Sterling falls ahead of Brexit talks, UK data disappoints

( 2 min )

- Go back to blog home

- Latest

Sterling fell back below the 1.25 level on Tuesday morning, extending its sell-off from a day previous amid ongoing Brexit concerns and some weak UK economic data.

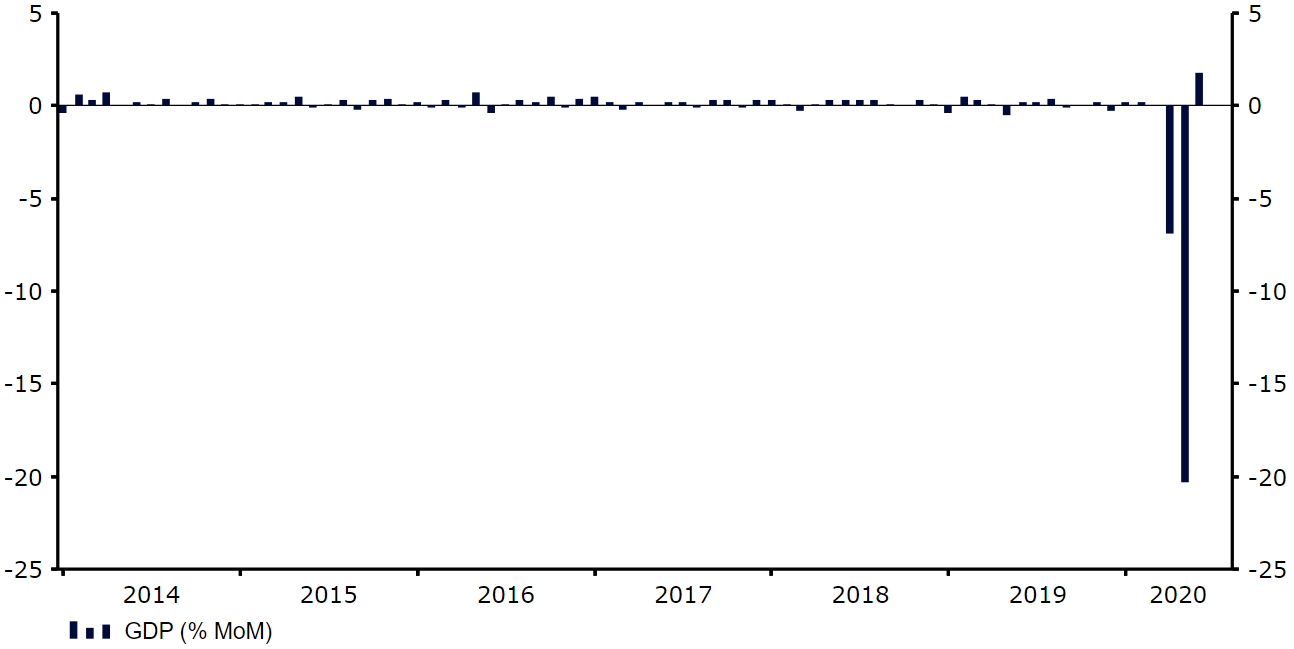

Meanwhile, this morning’s GDP data for May fell short of expectations, suggesting that the recovery in the UK economy could be a more gradual one than hoped. GDP expanded by 1.8% month-on-month in May. While this is much better than the 20%+ contraction recorded a month prior, it was slower than the 5% expansion that economists had pencilled in. This data does, however, run on a bit of a lag, so the reaction in sterling this morning was not overly dramatic.

Figure 1: UK GDP Growth Rate (2014 – 2020)

Source: Refinitiv Datastream Date: 14/07/2020

Broad sentiment in the market actually appears to have improved in the past few days, with the sell-off in the pound largely idiosyncratic rather than a sign that investors are selling risky assets. EUR/USD actually rose yesterday, with the pair briefly touching its strongest position in a month. Investors appear to be overlooking the continued increase in US virus cases so far this week, perhaps given the reports that two pharmaceutical companies (Pfizer and BioNTech SE) had been given status to speed up the production of their potential vaccines. If all goes well, this could see 30,000 patients enrolled for testing by the end of the month, with a best case scenario that a vaccine is developed by the end of the year. Positive news on this front would provide a massive boost to risk sentiment.

What to expect from a busy week in the FX market

This week looks set to be a very busy one in the foreign exchange market, much more so than the relative calm that we have witnessed in the past couple of weeks. A number of important economic releases are on the docket in the US, including June inflation data this afternoon, which we think could surprise to the upside. Industrial production (Wednesday) and housing data (Friday) may also receive some attention, but the main release will undoubtedly be Thursday’s retail sales figures for June. The latter should give us a decent indication as to how well the US economy is bouncing back from the height of the downturn.

Over in Europe, investors will also be eagerly awaiting both the July European Central Bank meeting on Thursday and the European Council meeting on Friday-Saturday. Regarding the former, no change in policy is expected, with President Lagarde likely to instead again pressure European authorities to do more to support the bloc’s economy. Should Lagarde both talk up the recent improvements in Euro Area economic data and forcefully signal that it is now the government’s turn to do more, then we think we may see a bit of strength in the euro during Thursday’s press conference. As far as the EC meeting is concerned, news that authorities have reached an agreement on the 750 billion euro stimulus package may be created positively by the markets, although we think that this is largely already priced in.