Hopes for fast economic recovery drive sharp emerging market rally

( 3 min read )

- Go back to blog home

- Latest

The relentless rebound in risk assets worldwide from March lows accelerated last week on the back of positive economic surprises almost everywhere.

The Brazilian real deserves a special mention, topping the charts last week with an extraordinary gain of 7% against the US dollar. The Turkish lira was the worst-performing major emerging market currency, down 1% against the dollar in spite of the positive environment, as investors fret over the fragility of the Turkish financial system and its dependence on foreign portfolio flows.

This week the focus will be squarely on events in the US. While the protests seem to have had little market impact, the Federal Reserve meeting on Wednesday will offer insight on how Fed officials are reacting to better-than-expected economic news, in particular last week’s payrolls report. On the economic front, we think that inflation numbers out on Tuesday could surprise markets to the upside, since US incomes have soared during the crisis while supply constraints are restricting expenditures. The currency market reaction to such an event would, however, be anyone’s guess.

GBP

Fortunately for sterling, markets are so far focusing more on the increasingly favourable environment for risk assets and the prospects for a fast economic recovery than the Brexit negotiations that, once again, appear to be going nowhere.

The Pound was also helped last week by comments from Bank of England officials that downplayed the possibility of negative interest rates in the UK. This week, we expect to see some dismal April GDP data, but markets are likely to look through it as outdated in view of the fast rebounds elsewhere.

EUR

The ECB decided to increase its PEPP bond purchase programme by even more than we expected (€600 billion vs our forecasts for €500 billion). This produced an environment of near euphoria in peripheral sovereign bonds, and spreads are coming down fast.

The euro has benefitted from this as much as from the upward revision to May’s PMIs of business activity and better-than-expected unemployment numbers. The ECB measures, in our view, rule out the possibility of a fresh euro crisis and therefore we expect the rally in the common currency to continue over the next few weeks.

USD

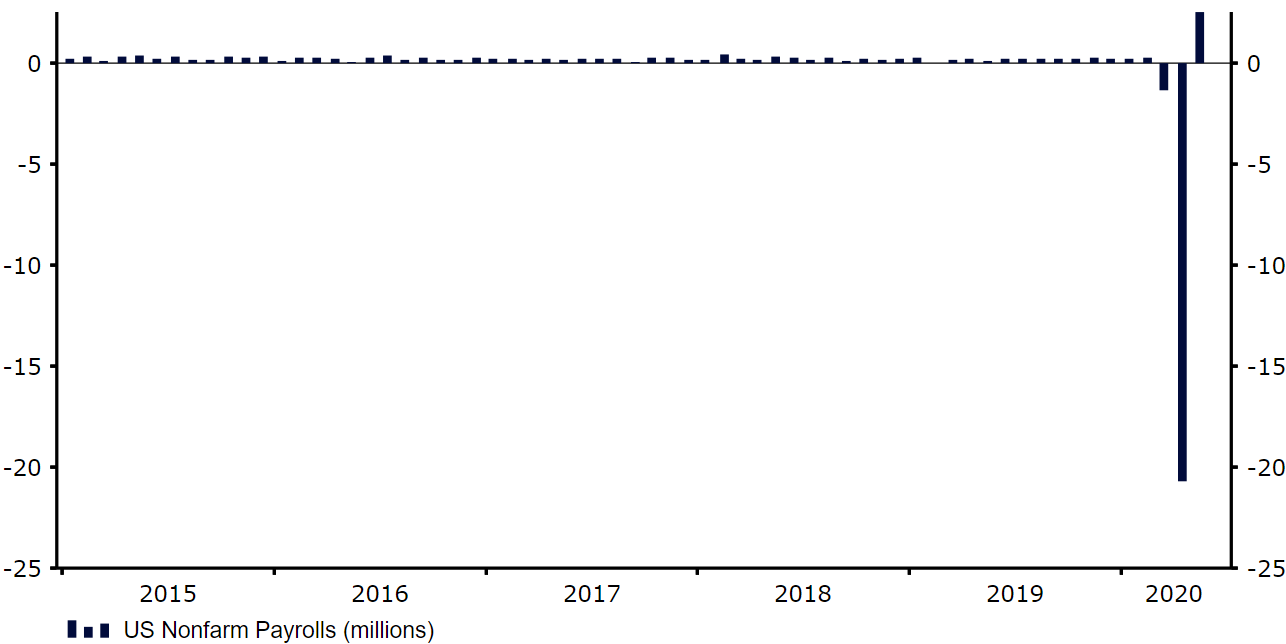

While other macroeconomic news were also positive, the US payrolls report for May was the key development of the week. The US economy created 2.5 million jobs last month (Figure 1), while economists were expecting, on average, the loss of 7.5 million. Unemployment also improved to 13.3%.

Figure 1: US Nonfarm Payrolls (2015 – 2020)

Source: Refinitiv Datastream Date: 08/06/2020

While the May picture is still dismal in many ways, the report means that a V-shaped recovery from the crisis is now a more likely scenario, and understandably financial markets celebrated the news on Friday. We will be paying very close attention to the reaction of Federal Reserve officials to the news at their June meeting on Wednesday.