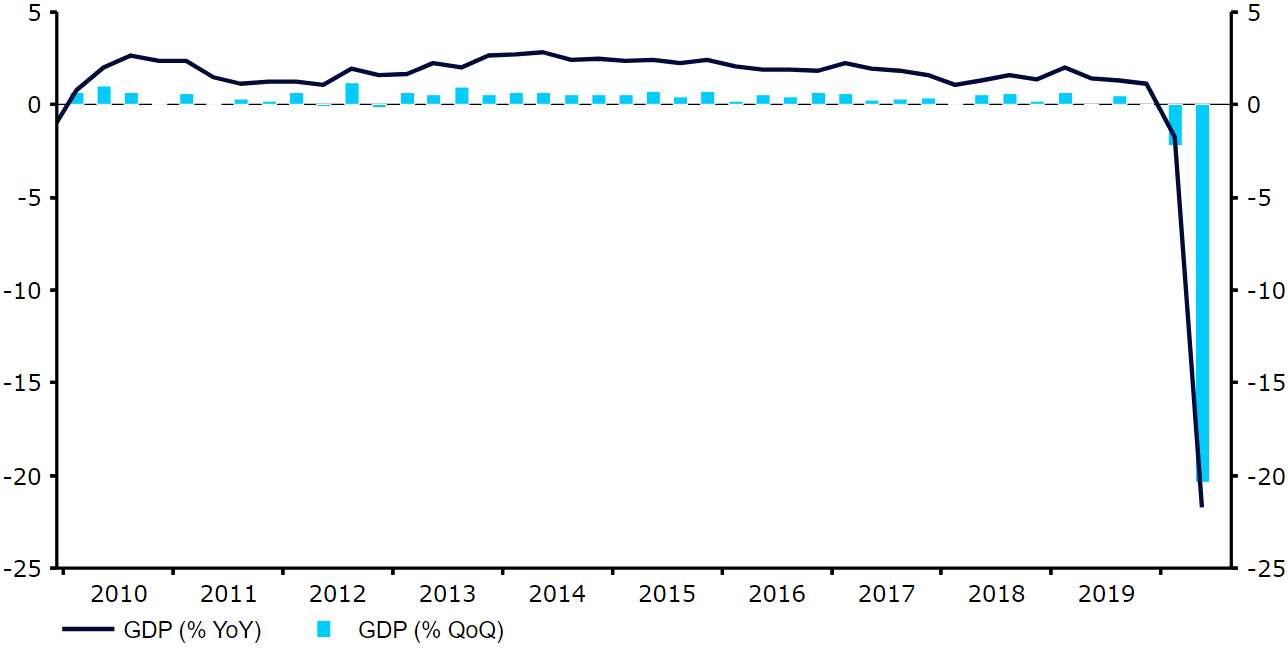

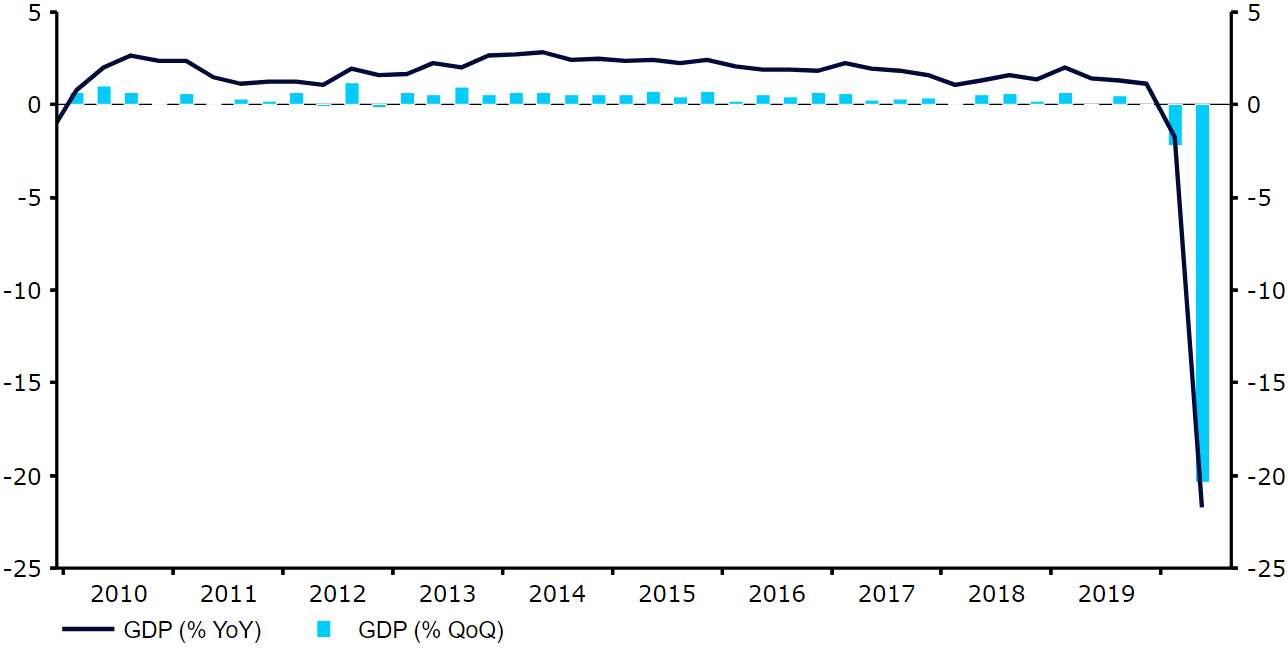

The UK economy officially entered into recession in the second quarter of the year, with the Covid-induced lockdowns triggering the largest slump in activity on record.According to data from ONS released this morning, the UK’s GDP contracted by 21.7% year-on-year in the three months to June (20.5% quarter-on-quarter), albeit both came in slightly stronger than economists had pencilled in. This therefore pushes the UK economy into a technical recession, denoted as two consecutive quarters of negative economic growth, for the first time since the global financial crisis in 2009. There were, however, signs that the economy is already beginning to bounce back well from the downturn, with GDP expanding by a better-than-forecast 8.7% month-on-month in June.Figure 1: UK GDP Growth Rate (2010 - 2020) Source: Refinitiv Datastream Date: 12/08/2020Despite the positive surprises, the data makes for pretty grim reading - on an annual basis the UK economy shrank by a far greater amount than some of its peers in Europe, notably Germany (-11.7%), Italy (-17.3%) and France (-19%), albeit by not quite as much as Spain (22.1%). This is not at all unexpected given that the UK government has been far more cautious in easing lockdown measures than some of its peers. It is worth remembering that non-essential shops (15 June) and restaurants (4 July) opened much later in the UK than almost all of the rest of Europe, which is clearly reflected in today’s data.The reaction in the pound this morning was very limited, with sterling stuck within the 1.30-1.31 range. We think this lack of reaction is due to both the lagged nature of the release and the slight irrelevance of the data, given that the extent of the downturns have been dictated almost entirely by the timing of the lockdowns. The real test for currencies will be how well respective economies bounce back from the contractions. Indicators so far suggest the UK recovery has got off to a decent start.

Source: Refinitiv Datastream Date: 12/08/2020Despite the positive surprises, the data makes for pretty grim reading - on an annual basis the UK economy shrank by a far greater amount than some of its peers in Europe, notably Germany (-11.7%), Italy (-17.3%) and France (-19%), albeit by not quite as much as Spain (22.1%). This is not at all unexpected given that the UK government has been far more cautious in easing lockdown measures than some of its peers. It is worth remembering that non-essential shops (15 June) and restaurants (4 July) opened much later in the UK than almost all of the rest of Europe, which is clearly reflected in today’s data.The reaction in the pound this morning was very limited, with sterling