How have emerging market currencies reacted to the COVID-19 pandemic?

( 5 min read )

- Go back to blog home

- Latest

The COVID-19 pandemic has created a very volatile and unpredictable environment in the foreign exchange market so far in 2020, particularly among emerging markets.

Risk assets rebound following dramatic sell-off

As is customary during times of intense financial market stress and uncertainty, investors flocked to those assets deemed as lower risk during the height of the panic in March, while selling those perceived as high risk. Emerging market currencies, perceived as higher risk, bore the brunt of the sell-off. Many of these EM currencies sank to multi-year or, in some cases, all-time lows versus the safe-haven US dollar. Barring only a few exceptions, the dollar is currently still trading higher year-to-date against almost every other currency, although the majority have bounced back from their lows. At the time of writing, the dollar is trading approximately 4% higher versus the weighted basket of currencies that comprise MSCI’s emerging market currency index (Figure 1).

Figure 1: MSCI Emerging Market Currency Index (June ‘19 – June ‘20)

Source: Refinitiv Datastream Date: 22/06/2020

Those that experienced the most violent sell-off were generally from countries that are either heavily dependent on the production of commodities, highly reliant on external demand, or have particularly fragile macroeconomic fundamentals. Among the worst performers were the Brazilian real (BRL), South African rand (ZAR), and Mexican peso (MXN), all down in excess of 20% year-to-date at one stage. The best performers tended to be those with either the most solid fundamentals or those that are closely controlled by their respective central banks. The Singapore dollar (SGD) and Israeli new shekel (ILS) are two examples of the latter.

As mentioned we have, however, seen most of these currencies initiate rebounds from their lows. This, we believe, has been a consequence of the falling new cases of the virus in key economic areas, the injection of vast sums of stimulus into markets from major central banks, and investor optimism surrounding a faster-than-expected recovery in the global economy.

Figure 2: FX Performance Tracker [select EM currencies vs. USD] (YTD)

![FX Performance Tracker [select EM currencies vs. USD] (YTD)](https://ebury.com/wp-content/uploads/2020/06/image-2-22062020.png)

Source: Refinitiv Datastream Date: 22/06/2020

What’s next for emerging market currencies?

While we think their performance will remain idiosyncratic, we remain optimistic that most emerging market currencies will bounce back in the long-term once the worst of the economic impact is over and the global economy returns to at least some sense of normalcy. The sell-offs induced by the virus were, in our view, driven in large part by an aversion to risk that the pending sharp contraction in global growth has induced. We think that this has left many of them at undervalued levels that are unjustified and not a true reflection of fair value. The recent rebound in EM currencies vindicates this view.

In the short- to medium-term, however, we believe that those emerging markets that are either unable to contain the spread of the virus and/or have the most fragile fundamentals will see their currencies more acutely exposed to additional sell-offs induced by the pandemic. Regarding the former, it is still too early to ascertain the true successfulness of the respective containment measures. The varying degrees of thoroughness and different methodologies used in testing also make cross-border comparison challenging, at best.

Figure 3: Reported COVID-19 Cases (per 1M people) [select EM countries]

![Reported COVID-19 Cases (per 1M people) [select EM countries]](https://ebury.com/wp-content/uploads/2020/06/image-3-22062020.png)

Source: Refinitiv Datastream Date: 22/06/2020

That being said, we are beginning to see somewhat of a dichotomy in performance between the currencies of those countries with very high levels of infection relative to population size and those that have, thus far, managed to contain the virus’ spread. Ranking currency performance YTD against COVID-19 cases per capita for the above select group of EM countries there appears a mild positive correlation between the number of COVID-19 cases and currency performance (once accounting for those currencies that we deem as most closely controlled by their respective central banks). Those currencies that have underperformed have tended to be from countries with relatively high levels of reported virus cases, while those currencies that have outperformed are generally from those with fewer reported cases of the virus. There are, however, a multitude of other factors at play of course.

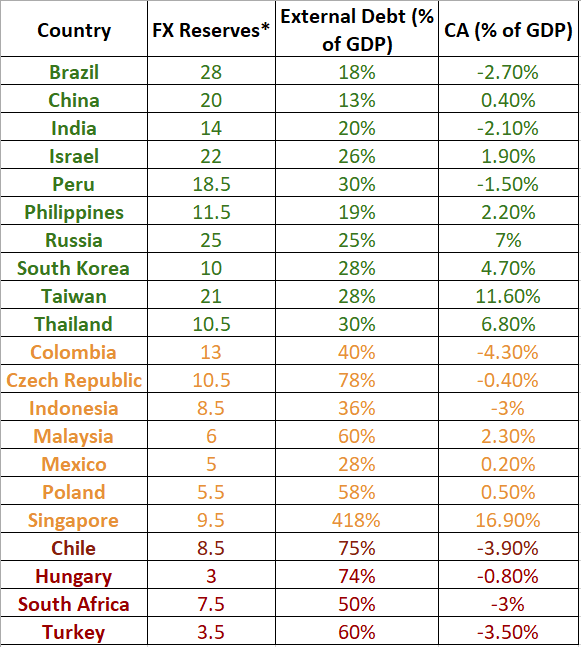

From a macroeconomic perspective, the three main factors that we are looking at when evaluating the EM currencies that we believe are best placed to withstand additional losses during the crisis period are the following:

1. Foreign exchange reserves in terms of months’ worth of import cover. Relatively high levels of FX reserves held at the central bank enable authorities to successfully intervene in the market on a more regular basis in order to protect their currency from an unwanted sell-off.

2. Current account deficit as a percentage of GDP. A large current account deficit tends to place a greater risk premium on the country’s currency, whereas a small deficit or surplus tends to lower that perceived risk. Deficits become less of an issue when financed by stable inflows such as foreign direct investment, and more unsustainable if financed by borrowing.

3. External debt as a percentage of GDP. As a general rule, those countries with high levels of external debt relative to GDP leave their currency more exposed to depreciation. This risk is magnified when the debt is denominated in a foreign currency.

We outline in the following table the above data for the most recent measurement period for a select group of EM currencies and assign colour codes for each currency based on the data. Those that we believe have the fundamentals that leave the currency most exposed to further losses are denoted in red, while those countries that we believe are best placed to weather additional sell-offs are marked in green.

Source: Refinitiv Datastream/Oxford Economics^

**months’ worth of import cover

Above data from prior to COVID-19 pandemic