a doubling in the pace at which net asset purchases are reduced from $15 billion to $30 billion, effective from January. Following Powell’s testimony to the US Treasury, we think that this is now largely expected by the market, and the reaction in the dollar to such an announcement would be neutral-to-mildly positive. No change to tapering would be a significant disappointment for markets and would almost certainly trigger a sharp sell-off in the dollar. A more modest acceleration in the pace of tapering would also be greeted negatively by investors, and the dollar would again likely sell-off, in our view, albeit to a lesser extent.

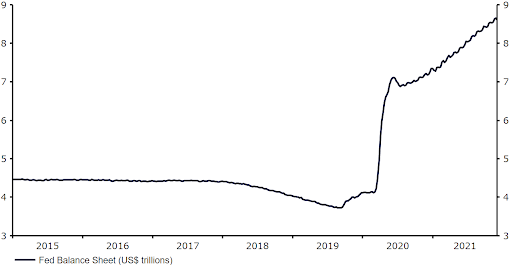

Figure 2: Federal Reserve Balance Sheet (2015 – 2021)

Source: Refinitiv Datastream Date: 13/12/2021

We will also be paying close attention to chair Powell’s accompanying communications, particularly on both inflation and the economic impact of omicron, the Fed’s latest macroeconomic projections and its updated ‘dot plot’. The Fed is expected to formally drop the word ‘transitory’ when describing inflation, and we expect Powell to indicate that a faster pace of tightening will be required to bring price growth back towards the central bank’s target. Its inflation forecasts for 2021 and 2022 are all but certain to be revised higher, while we also expect a downward revision to the near-term unemployment projections.

As far as the updated interest rate forecasts are concerned, we see an upward revision from the September meeting as likely in light of the recent upside surprises in inflation. At the last meeting, the committee was split 50/50 as to whether we’d see even one interest rate increase in 2022. We think that the median dot will be shifted fairly markedly higher, and indicate that at least two interest rate hikes are coming next year. This would support our, and indeed the market’s, view that the first rate increase may be on the way in Q2 2022 at the very latest, and could provide some additional upside to the dollar this week.

Overall, we expect tapering to come to an end in March next year, which would allow the Fed to begin raising rates at the May 2022 meeting, with two or three additional hikes to follow during the remainder of 2022.

👉 For more information on other special reports please see below:

ECB December meeting preview – Will Lagarde cave in to the hawks?

BoE December meeting preview – Rate high unlikely amid omicron risk