stuck within the 1.30-1.31 range. We think this lack of reaction is due to both the lagged nature of the release and the slight irrelevance of the data, given that the extent of the downturns have been dictated almost entirely by the timing of the lockdowns. The real test for currencies will be how well respective economies bounce back from the contractions. Indicators so far suggest the UK recovery has got off to a decent start.

Source: Refinitiv Datastream Date: 12/08/2020Despite the positive surprises, the data makes for pretty grim reading - on an annual basis the UK economy shrank by a far greater amount than some of its peers in Europe, notably Germany (-11.7%), Italy (-17.3%) and France (-19%), albeit by not quite as much as Spain (22.1%). This is not at all unexpected given that the UK government has been far more cautious in easing lockdown measures than some of its peers. It is worth remembering that non-essential shops (15 June) and restaurants (4 July) opened much later in the UK than almost all of the rest of Europe, which is clearly reflected in today’s data.The reaction in the pound this morning was very limited, with sterling stuck within the 1.30-1.31 range. We think this lack of reaction is due to both the lagged nature of the release and the slight irrelevance of the data, given that the extent of the downturns have been dictated almost entirely by the timing of the lockdowns. The real test for currencies will be how well respective economies bounce back from the contractions. Indicators so far suggest the UK recovery has got off to a decent start.

Source: Refinitiv Datastream Date: 12/08/2020Despite the positive surprises, the data makes for pretty grim reading - on an annual basis the UK economy shrank by a far greater amount than some of its peers in Europe, notably Germany (-11.7%), Italy (-17.3%) and France (-19%), albeit by not quite as much as Spain (22.1%). This is not at all unexpected given that the UK government has been far more cautious in easing lockdown measures than some of its peers. It is worth remembering that non-essential shops (15 June) and restaurants (4 July) opened much later in the UK than almost all of the rest of Europe, which is clearly reflected in today’s data.The reaction in the pound this morning was very limited, with sterling stuck within the 1.30-1.31 range. We think this lack of reaction is due to both the lagged nature of the release and the slight irrelevance of the data, given that the extent of the downturns have been dictated almost entirely by the timing of the lockdowns. The real test for currencies will be how well respective economies bounce back from the contractions. Indicators so far suggest the UK recovery has got off to a decent start.

.svg)

.svg)

.svg)